Ethereum went through a key network upgrade on Sept. 15, shifting from its proof-of-work (PoW) mining consensus to a proof-of-stake (PoS) one. The key upgrade is dubbed the Merge.

The Merge was slated as a critical change for the Ethereum network that would make it more energy efficient, with later improvements to scalability and decentralization to come.

A little over a month later, however, some industry observers fear the PoS transition has pushed Ethereum toward more centralization and higher regulatory scrutiny.

The Merge replaced the way transactions were verified on the Ethereum network. Instead of miners putting in their computational power to verify a transition, validators now pledge Ether (ETH) tokens to verify those transactions. The issue with this system is that validators with a higher number of Ether have a larger say, given they have a larger percentage of validator nodes or staked ETH.

To become a validator on the Ethereum network, one must stake a minimum of 32 ETH. Thus, whales and big crypto exchanges have staked millions of ETH to have a larger portion of the validator nodes.

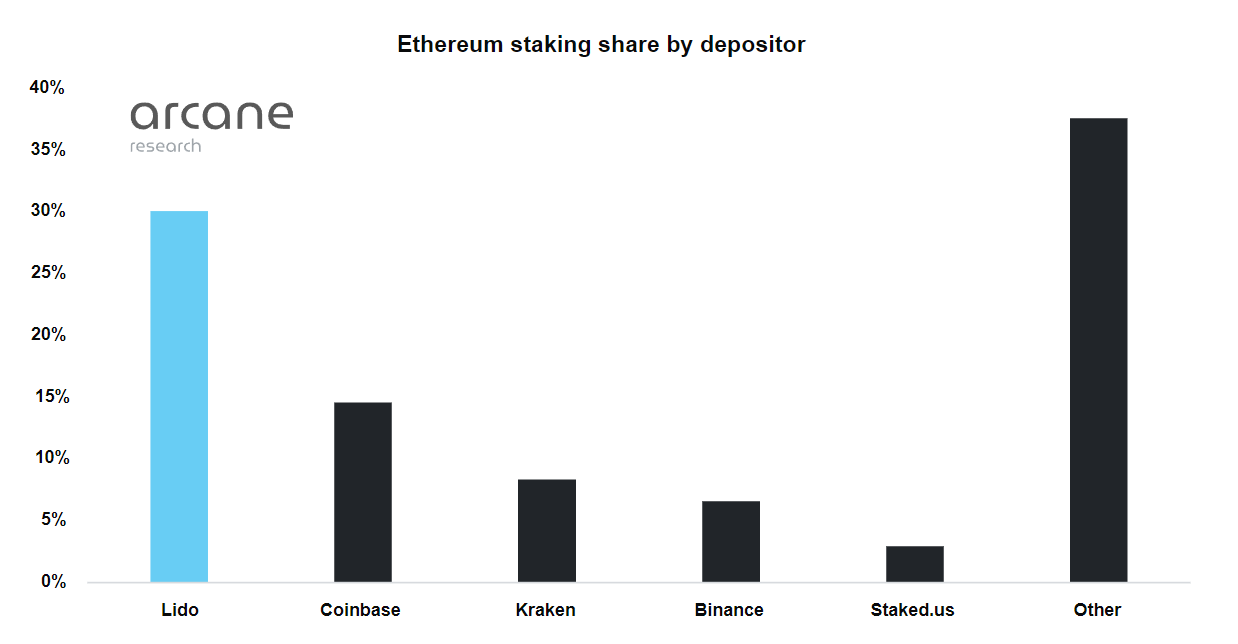

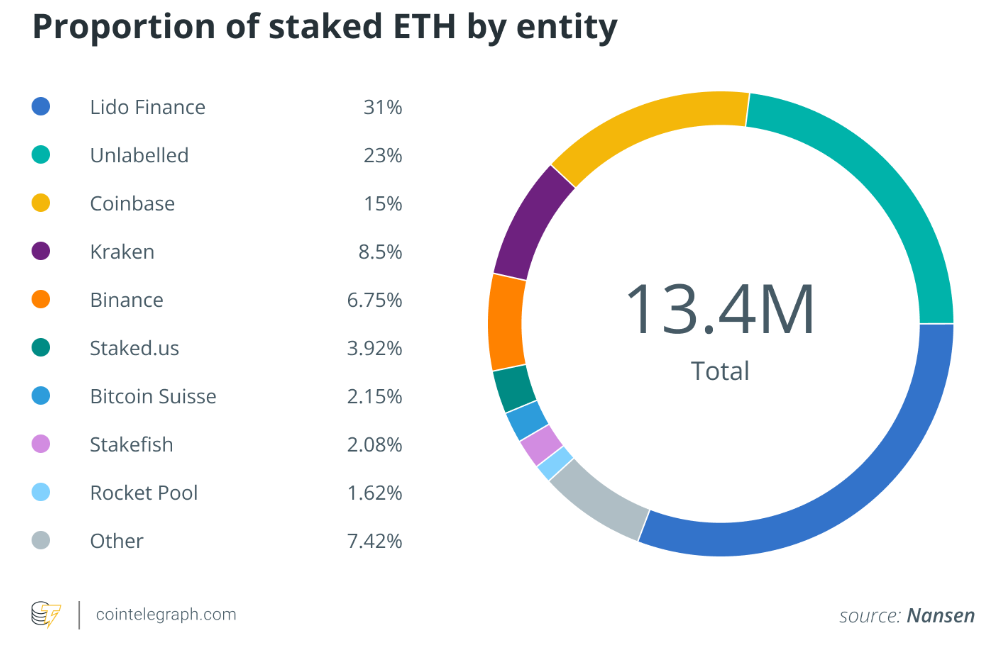

Current staking activities look very centralized, with the leading liquid staking protocol Lido and leading centralized exchanges such as Coinbase, Kraken and Binance accounting for over 60% of the staked ETH.

RA Wilson, chief technology officer of crypto and carbon credits exchange 1GCX, told Cointelegraph that the Merge has enabled large holders of Ether to gain mass control of the network, making it significantly more centralized and certainly less secure and explained:

“Many ETH holders stake their crypto on centralized exchanges such as Coinbase, which allows these platforms to become dominant holders on the network, contributing to stakeholder centralization.”

The centralization aspect was quite evident right after the Merge, as 46.15% of the nodes for storing data, processing transactions and adding new blockchain blocks could be attributed to just two addresses.

