PENSIONERS will have their care costs capped at £86,000 for the first time – and those with assets under £20,000 will have their costs fully covered.

In a major social care and NHS funding announcement today, the PM announced that National Insurance will rise, along with a new levy to help fund social care.

Under the new plans, it will mean that Brits will have their care costs capped, meaning pensioners will not rinse their entire inheritance to pay for it.

Those people with assets of between £20,000 and £100,000 will face a new means tested system, with a sliding scale of costs.

The cap of £86,000 will kick in from October 2023.

Mr Johnson said this will stop the nightmare of cash-strapped pensioners forced to sell their houses to foot the eye-watering costs.

Currently anyone with assets over £23,000 has to foot the entire cost of their care, such as nursing homes or visits that spiral into the tens of thousands.

But he is facing boiling rage for hitting the wallets of poorer workers while wealthy retired pensioners aren’t chipping in.

A double-whammy tax could see people pay up to £7.50 a WEEK more.

The PM said today as he revealed his plans: “Governments have ducked this problem for decades. Parliament, even voted to fix it.

“There can be no more dither and delay.”

In a statement to MPs today the PM confirmed:

- He will break a Tory manifesto vow not to raise National Insurance in this Parliament – to pay for the NHS and social care

- He will hike it by 1.25 per cent to raise billions of pounds of extra cash – which will come in in April 2022

- Boris revealed a massive raid on shareholder profits to raise even more money

- The NHS will get the extra cash at first to help sort out the backlog in the health service, which will then swap to social care from April 2023 onwards

- Over 65s who are working will have to pay a form of National Insurance for the first time in a bid to make it fairer for younger Brits

- The PM, Sajid Javid and Rishi Sunak will hold a press conference this afternoon to lay out the plans

- A basic rate taxpayer will pay an extra £100 a year but those on more cash will pay around £200

- Employers will also be asked to cough up extra cash too

- And sharekholder profits will also be whacked with extra taxes

The 1.25 per cent rise in National Insurance will kick in for employers and employees from April 20 next year.

TAX WHACK

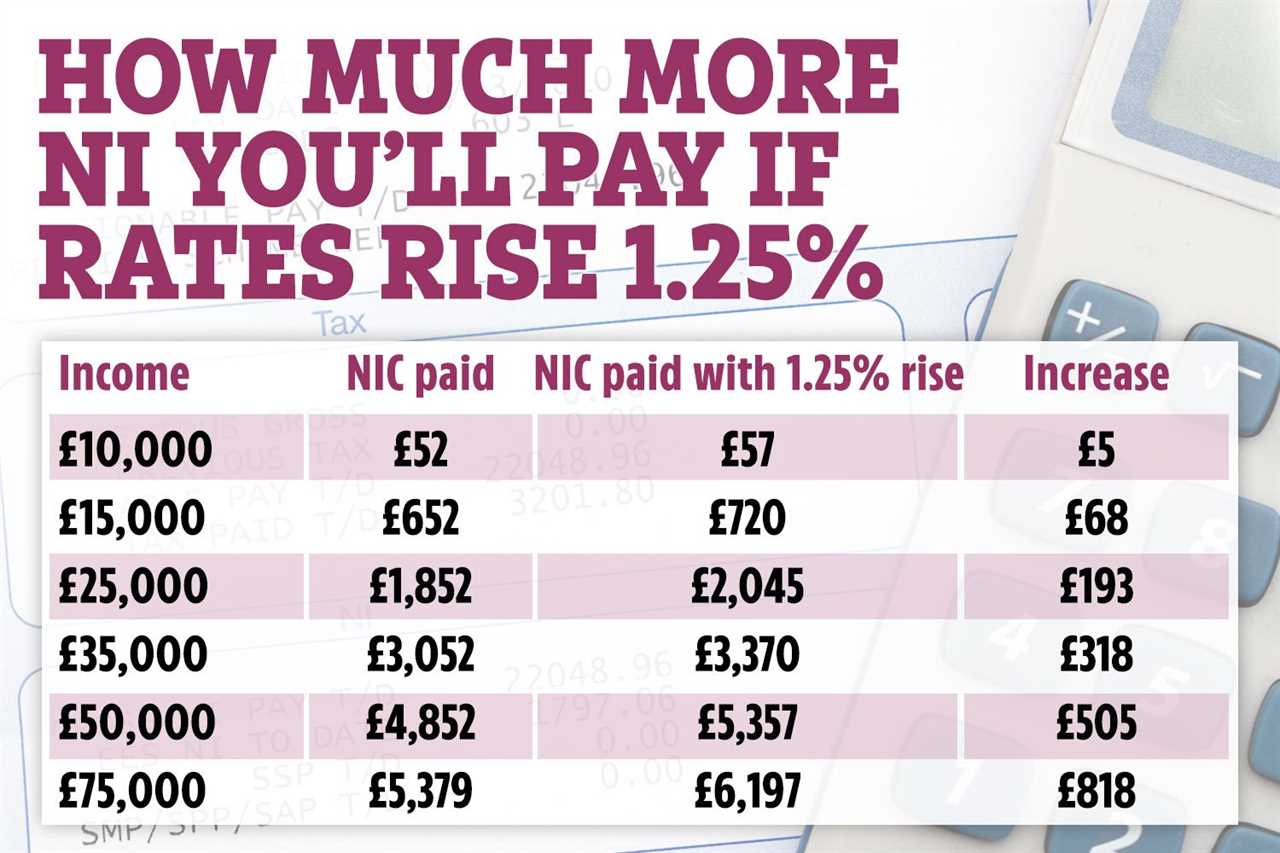

Someone on a £25,000 salary will stump up an extra £193 a year. Someone on £50,000 will pay an extra £506 a year. Someone on £75,000 will pay £818 more a year.

From April 2023 National Insurance will revert to their current rate – and the 1.25 per cent will appear as a standalone “health and social care levy” on people’s balance sheets.

The money raised will fund a £36billion health package over three years.

It will initially be used to tackle the enormous NHS backlog caused by axed appointments during lockdown.

But from October 2023 it will help fund the costs of social care by setting a cap on how much pensioners will be forced to pay.

It does mean that the social care crisis will continue for another two years – with Brits having to pay into the system for months to come before getting the needed help.

PENSIONERS HIT TOO

The PM’s new levy will see those plucky OAPs still working having to fork out to fund the county’s stricken elderly care system.

From April 2023 workers over the age of 66 will pay the 1.25 per cent levy – part of a National Insurance tax hike – despite not having to pay any contributions under current tax rules.

Speaking to MPs today, the PM said: “Our new levy will share the cost between individuals and businesses, and everyone will contribute according to their needs, including those above state pension age.”