HOUSEHOLDS across the UK face a £70 council tax rise next year to pay for Covid, experts at the Institute for Fiscal Studies warned.

The think tank said the average bills might go up significant as a result of the Chancellor giving the green light to raise taxes by up to 4.5 per cent.

He’s under pressure to help councils and the Treasury rake in lost income from the pandemic, and plug huge black holes.

The Chancellor has given the call for councils to raise their bills by 2 per cent as a baseline, and another chunk to pay for social care if they want to.

And with the coronavirus crisis having ravaged councils’ spending, it’s likely that many will choose to hike bills for their areas in April.

The Treasury expects to get a windfall of nearly £2billion if every local authority takes up the extra cash.

Paul Johnson, the IFS director, said yesterday: “That will increase annual tax bills by an average of around £70 per household.”

And Ben Zaranko, IFS analyst, said Mr Sunak was displaying “sleight of hand” worthy of Argentine footballer Diego Maradona, who died this week.

He said: “A move that will leave millions of English households disappointed and potentially angry is maybe the perfect tribute to the late, great Diego Maradona.”

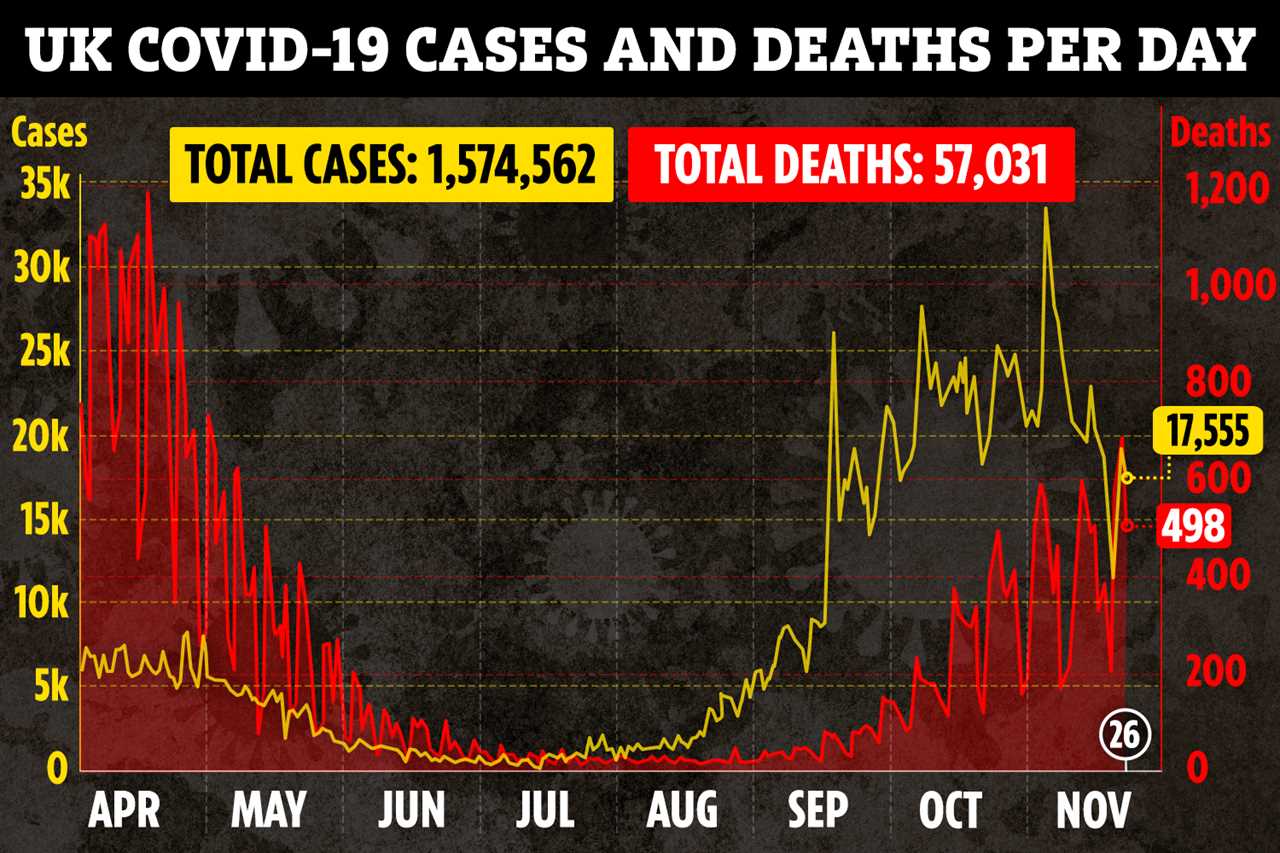

The economy faces its worst decline in 300 years in 2020 as a result of the pandemic – and is expected to take two years to recover from the 11.3% slump.