Arcane Crypto analyst Vetle Lunde told Cointelegraph that while the PoS transition was important for Ethereum’s long-term goals of energy efficiency and scalability, one should be aware of the trade-offs:

“The largest validators being exchanges represent a potential long-term risk. Exchanges already find themselves in a difficult regulatory landscape, and precautionary rejections of transactions may conflict with one important core principle in the crypto ethos, censorship resistance.”

While Ethereum proponents claim that anyone with 32 ETH can become a validator, it is important to note that 32 ETH, or around $41,416, is not a small amount for a newbie or common trader, added to the fact that the lock-in period is quite long.

Slava Demchuk, CEO of Web3 complaint platform PureFi, told Cointelegraph that the centralization and complexities involved in staking would make centralized entities like Coinbase more powerful:

“Most people will be staking with custodians (such as Coinbase) due to the simplicity and the fact that they don’t have 32ETH. This way, large companies will have a majority share of the network, making it more centralized. It means that entities with more ETH will have more control.”

The fear of regulatory scrutiny

Earlier in 2018, the SEC claimed that Ether is not a security, owing to its decentralized development and expansion over time. However, that may change with the move to PoS, which has complicated the relationship between the Ethereum blockchain and regulators.

Gary Gensler, Chair of the United States Securities and Exchange Commission (SEC), testified before the Senate Banking Committee on the day of the Merge, stating that revenue from “expectation of profit to be derived from the efforts of others” would include proof-of-stake digital assets.

Gensler also mentioned that staking from large centralized exchanges looks “very similar” to lending, calling out high-yield products that caused the recent crypto market meltdown and lumping these products into the financial instruments under the scrutiny of the SEC.

Furthermore, in an SEC lawsuit filed just a week after the Merge, the SEC claimed jurisdiction over the Ethereum network as the majority of nodes are concentrated in the United States.

