Eco-Baby, TrailBuddy, Quility and TapeKing aren’t exactly household names, but they’re working on it. Their products are among the most popular in their categories on Amazon, accounting for millions of dollars in yearly sales.

They’re also owned and operated by a single company called Thrasio, which recently raised $750 million in financing. It’s just one among dozens of firms snapping up successful Amazon brands for millions of dollars.

Several of the largest firms, including Perch, Branded and SellerX, aspire to become, loosely speaking, the Unilevers and Procter & Gambles of Amazon’s third-party seller economy.

For them — and for Amazon — 2020 was an undeniable boom year.

These companies are already reshaping Amazon in ways both visible and invisible to its customers, few of whom have heard their names but plenty of whom have ordered their products. They’ve given Amazon sellers a way to cash out of their businesses and helped create a new class of listing flippers.

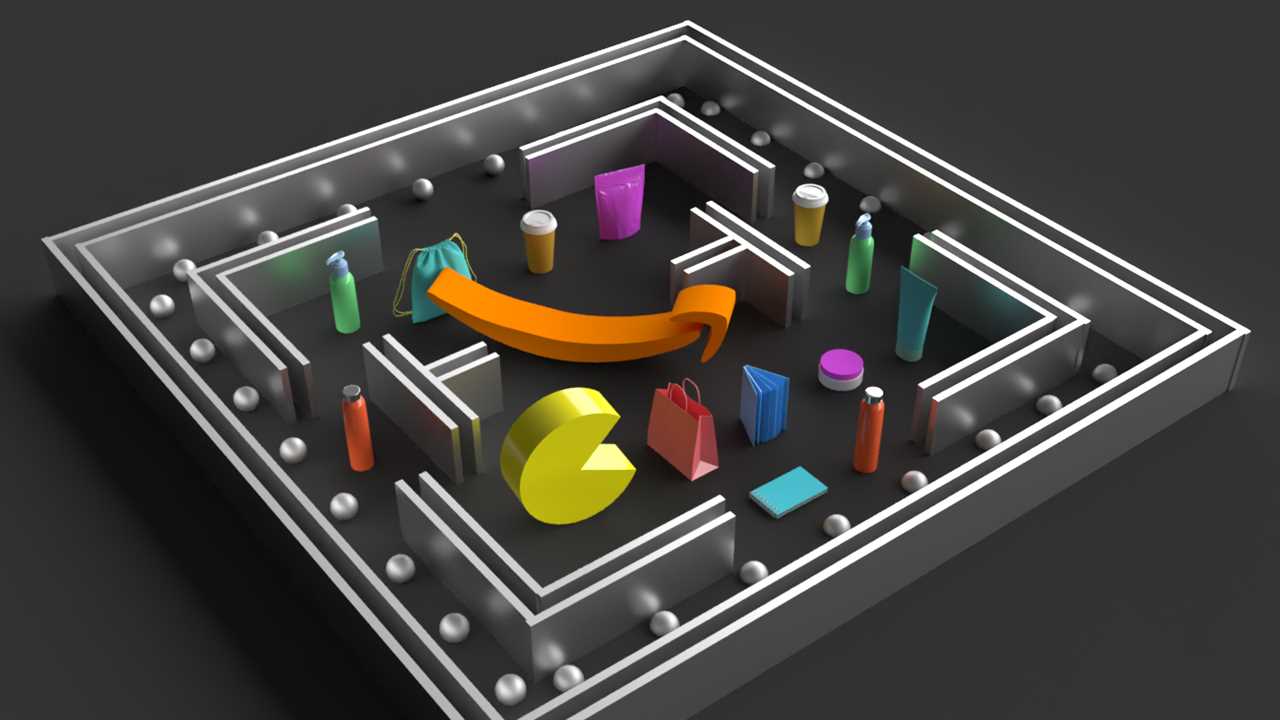

It’s an Amazon brand bonanza. How far will it go?

Building a Better Car Booster Seat for Dogs

A product can end up on Amazon in a few different ways. Much like a brick-and-mortar store, the company maintains relationships with vendors, whose products it stocks and sells. Amazon also operates dozens of private-label brands of its own, including Amazon Basics.

In recent years, though, most sales on Amazon have come through Amazon Marketplace, where millions of outside sellers compete to find customers. Many pay Amazon to store and ship their goods, making them eligible for Prime shipping, through an arrangement known as Fulfillment by Amazon, or FBA.

These sellers gain valuable access to Amazon’s customers and logistics infrastructure, but they do most of the work on their own: market research, making and sourcing products and taking individual financial risks, all to sell products that, as far as most customers are concerned, were purchased from Amazon.

Robb Green started selling on Amazon Marketplace in 2015, after years of working in dropshipping as a “side hustle” to a job in sales. (“It’s 90 percent marketing and 10 percent customer care,” Mr. Green, 45, said of dropshipping, a form of e-commerce in which sellers neither manufacture nor stock products, rather shipping them to customers, on-demand, from suppliers.)

