Blockchain data reveals suspicious dealings before the collapse

Insights from blockchain analytics firm Nansen shed light on the collapse of cryptocurrency exchange FTX and its close ties to Alameda Research, the company founded by former FTX CEO Sam Bankman-Fried. A report shared with Cointelegraph uncovers unusual on-chain interactions between the two entities before the collapse, including the transfer of $4.1 billion worth of FTT tokens. These revelations come as Bankman-Fried faces a string of charges related to the collapse of the FTX group.

Alarm bells ring as significant share of assets held in FTT tokens

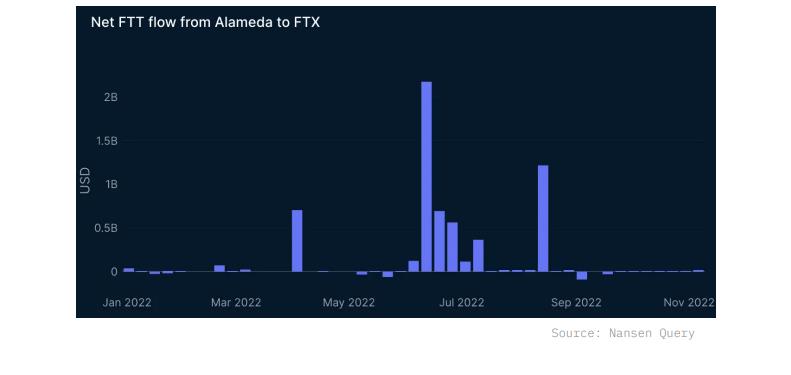

Initial reports flagged the alarming fact that 40 percent of Alameda's $14.6 billion assets were held in FTT tokens, sparking concerns about the stability of FTX. Nansen analysts discovered the transfer of $4.1 billion FTT tokens from Alameda to FTX between Sept. 28 and Nov. 1, as well as several transfers of USD stablecoins amounting to $388 million.

FTX's dominant position in FTT tokens

Blockchain data reveals that FTX held approximately 280 million FTT tokens, accounting for 80 percent of the total supply. The data also shows substantial trading volume, amounting to billions of dollars, between various FTX and Alameda wallets. Furthermore, the majority of the FTT token supply was locked in a vesting contract controlled by an Alameda-controlled wallet.

Entities propping up each other's balance sheets?

With FTX and Alameda controlling around 90% of the FTT token supply, Nansen suggests that the two companies may have been artificially inflating each other's balance sheets. This finding adds weight to the theory that Alameda sold FTT tokens over-the-counter and used them as collateral for loans from cryptocurrency lending firms.

A covert $4 billion loan from FTX

The collapse of the Terra/LUNA stablecoin and the bankruptcy of 3 Arrows Capital likely created liquidity issues for Alameda, leading to a secretive $4 billion FTT-backed loan from FTX. Nansen's on-chain data suggests that this loan may have taken place, as Alameda sent approximately 163 million FTT to FTX wallets during the collapse of 3 Arrows Capital.

Binance's damning announcement

Binance CEO Changpeng 'CZ' Zhao's announcement to sell off FTT tokens following negative reports about Alameda's balance sheet put further strain on the company. Blockchain data indicates that Alameda would not have been able to fulfill an offer to buy FTT tokens from Binance at $22.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/bitcoin-traders-eye-27k-amid-volatile-us-dollar