Key Takeaways:

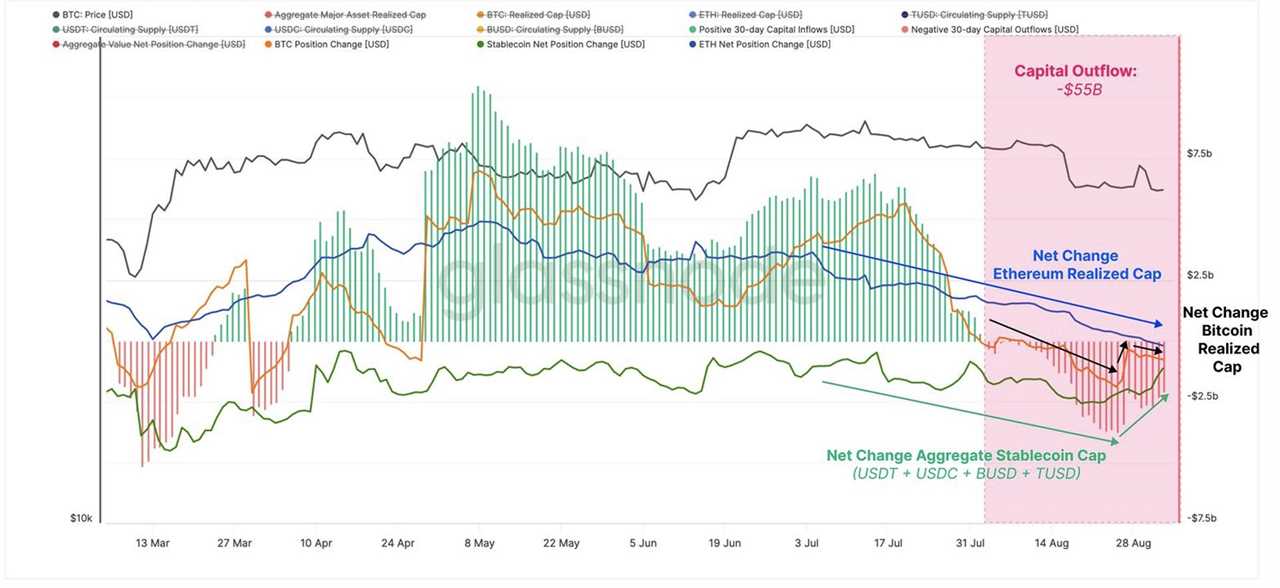

- Capital outflows in the cryptocurrency industry reached a staggering $55 billion in August, according to a report released by Bitfinex.

- The report highlights the impact on Bitcoin (BTC), Ether (ETH), and stablecoin liquidity, with August being the largest red monthly candle for BTC since November 2022.

- Event-based volatility and low liquidity have allowed isolated events to have a significant influence on market movements.