Discouraged by the razor-thin margins and lack of control in dropshipping, Mr. Green started looking into selling his own products. He took an online course — a “101-level private-labeling education, maybe 102” he said — and started trawling Amazon for product ideas.

He made a list and started reaching out to suppliers overseas; within months, he and a few friends had made plans to attend the China Import and Export Fair in Guangzhou, a long-running trade show also known as the Canton Fair, to meet with suppliers and research Amazon product ideas. (“Imagine three football stadiums, but on multiple levels, all full,” he said.)

Mr. Green had zeroed in on a few product categories beforehand. “The beauty of Amazon is that you know there’s demand,” he said. He focused early on pet products. Car booster seats for small dogs were selling well, he’d learned, but the most popular versions on Amazon were, according to reviews, flimsy and only suitable for very small dogs. At the trade show, Mr. Green met with a supplier who could make something sturdier. He visited a nearby factory and left confident that he had a shot at dominating this subcategory of a subcategory on Amazon.

The first few months of the business were “brutal,” Mr. Green said, and the learning curve steep. Once his item started selling well, however, things got even harder.

“When you have an inventory-based business, most people think only about the first order,” Mr. Green said. With long lead times from the factory in China, he was almost immediately trying to figure out how big his second and third orders should be. Underestimating would hurt not just sales but the overall status of his Amazon listing; overestimating would drain him of cash upfront, and he would incur further charges from Amazon for storing excess inventory in its warehouses.

Growing pains aside, Mr. Green was encouraged. His plan, to the extent he had one, had worked; based on sales of a few dozen dog car seats a day, his listing was reliably generating $5,000 in monthly income for him.

“If I can do this with a smaller-demand product, I can do more,” he remembered thinking. He started branching out almost immediately, quitting his job and scouring for more promising Amazon subcategories in kitchenware, supplements and coffee gear. He believed he had a playbook, maybe a knack. What he needed next, however, was capital. Investing more in Amazon, he began to realize, would first require finding an exit.

Flipping the Billion-Dollar Amazon Brand

Through Empire Flippers, a firm that connects Amazon sellers with potential buyers for their businesses, Mr. Green sold the dog seat business for “low six figures” to an individual investor interested in using it as a steady stream of income. In the years since his trip to Guangzhou, he has assembled a small team with the goal of building, and then flipping, more FBA businesses.

“FBA businesses aren’t great for cash flow, particularly in the early days or during a period of rapid growth,” said Justin Cooke, one of the founders of Empire Flippers. “Many entrepreneurs find themselves recycling profits into inventory and product creation and they don’t get an opportunity to realize the value they’ve created.”

FBA deals listed on Empire Flippers, Mr. Cooke said, have nearly doubled in average size since 2018. The company handled $15.7 million in FBA sales in 2018, $28 million in 2019 and $55.5 million in 2020.

“By the middle of 2020 we were working with dozens of private equity-backed roll-up companies looking to follow the Thrasio and Perch examples and capitalize on the trend,” Mr. Cooke said. Aggressive bids from newly flush aggregators, including Thrasio, have driven up prices, as has a broad increase in sales across Amazon Marketplace during the coronavirus pandemic.

Juozas Kaziukenas, the chief executive of Marketplace Pulse, an e-commerce research firm, estimates that Marketplace sellers moved more than $300 billion of product in 2020 — a figure that would make Amazon Marketplace, in his words, “the 42nd largest economy in the world by GDP. ” (As of 2021, Marketplace accounts for more than half of products sold on Amazon.com and is growing at a faster rate than Amazon’s own retail business, according to the company.)

Thrasio’s internal estimates, based on the number of distinct households to which is has shipped products, place its products in 1 in 10 American homes.

“Everything we buy is a solution to a problem of some kind,” said Joshua Silberstein, a founder of Thrasio. Much of what he looks for in acquisitions is obvious: a good product, differentiation, a solid, scalable supply chain. Other factors are more specific to Amazon. Good reviews and high search placement are extremely valuable and take time to acquire. Products that need to be frequently changed or refreshed are more challenging, for related reasons. “We wouldn't do something like drones,” Mr. Silberstein said. “No matter how good a drone is, someone else will come up with a better one.”

Not so for a pet deodorizer like Angry Orange, an acquisition which Thrasio frequently points to as a success story ($30 million in revenue last year, from a $1.4 million purchase in 2018), or TrailBuddy, its brand of hiking poles, or for its extensive listings in bedding, crafting supplies, coolers and thermoses. These priorities give Thrasio’s portfolio a peculiar and distinctly Amazonian quality: a little bit Bed Bath & Beyond, a little bit QVC, a little bit Home Depot, a little bit Dick’s Sporting Goods, with a dash of randomized chaos. (Air filters; door stoppers; an electric brush for car wheels, as seen on “Shark Tank.”)

Mr. Silberstein believes there are plenty more healthy Amazon businesses to acquire and owners ready to sell. “When you’re really successful on Amazon, it might make up 95 percent of your net worth,” he said. “You’re in a place where it’s kind of hard to diversify, and then what if something goes wrong?”

