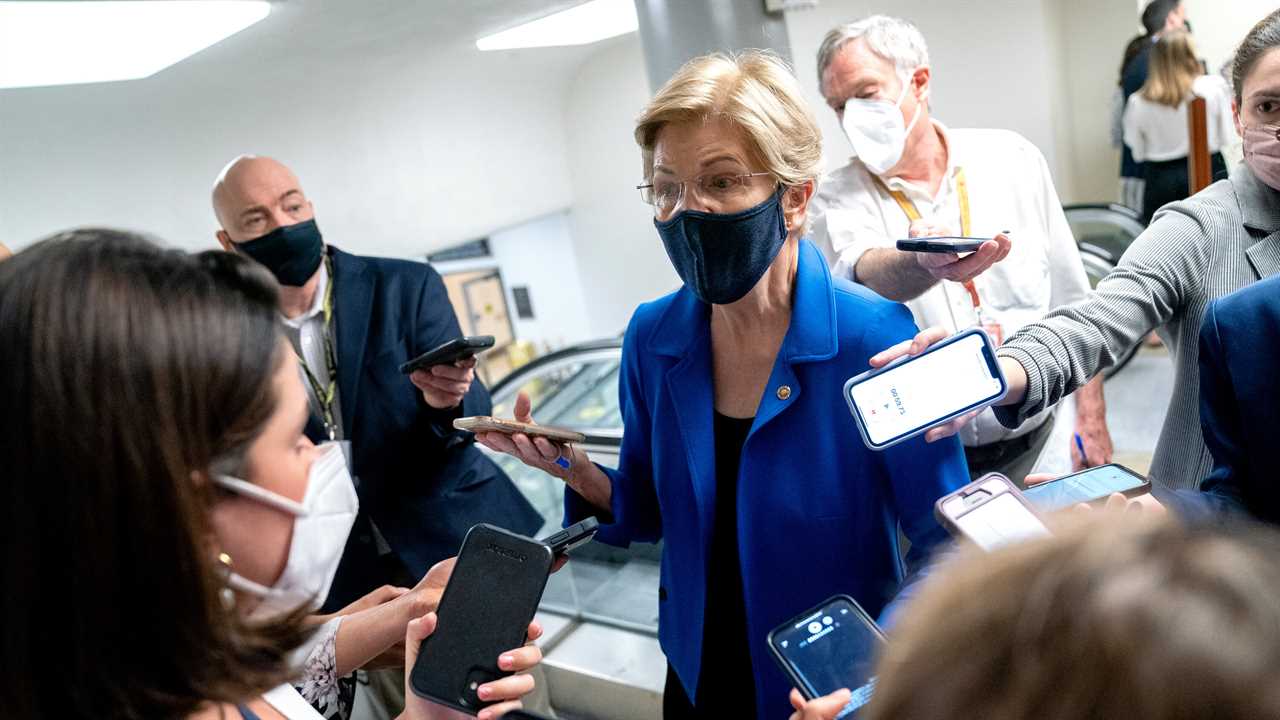

Senator Elizabeth Warren of Massachusetts and her allies will propose a minimum tax on the profits of the nation’s richest companies, regardless of what they say they owe the government, as part of Democrats’ $3.5 trillion economic and social-policy package.

Ms. Warren’s so-called “real corporate profits tax” was a key part of her presidential campaign, and she has enlisted Senator Angus King, the Maine independent, to help press her case that profitable companies should be taxed, regardless of loopholes and maneuvers that have allowed many of them to avoid federal corporate income taxes altogether.

The measure would require the most profitable companies to pay a 7 percent tax on the earnings they report to investors — known as their annual book value — above $100 million. By taxing the earnings reported to investors, not to the Internal Revenue Service, Democrats would be hitting earnings that companies like to maximize, not the earnings they try hard to diminish for tax purposes.

“During the presidential campaign, Joe Biden and I disagreed on some tax policies, but there was one thing we strongly agreed on: corporations shouldn’t be able to tell shareholders they were making huge profits, then tell the I.R.S. they made nothing in profits,” Ms. Warren said in an interview.

After the passage of a $1 trillion bipartisan infrastructure bill, which is expected this week, Democrats will turn to a budget blueprint that will set the terms of a sprawling multi-trillion-dollar package intended to carry the remainder of their ambitions to shore up the nation’s social safety net and to pay for it by increasing taxes on wealthy individuals and corporations. If it clears the Senate, it is all but guaranteed to do so with votes coming only from the 50 senators who caucus with Democrats.

That package won’t fully materialize until the fall, but the unveiling of the bare-bones blueprint has spurred Democrats like Ms. Warren to offer their proposed contributions. Although proposals on items like free pre-K, community college and family leave have attracted much of the attention, how to pay for it, including proposed tax increases on the wealthy and corporations, will generate at least as much controversy. The campaign to further scrutinize wealthy corporations has been boosted by reporting from ProPublica that showed how the richest Americans pay very little taxes.

“Now is the time to put the revenues on the table to pay for our infrastructure plans — this is the moment,” Ms. Warren said.

In a separate interview, Mr. King answered the expected Republican criticism, saying, “It’s not socialism — it’s an attempt to have a fair tax at a pretty low level for companies that would otherwise pay zero.”

An economic analysis from Gabriel Zucman and Emmanuel Saez, economic professors at the University of California, Berkeley, who advised Ms. Warren during the presidential campaign, estimated that about 1,300 public corporations would be impacted by the policy, generating close to $700 billion between 2023 and 2032.

“We understand that responsible legislation includes showing how it will be paid for and making those payments come from the billionaires and giant corporations who have evaded paying their fair share for so long,” Ms. Warren said. “Getting the tax revenue part of the reconciliation package right is about making the playing field just a little more level for everyone.”