Cryptocurrency exchange FTX has filed a motion with the District of Delaware Bankruptcy Court to seek authorization for the sale of digital assets that were recovered during ongoing bankruptcy proceedings. The company intends to transfer approximately $7 billion worth of cryptocurrency tokens to Galaxy Digital, a digital asset management firm led by Mike Novogratz, following the collapse of the exchange in 2022.

Maximizing value and reducing volatility

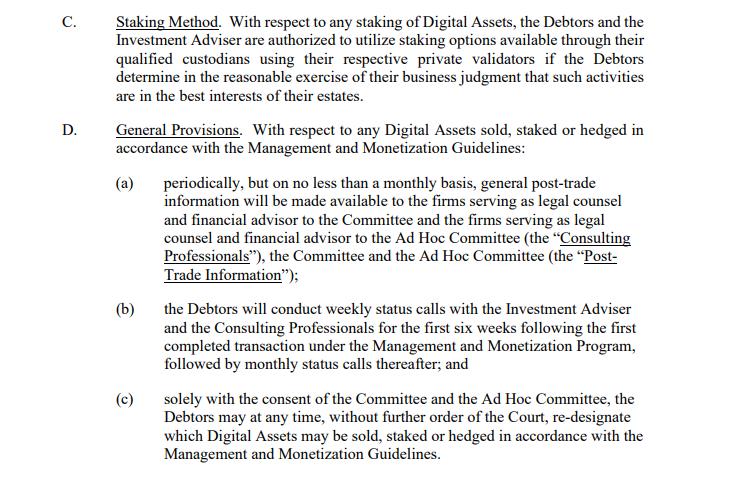

In its filing, FTX outlines its plans to provision for the potential sale of its cryptocurrency holdings through Galaxy Digital. The company aims to reduce exposure to market volatility and potential fiat repayments to creditors by implementing a comprehensive management and monetization plan for its cryptocurrency assets. By working with Galaxy Digital, FTX intends to tap into the firm's specialized knowledge of digital asset markets to maximize the value of its token portfolio.

Anonymity and risk mitigation

One of the potential benefits mentioned in the filing is the ability to anonymously sell FTX's cryptocurrency holdings into the markets, thus mitigating the risk of market manipulation. This strategic partnership aims to protect FTX's interests as it looks to sell its crypto holdings for fiat in order to reduce exposure to market volatility.

Decentralized Finance (DeFi) and passive yield income

The filing also mentions the inclusion of Decentralized Finance (DeFi) in FTX's plans. The company intends to stake certain cryptocurrencies to generate passive yield income under the guidance of Galaxy Digital. This signifies FTX's intention to explore new avenues for financial growth and diversification within the cryptocurrency ecosystem.

Rebooting the exchange and repaying creditors

Alongside the motion for the sale of recovered assets, FTX recently filed a proposed restructuring plan that suggests the creation of a rebooted offshore exchange. This plan could offer creditors the option to be paid out a portion of their lost funds or choose a share of equity, tokens, and other interests in the rejuvenated FTX exchange. The ongoing bankruptcy proceedings and FTX's strategic partnerships signify the company's determination to address its financial challenges and find a viable path forward.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/shibarium-l2-public-launch-imminent-as-testing-phase-concludes