Thrasio’s pitch is, basically, a payday and a promise that the business is in good hands. Many of its 700-plus employees have experience in Amazon’s often unpredictable and unforgiving Marketplace, which is an advantage the company maintains will set it apart from some newer competitors, especially private equity firms excited about what they understand to be a new asset class: Amazon listings.

There are, already, a few extraordinary Amazon seller success stories, perhaps most notable among them Anker, the electronics brand that made its name selling batteries; it is now traded publicly on a Chinese stock exchange and its products are carried in Apple retail stores. Still, Anker is at its core an Amazon-native brand — one with more than $1 billion in sales last year.

Like individual sellers, Thrasio’s business is still deeply intertwined with Amazon’s, and its continued success is to some degree dependent on Amazon’s desires and whims.

“The way we think about Amazon is very simple,” Mr. Silberstein said. “Our interests are aligned.” Companies like Thrasio, he suggested, are professionalizing Amazon Marketplace, moving more product and providing a more reliable experience to customers. “At the end of the day, what they want and what we want are very very similar. I worry about everything, but at the same time, we’re built on the right values. The underlying business model makes a ton of sense. It doesn’t hurt that we have a billion dollars in cash.” (“Whether they are new entrepreneurs just getting started or larger companies with families of brands, we welcome the opportunity to work with all sellers who share our commitment to delighting customers with great product selection, prices, and convenience,” said Joel Sider, an Amazon spokesman.)

That billion dollars raises other prospects, however. “Once you raise this level of capital, the only acceptable outcome is some sort of exit,” said Mr. Kaziukenas, of Marketplace Pulse. Indeed, Mr. Silberstein said, attempting to take the company public is, at this point, “an inevitability.” Competition is fierce. Prices for some listings are crossing into speculative territory and raising concerns about something of a mini-bubble for Amazon listings.

“It’s not peaking yet,” said Mr. Kaziukenas. “I think the peak is going to be when some of these aggregators start to fail.”

Losing Sleep Over Snuggle-Pedic

In 2014, Rick Swartzburg was struggling to keep Relief-Mart afloat. It sold pillows, mattresses and therapeutic products. The release of the Air-Pedic, a long-delayed foam mattress design, barely kept the company out of bankruptcy.

Mr. Swartzburg soon had a new problem, however, at the California factory where his mattresses were manufactured. “We were selling a whole lot of mattresses,” he said, “but we had a lot of leftover foam. It was a huge buildup, just bay fulls of this stuff,” he said.

“Meanwhile, I’m hearing people are doing really well on Amazon,” he said. He had listed products before, with underwhelming results — but this time decided to commit.

Mr. Swartzburg created a new brand, Snuggle-Pedic, under which he would sell therapeutic foam pillows made from the extra material. They would be priced lower than his company’s other pillows but higher than many competitors on Amazon, at around $80. It was, effectively, a new division of his business — new name, different sales channel, similar product.

After tweaking the product based on customer feedback and accumulating a critical mass of positive reviews the pillows started selling briskly. It wasn’t the first time Mr. Swartzburg had marketed a new product online, but the experience of doing so on Amazon was jarring.

“The intricacies of running an Amazon business are a whole world of difference,” Mr. Swartzburg said. Among the constant worries: potential sabotage from competitors; bad reviews; mysterious fluctuations in your placement on Amazon’s algorithmically generated search and product listing pages. Using FBA makes it easier to scale a business, which is of course good, but a flood of sales creates an enormous amount of customer service work. “Even though it’s essentially their customers, they’re making you responsible for the customer experience,” Mr. Swartzburg said.

He felt the loss of control acutely. “You build your pallets up, you ship them to Amazon, and then from there they turn into FBA. Suddenly, he said, “trying to keep Amazon happy was more than a full-time job in itself.”

Mr. Swartzburg had seen his plan through to success, but was now looking for an exit. “I had heard of Thrasio and researched them in particular,” he said. He approached the company, and eventually Thrasio acquired Snuggle-Pedic, which by then sold mattresses as well, in a deal that, according to Thrasio, will total “over $10 million” — a number, however, that’s substantially contingent on the future performance of the brand.

“I’m obviously still helping them,” Mr. Swartzburg said, including with manufacturing, but the sale gave him the “break that I need.” Much of the money he and his partners made from the sale, he said, is being reinvested in new products, payroll and rent for his brick-and-mortar locations.

Mr. Green, of the dog booster seats, is currently in the process of selling another Amazon listing — a coffee gadget. He has spent recent weeks reconsidering his strategy, however. He knows that investors and aggregators who might buy his listings believe they can increase their value. He knows that money is flooding into the category. He believes that one thing separating him from them is access to the capital needed to go after bigger product categories, take bigger risks and make bigger orders — he’s the one who knows how Amazon really works, in other words, not them.

“I could raise money, launch new brands, acquire more brands and keep going,” he said. And then what?

“The goal would be to go public in two years,” he said, with a prospector’s confidence. “Maybe via a SPAC.”