Key Points:

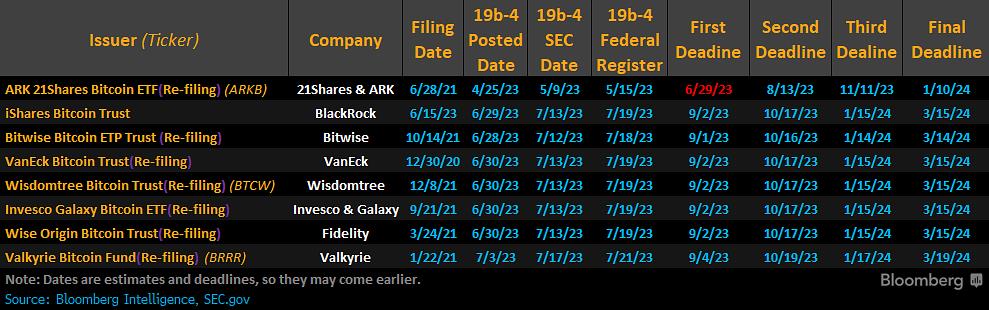

- The United States Securities and Exchange Commission (SEC) is facing deadlines to decide on seven new Bitcoin exchange-traded fund (ETF) applications.

- Investment firm Bitwise will learn if its ETF will win approval on Sept. 1, while BlackRock, VanEck, Fidelity, Invesco, and Wisdomtree await decisions by Sept. 2.

- Valkyrie is set to hear back from the SEC on Sept. 4.

- The U.S. Court of Appeals ruled that the SEC's rejection of Grayscale's Bitcoin ETF application was "arbitrary and capricious," increasing the odds for the next wave of applicants.

First Decision Deadline Approaches

The United States Securities and Exchange Commission (SEC) is facing its first deadlines to decide on seven new Bitcoin spot exchange-traded fund (ETF) applications, with the latest deadline being Sept. 4. Investment firm Bitwise will learn if its ETF will win approval on Sept. 1, while BlackRock, VanEck, Fidelity, Invesco, and Wisdomtree will all be awaiting the SEC's decisions for their funds by Sept. 2, according to SEC filings.

Grayscale's Win Boosts Hopes for Other Applicants

The U.S. Court of Appeals recently ruled that the SEC's rejection of Grayscale's application to convert its Grayscale Bitcoin Trust (GBTC) into a Bitcoin ETF was "arbitrary and capricious." Though this victory doesn't guarantee approval for Grayscale or other applicants in the future, Bloomberg ETF analyst James Seyffart believes it increases the odds of a successful outcome for the next wave of applications.

Seyffart noted that the SEC can delay its decisions and has two more proposed deadlines for each fund before needing to make a final decision on the 240th day post-filing. The final deadlines for the awaiting applicants are set for mid-March next year.

SEC's Next Move Remains Unclear

Following the court ruling in favor of Grayscale, the SEC has 90 days to file an appeal with the U.S. Supreme Court or apply for an En banc review, where a full circuit court can overturn a ruling made by a three-judge panel. However, the SEC has not yet indicated its next move.

If the SEC decides not to appeal, the court will need to specify how its ruling should be executed, which could include instructing the SEC to approve Grayscale's application or at least revisit it. Bloomberg ETF analyst Eric Balchunas considers it "highly unlikely" for the SEC to revoke Bitcoin futures ETFs since they have reportedly shown openness to Ethereum futures ETFs.

Outcomes for the Regulator

According to Seyffart, there are two viable options for the SEC. The first is to concede defeat and approve Grayscale's conversion of its GBTC to a Bitcoin spot ETF. Alternatively, the SEC would need to revoke the listing of Bitcoin futures ETFs entirely or deny Grayscale's application based on a new argument.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/elon-musks-x-gets-closer-to-crypto-payments-with-new-state-license