Key Points:

- Fiat payment rails and neobanking services are crucial for the wider adoption of cryptocurrencies.

- OpenPayd, Ramp Network, and Damex are leading the way in providing banking infrastructure for the crypto space.

- These services address concerns around identity, traceability, and money laundering.

- They act as intermediaries between traditional banks and crypto-related businesses, providing necessary due diligence.

- The gap between emerging financial technologies and existing banking systems remains a challenge for crypto-native businesses.

- Compliance with regulatory standards, such as the European Union's MiCA framework, is essential for wider acceptance.

Driving Mainstream Adoption

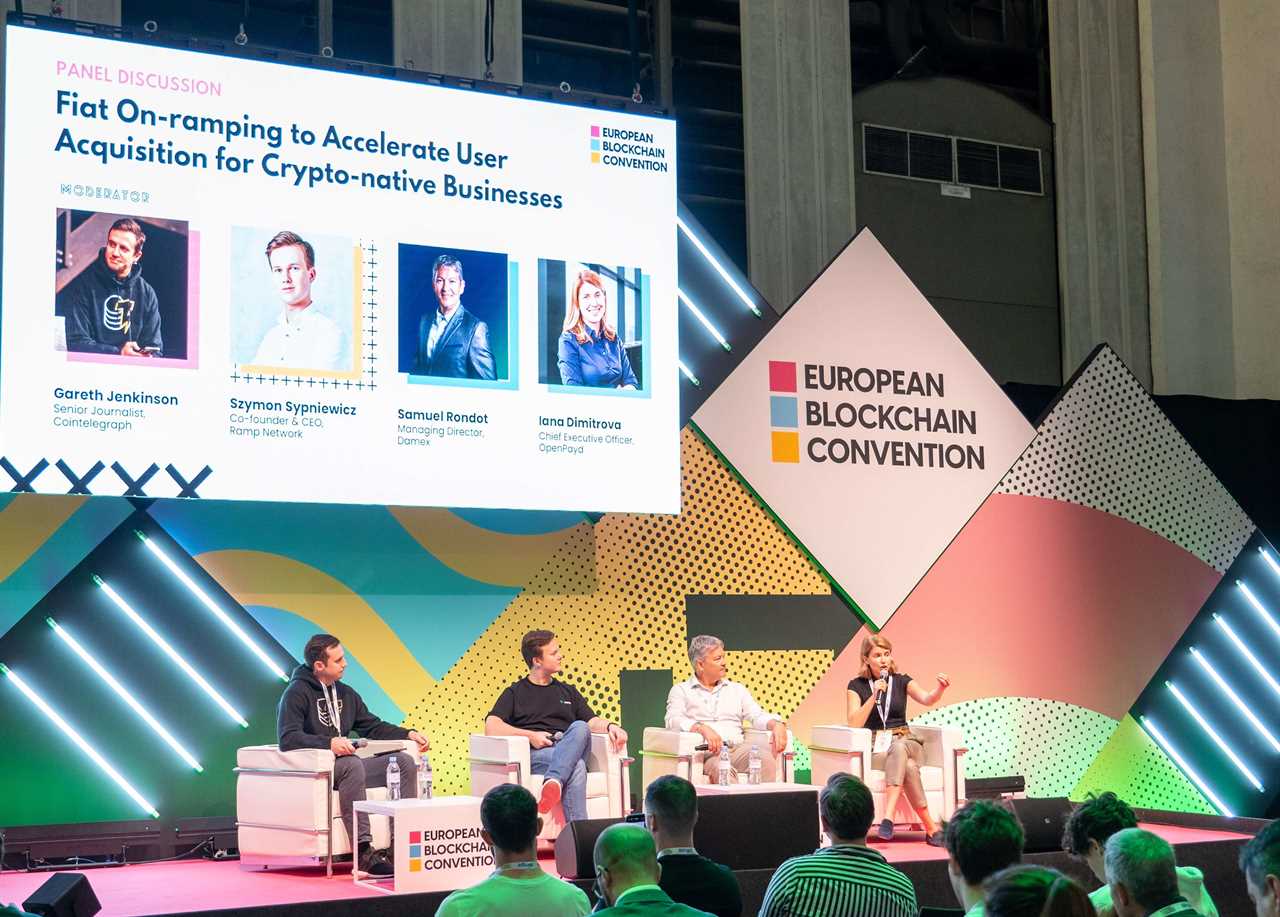

Fiat payment rails and neobanking services are playing a critical role in driving the mainstream adoption and acceptance of cryptocurrencies, according to industry experts. Executives from OpenPayd, Ramp Network, and Damex highlighted the increasing importance of these third-party platforms at the recent European Blockchain Convention in Barcelona.

Bridging the Gap

OpenPayd, which processes over 3 billion euros of monthly transaction volume, offers banking and payment infrastructure for various industries, including the cryptocurrency space. CEO Iana Dimitrova explained that these services help bridge the gap between regulators, traditional financial institutions, and the crypto world. By addressing concerns around identity, traceability, and money laundering, fiat on-ramps and payment rails provide a level of trust for all parties involved.

Specialist Actors

Damex specializes in providing fiat on and off-ramps for higher risk category clients, such as iGaming, Forex, and hedge funds. By acting as a shield between traditional banks and cryptocurrency-related businesses, Damex helps clients overcome reputational issues associated with the crypto ecosystem. This specialist role is also filled by platforms like OpenPayd and Ramp, which understand and facilitate Anti-Money Laundering and Know Your Customer processes.

Seamless Transition

Ramp Network offers a single API platform that connects the global fiat system with cryptocurrencies. By providing access to a regulatory-compliant tech setup, Ramp enables users to buy and sell cryptocurrencies worldwide. CEO Szymon Sypniewicz emphasized the importance of making the transition to crypto-enabled products seamless. Ramp's infrastructure allows crypto-related businesses to offer credit cards, debit cards, local payment methods, and bank transfers for users to acquire cryptocurrencies or pay for services.

The Challenges

While fiat payment rails and neobanking services offer a solution for the crypto world, there are challenges that crypto-native businesses face. One major challenge is the gap between the level of innovation and agility required by these businesses and the banking technology of incumbent banks. Infrastructure providers like OpenPayd and Ramp address this challenge by aggregating different payment rails, banks, and channels, providing a consistent level of service and experience.

Compliance and Regulation

In addition to technological challenges, compliance with regulatory standards is crucial for wider adoption of crypto-native businesses. The European Union's Markets in Crypto-Assets (MiCA) framework is expected to provide a common framework for both Web3 and traditional finance players to operate more easily. Compliance with these standards ensures a level playing field and builds trust among regulators and financial institutions.

In conclusion, fiat payment rails and neobanking services are driving the mainstream adoption of cryptocurrencies by addressing concerns around trust, identity, and compliance. These services act as intermediaries between traditional banks and crypto-related businesses, providing the necessary due diligence and regulatory compliance. While challenges remain, the industry is moving towards a more seamless and integrated future.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/bnb-smart-chain-scam-losses-plummet-75-in-q3-report