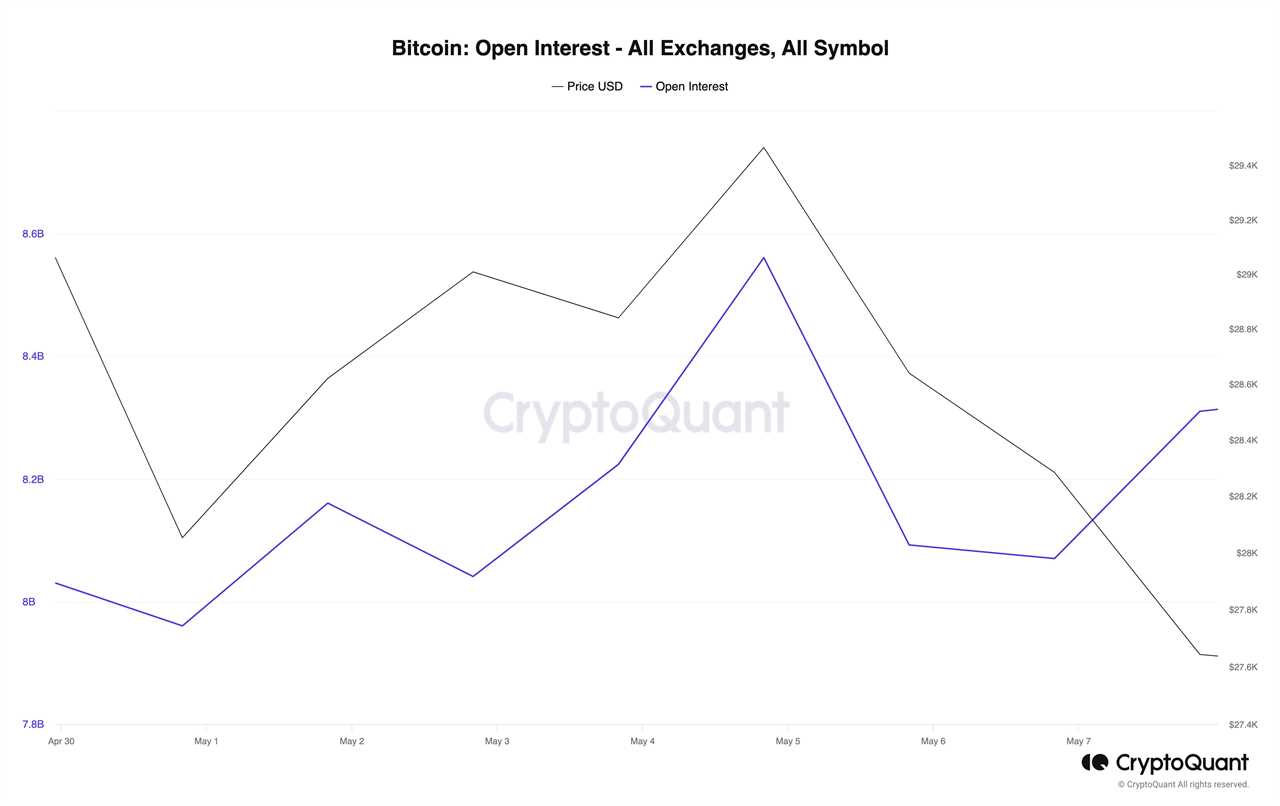

- Bitcoin open interest has outperformed the crypto markets due to increased institutional interest, while Ether futures and options have declined by almost 50% compared to previous years.

Analysis and Insights:

A recent report from Bitfinex reveals that capital outflows in the crypto market hit a staggering $55 billion in August, signaling a significant drain from the industry. This analysis is based on the aggregate realized value metric, which measures the realized capital of Bitcoin and Ether along with the combined supply from the top five stablecoins.

According to the report, August marked the largest red monthly candle for Bitcoin since the bear market bottom was formed in November 2022. Bitcoin experienced a decline of 11.29% during this period.

The analysis also highlights the return of event-based volatility, where isolated events have a larger impact on prices and overall market movements. In August, two specific events stood out: a flash crash on August 17 resulted in a sell-off of over 11.4% for Bitcoin, while Grayscale's partial legal victory over the Securities and Exchange Commission on August 29 led to a 7.6% price jump within two hours.

Bitfinex suggests that low liquidity in the market is allowing these isolated events to have a more significant influence on market movements. Furthermore, the report points out that Bitcoin open interest has outperformed the broader crypto market due to increased institutional interest and wash trading on some exchanges.

On the other hand, Ether futures and options have seen a significant decline in 2023 compared to previous years. Daily trading volume for Ether futures and options has dropped to $14.3 billion, marking a steep decline of almost 50% from the two-year average.

Bitfinex attributes this decline to the overall patterns of low liquidity seen in the derivatives market, reflecting the general market conditions.

Conclusion:

The crypto market experienced a substantial drain of $55 billion in August, as indicated by the Bitfinex report. This outflow affected Bitcoin, Ether, and stablecoin liquidity. The analysis also highlights the impact of event-based volatility and the influence of low liquidity on market movements. While Bitcoin open interest has outperformed the broader market, Ether futures and options have seen a significant decline. These trends suggest a need for further examination of market liquidity and its impact on cryptocurrency prices.