The rise of the crypto spring

Bitcoin (BTC) and other cryptocurrencies are on the rise, signaling the arrival of a long-awaited "crypto spring" and the potential for a full-on bull market. During the recent crypto winter, various projects have been gaining momentum and building new networks. Among these projects are layer-2 (L2) solutions like Polygon, which aim to scale the primary protocol, Ethereum. But what does this mean for the future of blockchain technology? Are L2s a better choice for developers and investors? And how are other layer 1s (L1s) staying competitive? These questions and more are explored in a new report from the Cointelegraph Research Terminal.

Exploring the implications of L2s

The report, titled "L1 vs. L2: The Blockchain Scalability Showdown," delves into the world of scaling solutions in the cryptoverse. It provides insights into up-and-coming projects and presents case studies on L1s like Avalanche and Hedera. The report aims to shed light on how these projects compare to the rising L2 technology and the potential implications for the future of blockchain.

Understanding the need for scaling solutions

Layer-1 blockchains, such as Bitcoin and Ethereum, are the base protocols that can be used alongside third-party layer-2 protocols. These layer-2 protocols, also known as mainnets or primary chains, enable thousands of low-value transactions to be processed on parallel blockchains before being transferred to the main blockchain. This helps ensure that transactions are immutably recorded. The report emphasizes the necessity of scaling solutions to address the shortcomings of L1s and explores projects that focus on interoperability and bridges.

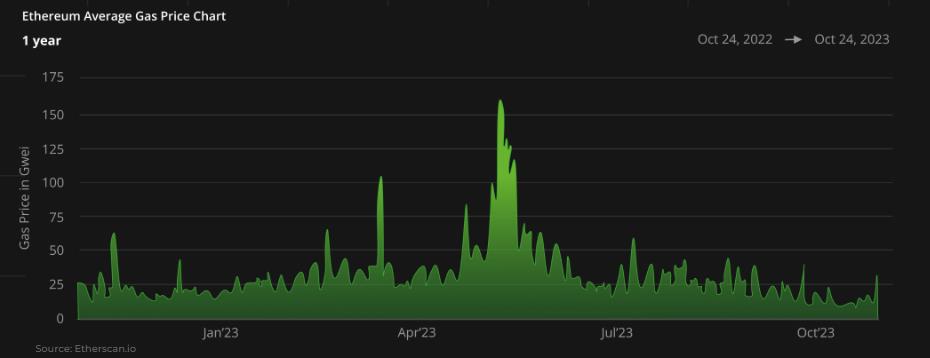

Gas fees and the quest for increased scalability

One of the challenges faced by Ethereum users is the issue of high gas fees. These fees can sometimes exceed the value of the underlying asset being transacted, discouraging further adoption. To combat this issue and improve scalability, solutions have been developed to enhance transactions per second (TPS), interoperability, and user experiences for developers and users. The report highlights TPS as a crucial factor that sets newer protocols apart from older generations like Bitcoin and Ethereum.

The future of blockchain technology

The report also explores emerging trends that are shaping the future of blockchain technology. One of these trends is asset tokenization, which involves the digital representation of real-world assets on decentralized ledger protocols. The migration of assets to these protocols is expected to increase transaction congestion, leading to the need for user-friendly custody solutions. Another trend is account abstraction, which aims to simplify user experiences by removing requirements like seed phrases for account recovery and streamlining complex smart contract executions. By addressing these trends, layer-0 (L0) and L2 protocols can drive mass adoption.

Insights from industry professionals

In addition to analysis and insights, the report includes contributions from industry professionals who are at the forefront of blockchain technology. These experts provide insider perspectives on different technologies in the decentralized ledger space, further enriching the report's content.

The crypto spring is upon us, and the Cointelegraph Research Terminal's report aims to equip readers with the information and insights needed to make informed decisions in this ever-evolving landscape. Whether it's L1s, L2s, or something else entirely, the report serves as a valuable resource for navigating the exciting world of blockchain technology.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/binances-market-share-in-spot-trading-drops-to-40-in-2023-report