Reform Party Leader Debanked Due to Political Affiliation

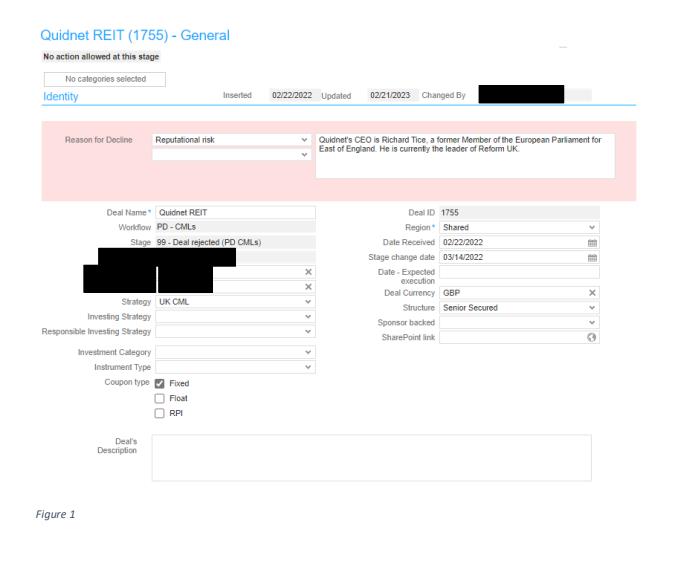

A leaked email has revealed that Richard Tice, a key figure in the Brexit movement and leader of the Reform Party, was debanked on the grounds of his political views. Tice had applied for a loan from financial giant Swiss Re last year, but internal documents show that his firm, Quidnet Capital, was rejected due to Tice being considered a "reputational risk". The document explicitly cited Tice's position as leader of Reform UK as a reason for decline.

Debanking Controversy Resurfaces

This revelation has reignited the debanking controversy that has shaken Britain's financial institutions. Tice criticized the decision and claimed that woke culture is negatively impacting the country's economy. He argued that excessive bureaucracy and wokeness are hindering growth and stifling success. Tice's comments come as a growing concern among politicians and business leaders who believe that ideological bias should have no place in financial decisions.

Swiss Re Remains Silent

Swiss Re, housed in London's Gherkin building, declined to comment on the case. The financial giant was compelled to disclose the reasons for blocking the loan only after Tice made a subject access request to obtain the secret documents. The refusal to provide comment adds weight to the accusations of political bias in banking.

Woke Culture and the Economy

Tice, a successful businessman and a close ally of Nigel Farage, warns that the UK's obsession with woke culture is harming the economy. He argues that his status as a reputational risk due to his political views is indicative of a larger problem. Tice believes that successful businessmen like himself are being unfairly targeted, which ultimately hampers economic growth. He is advocating for an end to the stifling bureaucracy that he claims is driven by woke culture.

Government Intervention

The Treasury has stepped in, ordering banks to stop blacklisting clients due to their political views. The directive followed another scandal involving debanking, in which former Brexit Party leader Nigel Farage was targeted by Coutts. The fallout from that incident led to the resignation of Dame Alison Rose, the CEO of Coutts' owner NatWest. Treasury Minister Andrew Griffith condemned such actions and emphasized that political views should not hinder access to banking services.

Swiss Re has maintained their policy of not commenting on specific investments.

The debanking of Richard Tice raises important questions about the potential influence of political bias on financial decisions. As the controversy continues, it is clear that more scrutiny and transparency are needed to ensure banks remain impartial in their treatment of customers.

Did you miss our previous article...

https://trendinginthenews.com/uk-politics/schools-urged-to-publish-full-list-of-buildings-at-risk-of-collapse