Recent events in the House of Commons have not only stirred political turmoil but also sent ripples through the financial world, as Rachel Reeves' emotional display left markets unsettled. The implications of this display, including the uncertain future of the Chancellor and potential economic instability, have triggered a chain reaction impacting the value of the pound and government borrowing costs.

The Emotional Turmoil in Westminster and Market Reactions

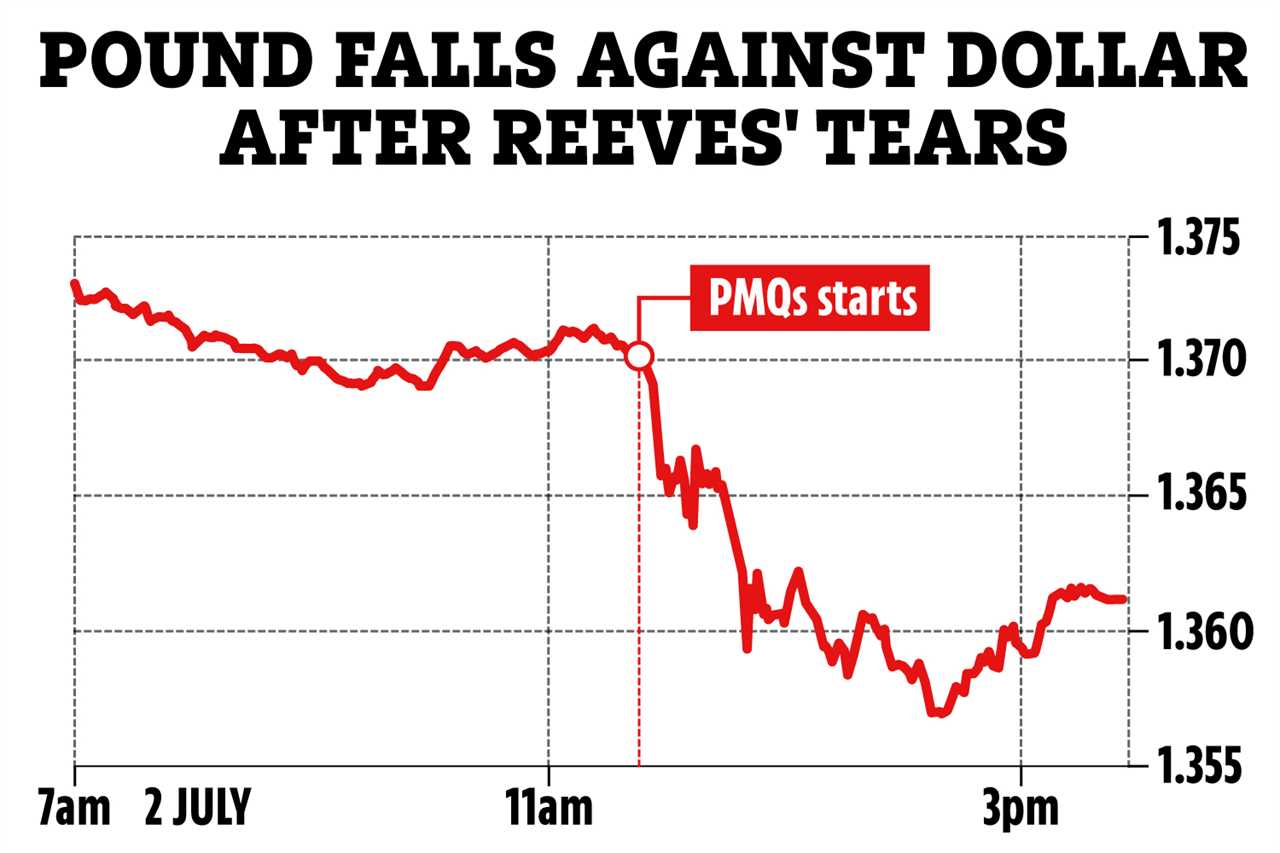

The tears shed by Rachel Reeves in Parliament have set off a chain of reactions in the financial world, with bond markets rocked and the pound tumbling against major currencies. The lack of solid support from prominent figures like Sir Keir Starmer has further exacerbated concerns regarding economic stability and government fiscal policies.

The Fiscal Fallout: Pound's Decline and Rising Borrowing Costs

Following the emotional display in Parliament, the pound experienced a notable decline against both the US dollar and the euro. This decline, coupled with a rise in government bond yields, has raised alarms about the potential challenges ahead, particularly in meeting fiscal targets and managing national debts.

The Political Uncertainty and Economic Consequences

With the recent U-turn on welfare cuts and a looming budget deficit of £4.8 billion, the government faces tough decisions ahead. The uncertainties surrounding the Chancellor's position and the adherence to strict fiscal rules have left investors and analysts wary of potential tax increases or spending cuts to address the financial gap.

Expert Insights and Market Concerns

Financial experts have expressed concerns about the stability of the UK government's economic plans, especially in light of recent political upheavals. The risk of veering off course from established fiscal strategies and encountering opposition to spending cuts poses a significant challenge to economic stability and investor confidence.

In conclusion, the emotional display by Rachel Reeves in the House of Commons has not only shaken Westminster but also had tangible effects on financial markets and government borrowing costs. The underlying uncertainties and challenges facing the government in navigating economic policy highlight the intricate relationship between political decisions and economic consequences, underscoring the need for careful and strategic leadership in times of crisis.