The Chicago Mercantile Exchange (CME) Dominates Crypto Trading

The Chicago Mercantile Exchange (CME) has established itself as the go-to platform for traditional finance investors looking to enter the crypto market. Despite the imminent approval of a Bitcoin spot ETF, the CME's dominance is unlikely to waver.

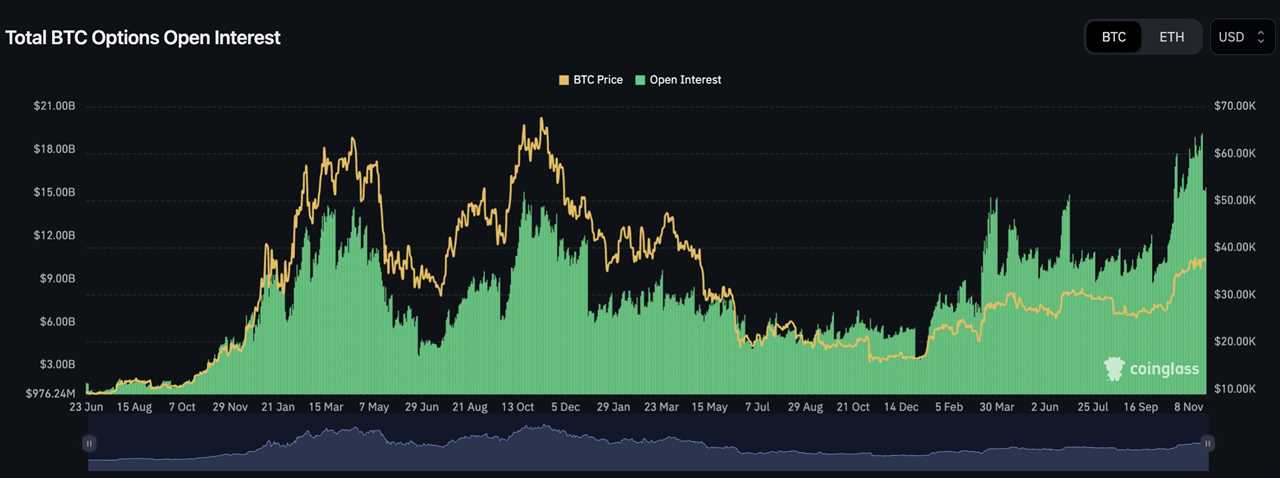

Over the past year, the CME has experienced remarkable growth in Bitcoin (BTC) futures trading, surpassing even the world's largest crypto exchange, Binance. In fact, the CME now accounts for 24.7% of the entire Bitcoin futures market, solidifying its position as the top Bitcoin futures trading venue globally.

While the anticipation of a spot ETF approval has contributed to this surge in activity, the introduction of one or more spot ETFs will not diminish the popularity of futures trading. On the contrary, futures trading is expected to expand further once the Securities and Exchange Commission (SEC) grants approval to BlackRock and other major players.

The Unique Value of Futures in the Crypto Market

A spot ETF is undoubtedly poised to attract substantial institutional investments into the crypto sector. However, it will not alter the fundamental dynamics of Bitcoin liquidity. With a capped supply of 21 million Bitcoin, the futures market remains the primary venue for real trade action.

Major financial institutions like Goldman Sachs, Morgan Stanley, and JP Morgan have been utilizing the CME for years to trade cryptocurrency instruments, predominantly through futures. The futures market remains the instrument of choice due to liquidity concerns in the spot market. While these institutional investors have the ability to buy Bitcoin directly, the lack of liquidity poses a significant obstacle, not the absence of a spot ETF.

Furthermore, sophisticated institutional investors utilizing the CME are likely to hedge their positions in spot ETFs by engaging in futures trading. Consequently, we can expect the activity on the CME to grow in tandem with the expansion of spot ETFs.

Futures as a Speculative Instrument and the Impact of Clearer Regulation

As we know, futures are inherently speculative, and the cryptocurrency market epitomizes this characteristic. As digital assets gain increased legitimacy and credibility through the approval of a spot ETF, more investors will be drawn to various aspects of digital asset trading.

Day traders, who may have previously focused on the foreign exchange market, are expected to venture into Bitcoin and other crypto instruments. And when they do, they are likely to gravitate towards the CME. In fact, we can anticipate growing interest in perpetual swaps and other derivative instruments within the sector in the coming year.

Additionally, clearer and more consistent regulation surrounding crypto futures has been a significant contributing factor to their success. While the Commodity Futures Trading Commission (CFTC) oversees futures trading, the regulatory oversight of the crypto spot market remains uncertain. This lack of regulatory clarity has hindered the growth of the spot market.

While applications for Bitcoin spot ETFs await approval from the Securities and Exchange Commission (SEC), Chairman Gary Gensler's preference for ambiguity has prolonged the decision-making process. As a result, the futures market continues to be an attractive trading ground for institutional investors while we await the arrival of an approved ETF.

This article is for general information purposes and should not be considered legal or investment advice. The views expressed here are solely those of the author and do not necessarily reflect the views of The Guardian.