The Federal Reserve Sends a Clear Message

On September 20, the Federal Reserve made its intentions known: interest rates are staying high for the foreseeable future. This decision comes as inflation remains stubbornly high at 4.2% and unemployment hits record lows. The market is left wondering how this will impact the S&P 500 and Bitcoin.

Markets React to the News

The consequences of the Fed's decision were immediate and significant. The S&P 500 experienced a sharp drop, reaching its lowest level in 110 days. This volatility prompts concern among investors who are now questioning how the market will fare under a tighter monetary policy.

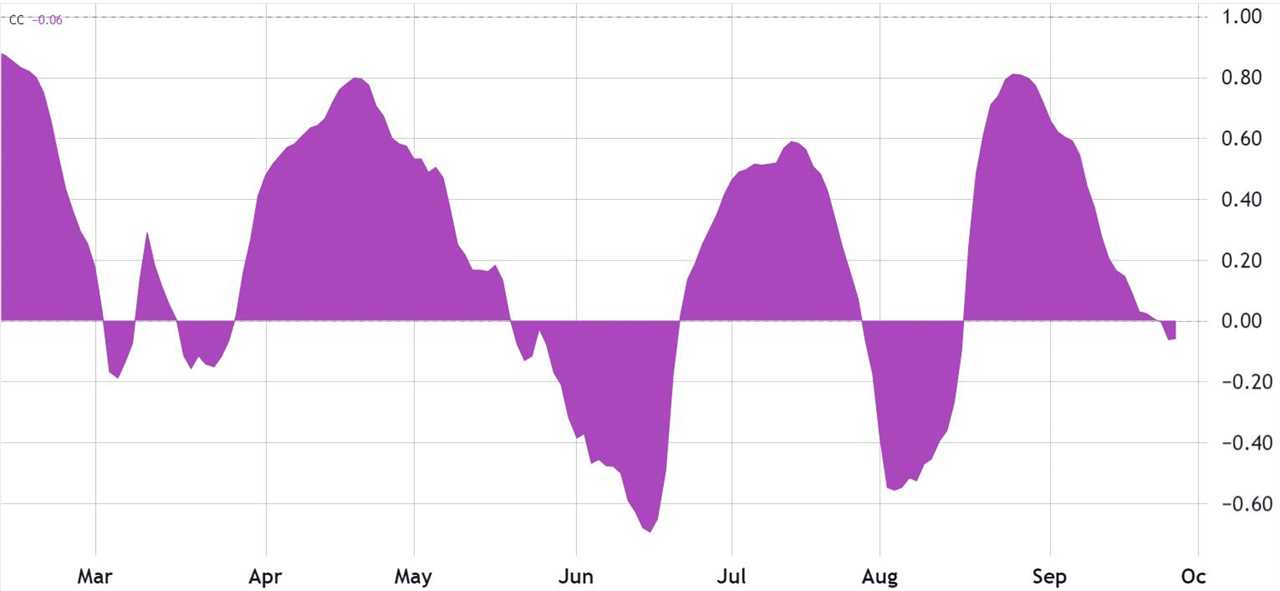

A Disconnect Between the S&P 500 and Bitcoin?

An interesting development during this financial turbulence is the apparent disconnect between the S&P 500 and Bitcoin. Over the past five months, the correlation between these two assets has been inconsistent. One explanation for this divergence is the speculation surrounding a potential spot Bitcoin ETF and regulatory concerns that have hindered the upside potential of cryptocurrencies. Meanwhile, the S&P 500 has benefited from strong 2nd-quarter earnings reports.

The Uncertain Road Ahead

As the Fed remains committed to high-interest rates, the financial landscape enters unfamiliar territory. While some see this stance as necessary to combat inflation, others worry that the economy may suffer under the weight of elevated rates. Families and businesses, especially those with existing loans, may struggle to refinance at higher rates.

A Decoupling Could Favor Bitcoin

There are several factors that could lead to the decoupling of cryptocurrencies, such as Bitcoin, from traditional markets like the S&P 500. Government difficulties in issuing long-term debt and a deteriorating housing market are just a couple of examples. In times of economic uncertainty, alternative assets like gold and Bitcoin become attractive options for investors seeking to hedge against potential downturns.

Political Instability and the Flight to Cryptocurrencies

The potential for political instability, both globally and during the U.S. elections in 2024, could also impact financial markets. Increasing fears of capital controls and historical instances of international financial embargoes highlight the risk of governments imposing such controls, which could further drive investors towards cryptocurrencies.

Bitcoin's Unique Advantages

Unlike traditional stocks and bonds, cryptocurrencies like Bitcoin are not tied to corporate earnings or growth. Instead, they are influenced by factors such as regulatory changes, resilience to attacks, and predictable monetary policies. Thus, Bitcoin has the potential to outperform the S&P 500 without relying on any of the scenarios discussed above.

This article provides general information and should not be considered legal or investment advice. The opinions expressed are solely those of the author and do not necessarily reflect the views of Cointelegraph.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/uniswap-foundation-seeks-62m-in-funding-to-expand-operations-and-research