Introducing Cointime Economics: A Revolutionary Method for Bitcoin Analysis

ARK Invest and Glassnode have collaborated to develop a groundbreaking framework for analyzing Bitcoin on-chain metrics. The new method, called Cointime Economics, introduces a unique measure known as the coinblock, which aims to represent the current state of the Bitcoin network. This innovative approach could potentially enhance valuation metrics and provide a powerful analytical tool for measuring Bitcoin activity.

Why Cointime Economics Matters

According to David Puell of ARK Invest and James Check of Glassnode, the traditional way of assessing Bitcoin's economic state based on outstanding supply may not provide the most accurate picture. The authors argue that the importance of a single bitcoin should vary based on the duration of its dormancy. In other words, the longer a bitcoin has remained unmoved, the more significant its transfer becomes. These long-dormant bitcoins are likely to be held by experienced investors and market whales, making their movements more noteworthy.

The Role of Coinblocks

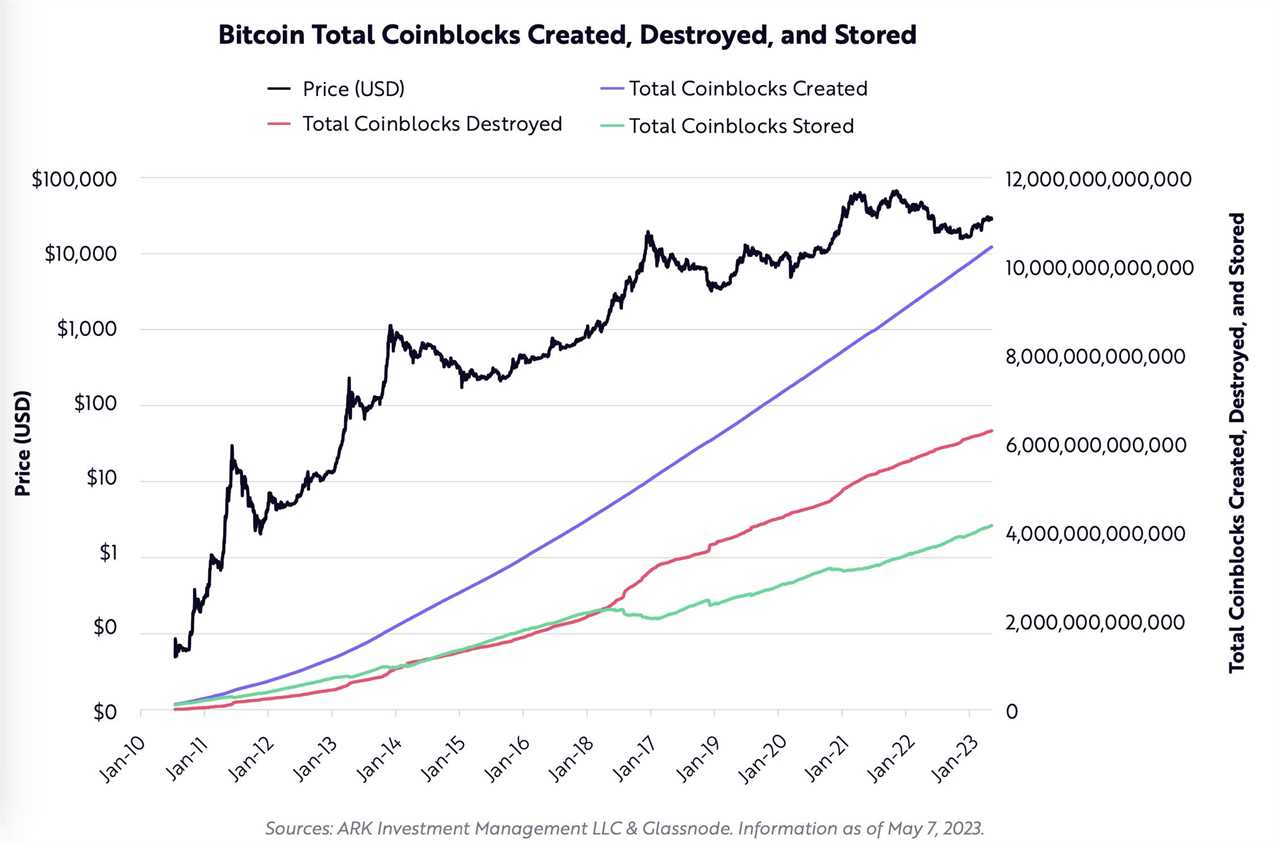

To measure Bitcoin activity using Cointime Economics, the authors propose utilizing a new unit of calculation called the coinblock. One coinblock is determined by multiplying the number of bitcoins by the number of blocks produced while the bitcoins remain stationary. With the Bitcoin network producing a block every 10 minutes, one coin generates approximately 144 coinblocks per day. Coinblocks are "destroyed" based on the length of time the bitcoins were held. This destruction of coinblocks helps identify higher activity by long-term hodlers.

Cointime Economics vs. Traditional Models

Unlike the traditional Unspent Transaction Output (UTXO) model, which assigns equal weight to all bitcoins, Cointime Economics takes into account the duration of dormancy. This difference in approach leads to varying representations of both active and inactive bitcoins in the two models. In Cointime Economics, inactive bitcoins are referred to as the "vaulted supply" and are calculated by dividing the total number of coinblocks created by the total number not destroyed.

Real-World Applications of Cointime Economics

The white paper outlining the Cointime Economics framework provides three use cases to illustrate its practicality. Glassnode has also released a more advanced version of the paper for blockchain specialists, along with a suite of Cointime Economics metrics. These resources aim to empower analysts and researchers to delve deeper into the world of Bitcoin analysis.

ARK Invest is an investment management company founded by Cathie Wood, while Glassnode is a Swiss-based market intelligence service.