Phishing Attack Results in $24M Loss

A cryptocurrency whale, a term used to describe a large cryptocurrency investor, has been targeted in a major phishing attack, losing millions of dollars in staked Ethereum. The attack specifically targeted the liquid staking provider Rocket Pool, according to cryptocurrency security firm PeckShield.

The Two Transaction Hack

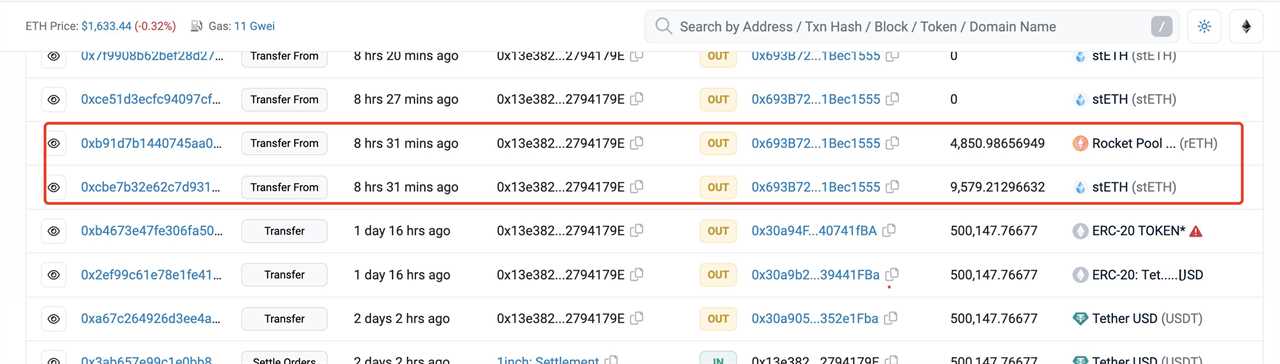

The phishing attack was carried out in just two transactions. In one transaction, 9,579 staked Ethereum (stETH) was stolen, and in the other, 4,851 Rocket Pool ETH (rETH) was taken. The attack took place on September 6th and resulted in the theft of approximately $15.5 million worth of stETH and $8.5 million worth of rETH, bringing the total loss to a staggering $24 million.

Change of Assets and Transfers

Following the theft, the hacker quickly exchanged the stolen assets for 13,785 Ether (ETH) and 1.64 million Dai (DAI) tokens, as reported by PeckShield. The report also revealed that a significant portion of the stolen funds were transferred to the fully automatic cryptocurrency exchange FixedFloat. Additionally, most of the remaining stolen funds were sent to three specific addresses: 0x4f2f02ee, 0x7023505, and 0x2abdc2ab, according to SlowMist's crypto tracking team MistTrack.

Token Approvals and Risk Warnings

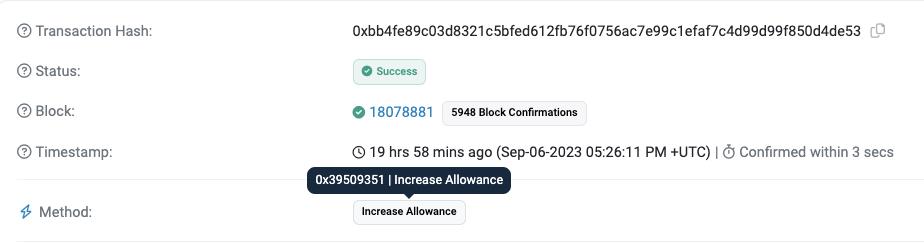

According to Scam Sniffer, the victim had enabled token approvals to the scammer by signing "Increase Allowance" transactions. ERC-20 tokens, which include Ethereum, have a feature called allowance or access permissions that allow third parties to spend tokens that do not belong to them. However, some experts have warned about the risks associated with approving ERC-20 allowances, highlighting the potential for anonymous developers to use malicious smart contracts to deceive users.

Broader Context: Self-Limit Rules

This incident comes at a time when several Ethereum liquid staking providers, including Rocket Pool, StakeWise, Stader Labs, and Diva Staking, have either implemented or announced plans to implement a self-limit rule. This rule restricts these providers from owning more than 22% of the Ethereum staking market. It is a preventive measure aimed at ensuring a more decentralized and secure staking ecosystem.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/polygon-foundation-denies-matic-dump-on-binance-claims-wallets-were-mislabeled