While the SEC’s claims raised some eyebrows and with many criticizing the regulator for its approach, some believe Ethereum has had it coming, as Gensler has already stated that moving to PoS could trigger securities laws. Ruadhan, the lead developer of PoW-based mining token developer Seasonal Tokens, told Cointelegraph:

“The argument that many of the validators are located in the U.S. is weak because it’s not even a majority. However, this move does show an intent to regulate, and it would cause a major disruption to the economy if Ethereum were to be classified as a security. Centralized exchanges would need to de-list Ethereum. The world economy is currently very vulnerable, and Ethereum’s market cap is so large that an event like this could have spillover effects and even cause an economic crisis.”

Ruadhan predicted that if Ethereum was classified as a security, then it would be much more heavily regulated regardless of how centralized it is: “If there are very few block proposers, all concentrated in the United States, then they can be forced to censor transactions that violate U.S. sanctions, which would mean that Ethereum’s censorship resistance is lost.”

Kenneth Goodwin, director of regulatory and institutional affairs at Blockchain Intelligence Group, told Cointelegraph that the move to PoS has certainly provided the SEC with leverage to oversee validators and even the nodes themselves as long as they are connected with a U.S. person, entity or jurisdiction. However, there is an irony to the situation. Goodwin explained:

“The irony here is that this could be one of the networks in consideration for the U.S. central bank digital currency given its central nature of it. On the flip side, there would be more regulatory oversight that may include creating a system of registration for validators and Ether protocol-based projects. Nevertheless, it seems as though the SEC is seeking to classify Ethereum as a security.”

Jae Yang, CEO and co-founder of noncustodial crypto exchange Tacen, told Cointelegraph that centralization could become a concern for Ethereum if regulators move to impose Anti-Money Laundering (AML) regulations on staking.

“Centralization will be a concern if the FinCEN or other regulators impose Know Your Customer, AML or other AML compliance requirements on users simply staking ether. Though a long shot at this point, there is a risk that centralized validators omit certain transactions, establishing themselves as the third-party intermediary on decision-making that goes against the very guiding principles of the decentralized financial system,” he explained.

Long-term impact of PoS transition

Despite concerns of over-centralization and regulatory scrutiny, industry observers are confident that the Ethereum blockchain will overcome these short-term issues and continue to play a key role in developing the ecosystem in the long term.

Okcoin chief operating officer Jason Lau advocated for an expanded view of the transition. He told Cointelegraph:

“When we think about the centralization vs decentralization debate, we need to look at the long-term. Open blockchains require a high level of decentralization to ensure censorship resistance, openness and security, so any shift towards more centralization would be worth keeping an eye on. The community is well aware of the importance of encouraging and ensuring a diverse set of participants, and we will see how this plays out over time.”

Wilson noted that the network may become slightly more decentralized over the course of the next 6–8 months, as lock-up periods on Ethereum begin to expire and holders will be able to withdraw their staked tokens.

And while node and validator centralization is a valid concern, Chen Zhuling, co-founder and CEO of noncustodial staking service provider RockX, noted PoW mining on Ethereum was as centralized as validators of the current PoS-based network.

Chen told Cointelegraph that in the PoW era, “Three mining pools dominated the Ethereum network’s hashrate. You could hardly compete with other miners to verify blocks if you didn’t possess an immense amount of computing power, requiring expensive, energy-guzzling mining rigs.”

Chen also advocated for a long-term view of the PoS transition as currently, tokens are mostly controlled by large foundations for the sake of security and on the goodwill assumption that they wouldn’t do anything to corrupt the network.

Demchuk was quick to point out that centralization in staking does not mean it will be easy for a large malicious group of stakers to potentially take control of the Ethereum network, as “there is an additional protective measure. ‘Bad’ validators will get slashed, meaning that their ‘stake’ can get confiscated.”

Ethereum might have transitioned to a PoS network, but a majority of scalability and other features will only arrive after the completion of the final phase, expected by the end of 2024.

Going ahead, it will be interesting to see how Ethereum overcomes the centralization of validators and addresses the growing regulatory concerns facing the network.

Title: Ethereum at the center of centralization debate as SEC lays claim

Sourced From: cointelegraph.com/news/ethereum-at-the-center-of-centralization-debate-as-sec-lays-claim

Published Date: Mon, 24 Oct 2022 14:01:00 +0100

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/the-madeira-bitcoin-adoption-experiment-takes-flight