BORIS Johnson today unveils his highly controversial plan to fix Britain’s crippling social care crisis – with steep tax rises.

Workers will be asked to pay more so elderly pensioners aren’t forced to sell their houses to foot spiralling care costs.

In a Commons statement and press conference, the PM is expected to announce a 1.25 per cent hike to National Insurance Contributions (NICs).

The promise-breaking proposals have been blasted by senior Tories and sparked a blazing Cabinet row.

WHAT IS THE SOCIAL CARE CRISIS?

Many pensioners need help in old age – and both home visits or space in a nursing home can cost a bomb.

Anyone who has combined cash and property worth more than £23,250 has to pay for their own care, which costs tens of thousands of pounds each year.

Britain’s ageing population means funding for the poorest has been squeezed – and many pensioners are left with no choice but to sell their homes to pay bank-draining care bills.

WHAT IS BORIS JOHNSON DOING?

The PM wants pensioners to pay for the first £80,000 of their care – and anything else will be paid by the Government.

Anyone with assets under £100,000 will be eligible for state support to pay for care.

This “cap and floor” plan was first suggested by top economist Andrew Dilnot 10 years ago.

HOW WILL IT BE PAID?

Mr Johnson is expected to increase NICs by 1.25 per cent.It will be called the “health and social care levy” – but is essentially a tax.

The tax will raise about £10billion a year for the public purse.

HOW MUCH WILL IT COST YOU?

Every worker the lowest earners pays NICs, meaning most will have to pay more tax.

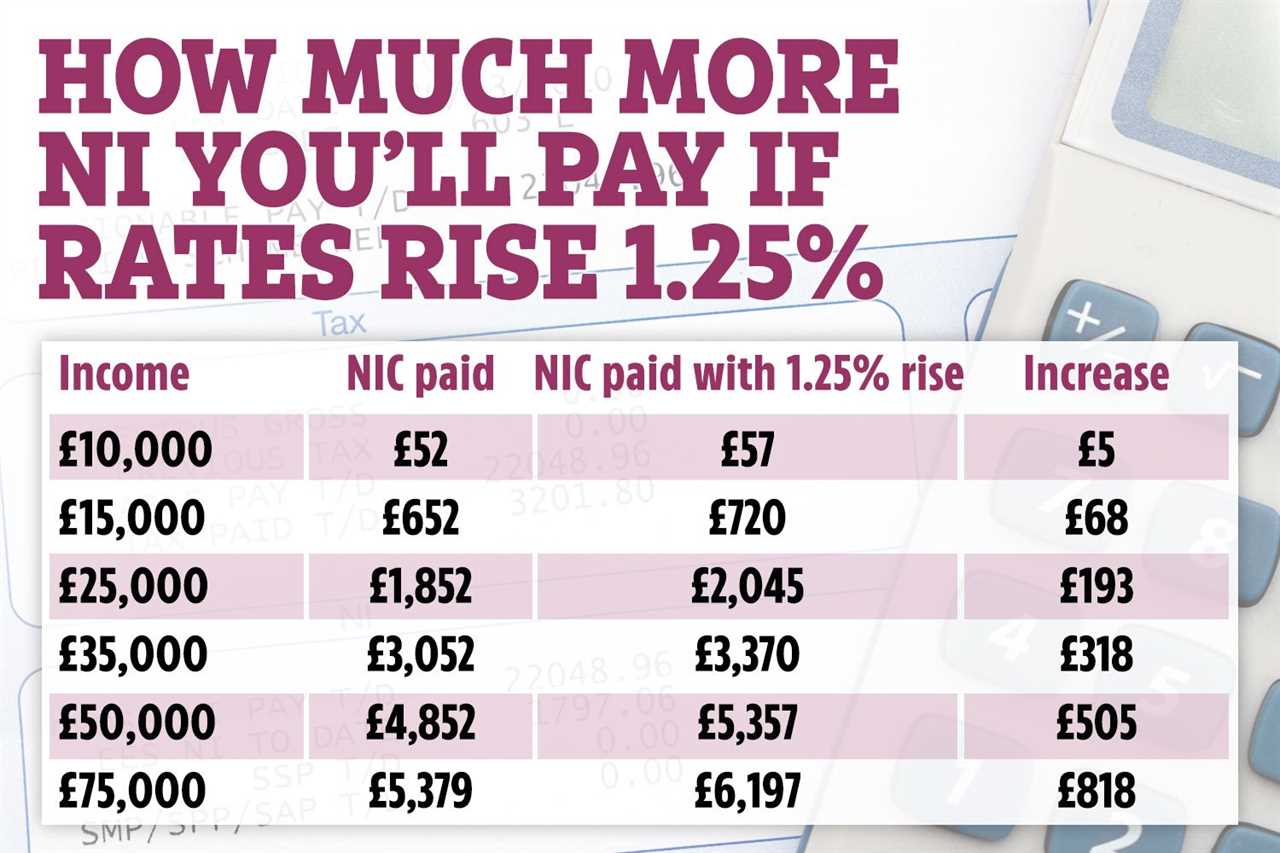

Someone on a £25,000 salary will stump up an extra £193 a year. Someone on £50,000 will pay an extra £506 a year. Someone on £75,000 will pay £818 more a year.

WHY IS IT SO CONTROVERSIAL?

There is anger that young workers are being expected to chip in for elderly care.

Pensioners don’t pay national insurance – but many have large houses worth a lot of money.

That poorer workers are expected to shoulder the cost of care for someone wealthier strikes many as unfair.

As senior Tory Jake Berry said: “It doesn’t really seem to me reasonable that people who are going to work in my own constituency in east Lancashire, probably on lower wages than many other areas of the country, will pay tax to support people to keep hold of their houses in other parts of the country where house prices may be much higher.”

AND DIDN’T BORIS RULE OUT TAX RISES?

At the 2019 general election Mr Johnson promised not to raise national insurance, as well as income tax and VAT.

He even put his own signature to the vow.

Tory MPs fear that breaking a key manifesto pledge could spell disaster at the ballot box and see them lose trust with voters.

SO WHY IS BORIS DOING IT?

Mr Johnson is under huge political pressure to lay out his blueprint to fix social care.

On becoming PM in July 2019, he stood on the steps of Downing Street and claimed to have a ready-made solution.

More than two years later and voters are fast becoming impatient there’s been no sign of it.

Downing Street is also hoping to use the pandemic as cover, claiming Covid was unforeseeable and justifies ministers changing their minds.