SEC Kicks Bitcoin ETF can down the road

When the price of Bitcoin (BTC) experiences a sudden and steep drop, various theories emerge to explain this phenomenon. Some of the usual suspects include government regulations, exchanges manipulating prices, Bitcoin whales influencing prices, over-leveraged traders, and even conspiracies involving Tether (USDT).

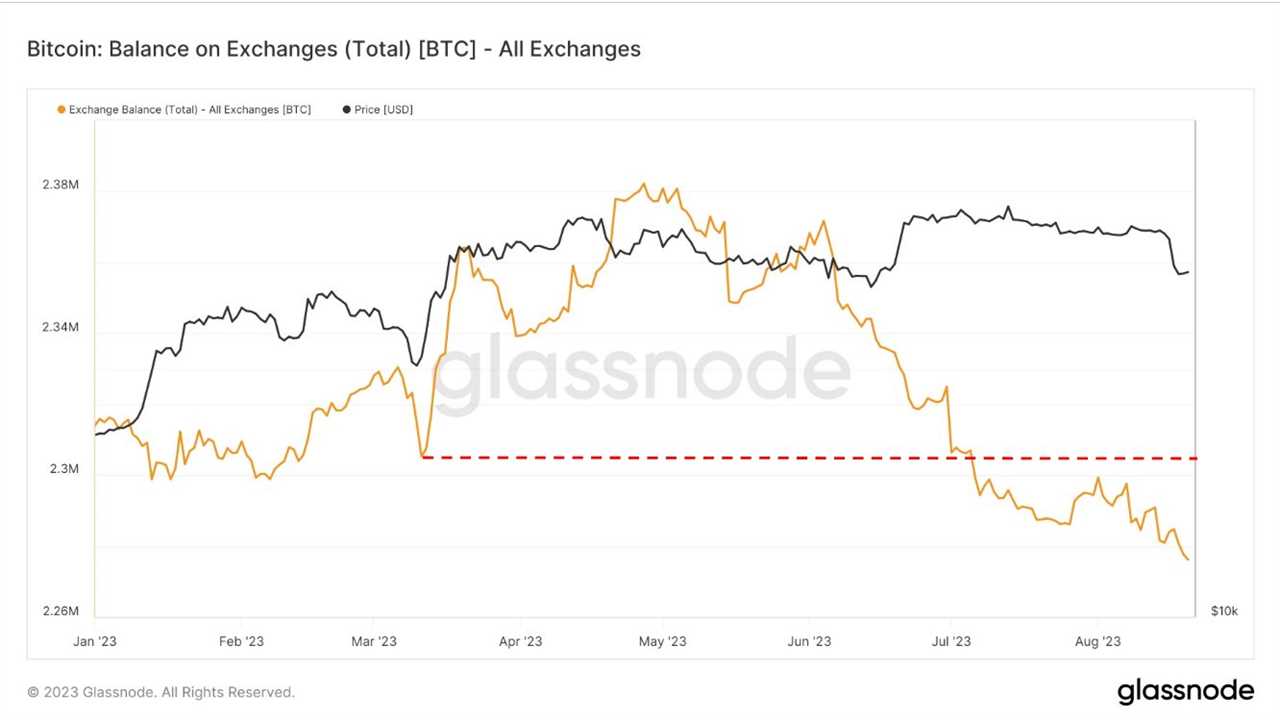

Between August 15 and August 18, Bitcoin's price saw a significant decline of 12%. As was expected, analysts and experts came up with different reasons to explain this occurrence. However, due to the decentralized nature of cryptocurrencies and the lack of transparency among exchanges, it remains a challenging task to verify whether a specific entity influenced the price movement.

Earlier on August 11, co-founder of Ceni Capital, Ceni, made a prediction that turned out to be partially accurate. Ceni predicted a Bitcoin price lower than $29,000, anticipating the U.S. Securities and Exchange Commission (SEC) to postpone its decision regarding the Ark Bitcoin ETF. While the prediction lacked specific timing or an exact support level, it still raises questions about BlackRock's potential involvement in Bitcoin's crash, which deserves further investigation.

Spot-based Bitcoin ETF is not a short-term deal for BlackRock

The idea that BlackRock might benefit from a lower Bitcoin price before launching a spot-based Bitcoin ETF is not as straightforward as it may seem. BlackRock, being a respected financial institution, has built its reputation based on commitment to market stability and investor confidence. A sudden and substantial drop in Bitcoin's value could undermine the overall credibility of the cryptocurrency market, something BlackRock would aim to avoid. The priority of maintaining the market's legitimacy might outweigh immediate gains resulting from a low Bitcoin price.

Furthermore, launching any financial product, especially within the cryptocurrency domain, requires regulatory approval. The SEC thoroughly assesses the potential for market manipulation and safeguards for investor protection. Engaging in activities that could be seen as price manipulation could jeopardize BlackRock's chances of securing the necessary regulatory approvals for their ETF offering.

Lastly, introducing any investment product, especially a novel one like a Bitcoin ETF, requires instilling investor confidence. A sharp drop in Bitcoin's price could erode trust among investors, not only in the asset class itself but also in the ETF. Therefore, it is likely that BlackRock's interest lies in launching the ETF during a period of positive sentiment, where investors feel confident about the potential for future gains.

If not BlackRock, who's to blame for the BTC price drop?

The next possibility often considered when trying to explain a drop in Bitcoin's price is the idea that the government will regulate the cryptocurrency sector. This could be driven by reasons like reducing demand to make the U.S. dollar stronger.

However, there are challenges and factors that make this theory seem less likely. While it's possible to track government wallets to some extent, governments usually hold only a small portion of all the Bitcoin in circulation, limiting their influence on the overall market.

Another theory suggests betting against the price of BNB (Binance Coin) as a cause for the price drop. However, this idea is not as simple as it sounds since borrowing BNB is not allowed on regulated platforms. Checking Binance's transparency page, where real-time information about the exchange's Bitcoin wallets is available, could provide insights into any unusual activities or financial problems, but relying on actual data is more important than mere speculation.

Ultimately, most of these theories make assumptions and oversimplify the complex nature of cryptocurrency markets, exchanges, and regulations. The actual reasons behind a Bitcoin price drop could be very different from what is suggested. While the truth may never be known for sure, it is important to dismiss such theories, like BlackRock crashing Bitcoin before a spot-Bitcoin ETF approval, as merely speculative.

This article is for general information purposes and should not be considered legal or investment advice. The views expressed here are the author's and do not necessarily reflect the views of Cointelegraph.