A STAGGERING 50,000 Brits will join the dole queue because of Boris Johnson’s £12billion-a-year tax bomb, bosses have warned.

The Federation of Small Businesses said the plan could trigger an unemployment tsunami bigger than the ending of furlough.

The move will end up hammering UK plc by deterring enterprising Brits from launching businesses and hiring staff, they warned.

FSB chairman Mike Cherry fumed: “The Government’s regressive jobs tax hike will put jobs at risk, stifle start-ups and prevent new jobs from being created.

“It could mean 50,000 more people out of work after it takes effect in April. That means 50,000 livelihoods harmed – 50,000 people who would otherwise be at work in our economy.

“Combined with other rising employment costs – and firms having to make tough decisions about the futures of those who have been supported by the job retention scheme – that 50,000 figure could easily end up being a good deal greater.”

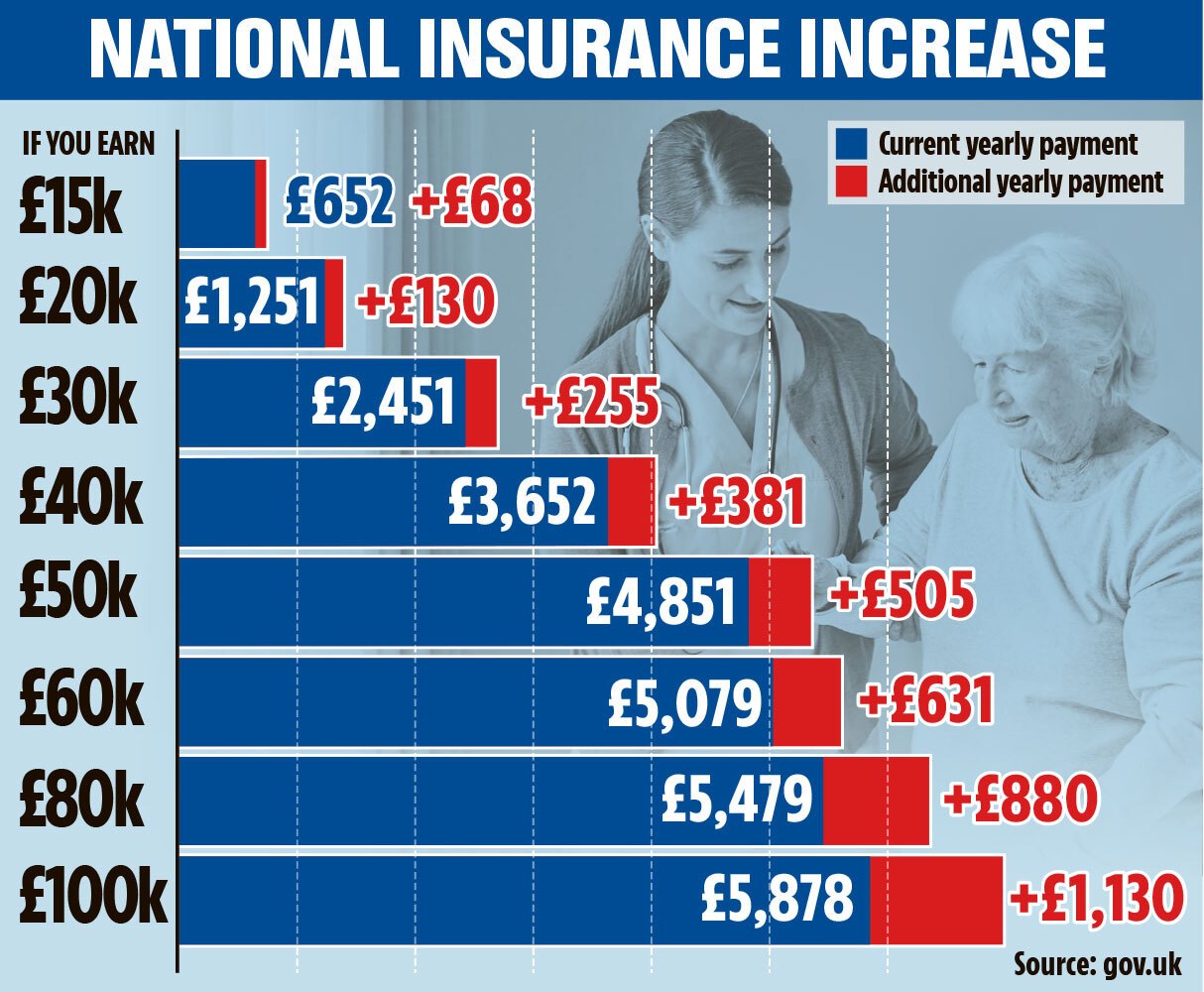

The PM will hit Brits with a tax double whammy – hiking national insurance contributions and tax on shareholder profits by 1.25 per cent. The manifesto-busting levies mean Brits now face the biggest tax burden since the Second World War. Cash raised will go to clearing the NHS backlog and funding social care.

A small business with five staff earning £31,000 a year will have to fork out a whopping £16,500 in NICs when the rise kicks in, the FSB warns. In total, the tax hike will cost Britain’s army of small businesses a staggering £5.7bn, the group said.

Facing a barrage of fury from businesses, Boris attempted to bat off accusations he was hitting toilers with an unfair jobs tax.

Hitting back at Labour jibes in the House of Commons during PMQs, he boomed: “The whole country can appreciate that we at least have a plan to fix the backlogs.

“We understand the only way to fix the long-term underlying problems in the NHS, and the problem of delayed discharges, is to fix the crisis in social care as well, which Labour failed to address for decades.”