The Chancellor faces tough decisions of whether to raise taxes to pay back the nearly £400billion he’s borrowed this year to help support the economy through the virus.

There’s a £40billion black hole in the public finances that must be plugged.

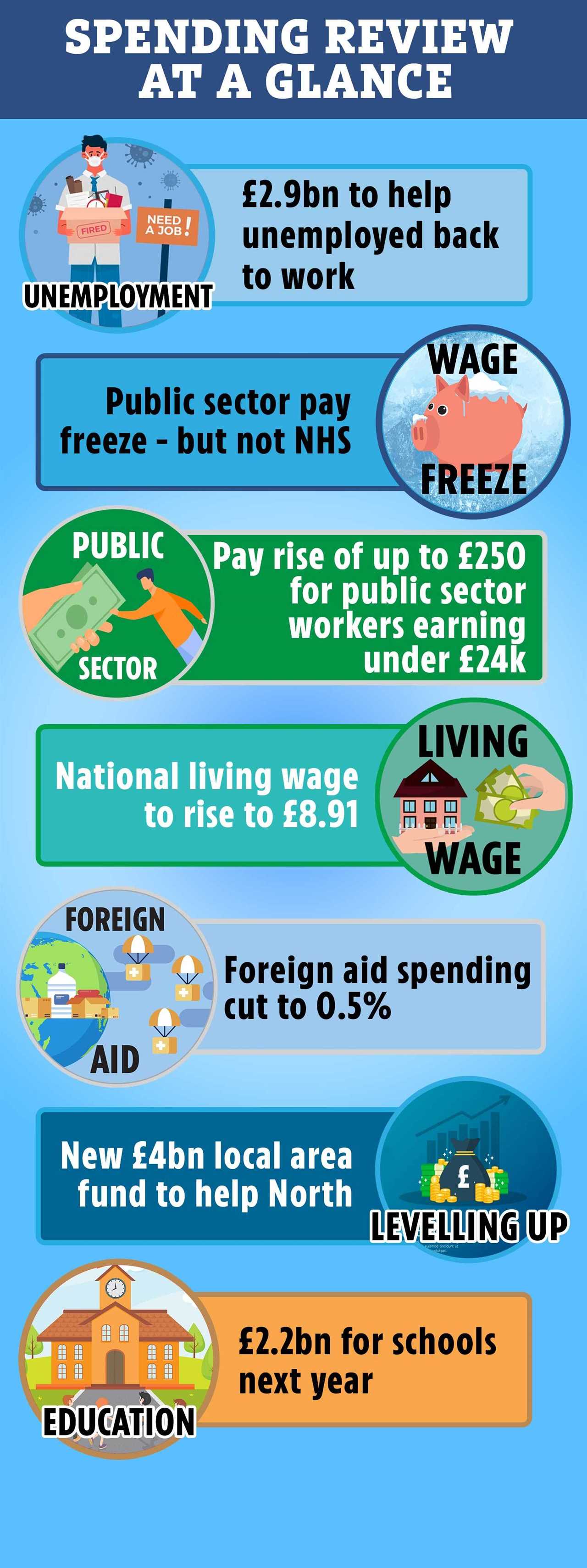

Mr Sunak has already said he will cut foreign aid – but this cash is being earmarked for a new £4billion levelling up fund.

He will save nearly £1billion this year from not having to pay out state pensions to people.

And overall departmental spending will be down on last year.

But it’s not yet clear where the bulk of the cash to pay back the pandemic debt will come from.

The Chancellor has stressed any decisions on tax rises will come once the economy has started to recover.

But he faces difficulty as the Tory manifesto promised not to raise income tax, VAT or National Insurance – which is where huge amounts of tax revenue are generated.

Carl Emmerson, IFS deputy director, said: “The obvious thing to do is to push up the standard rates of income tax or national insurance or VAT, and indeed if we look at past fiscal consolidations that involve tax rises under Labour, Coalition and Conservative governments, it has often been the rate of national insurance, or VAT they have reached for.”

“Clearly Covid is a very, very big shock that wasn’t anticipated last year.”

Under the OBR’s base scenatio, the Treasury will need to raise £20 billion by

2025 to balance day-to-day spending with tax revenues.

He also refused to commit to extending the £20 a week Universal Credit uplift beyond April – which would cost him around £9billion.