Paradigm accuses SEC of altering laws without proper procedure

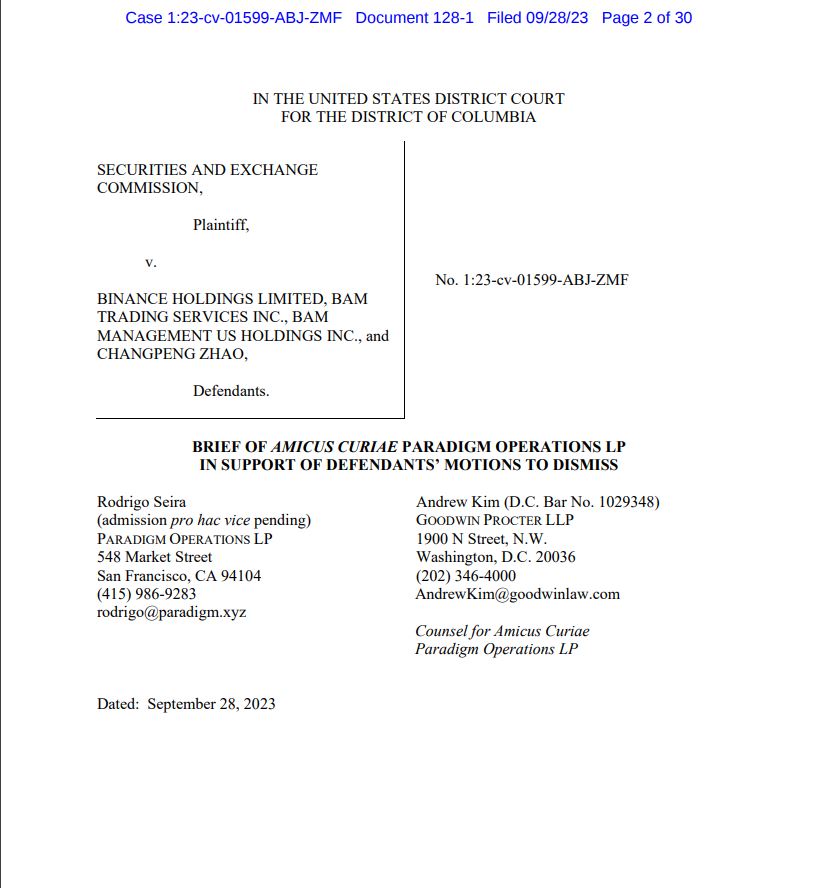

Venture capital firm Paradigm has accused the United States Securities and Exchange Commission (SEC) of sidestepping standard rulemaking procedures in its current lawsuit against cryptocurrency exchange Binance. The SEC is using allegations in its complaint to change the law without following established processes, according to a statement from Paradigm. The firm firmly believes that the SEC is overstepping its regulatory boundaries and strongly opposes this tactic.

SEC accused of reshaping securities law in cryptocurrency cases

In June, the SEC launched legal action against Binance, alleging multiple violations of securities laws, such as operating without the necessary registration as an exchange or broker-dealer. Paradigm pointed out that the SEC has recently pursued similar cases against various cryptocurrency exchanges and expressed concerns that the SEC's approach "could fundamentally reshape our comprehension of securities law in several critical aspects."

Concerns raised over SEC's application of the Howey Test

Paradigm also raised concerns about the SEC's use of the Howey Test, a criteria used to determine if transactions meet the definition of an investment contract and fall under securities regulations. The test originated from a 1946 U.S. Supreme Court case involving citrus groves. Paradigm asserted that many assets, including gold, silver, and fine art, are actively marketed and traded based on their profit prospects, yet the SEC consistently exempts them from being classified as securities. The firm argued that the potential for value appreciation does not automatically classify a sale as a security transaction.

Circle joins legal dispute over stablecoins

Circle, the issuer of the USDC Stablecoin, has entered the ongoing legal battle between Binance and the SEC. Circle believes that stablecoins, including BUSD and USDC, should not be classified as securities. The company argues that individuals who acquire these stablecoins do not anticipate deriving profits solely from their acquisition.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/terraform-labs-cofounder-denies-slack-messages-linking-him-to-fraud-on-terra-blockchain