Raoul Pal highlights correlation between rising fiat market supply and crypto bull run

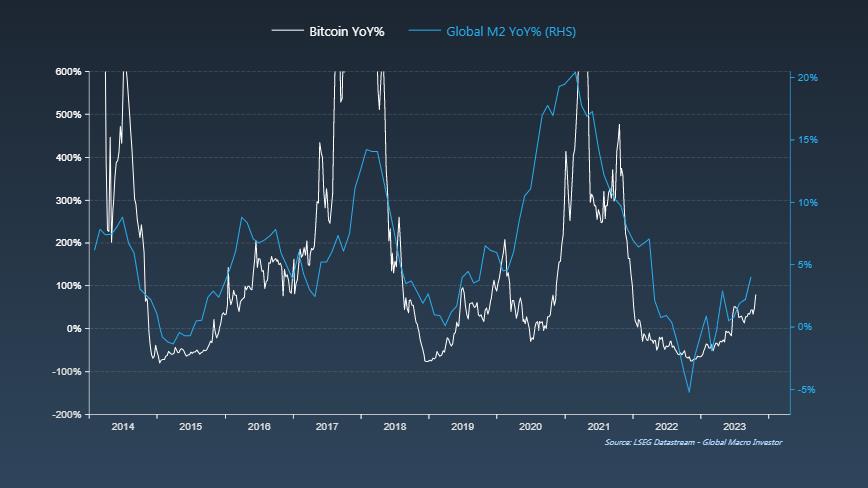

Raoul Pal, co-founder and CEO of financial media platform Real Vision, believes that the rising total money supply (M2) could fuel another bull rally in the crypto market and help it outperform traditional markets. Pal recently shared a graph on social media comparing Bitcoin's yearly performance against the global M2 money supply, highlighting the simultaneous rise of Bitcoin and global M2 supply. This correlation has historically led to the outperformance of the crypto market compared to traditional financial markets.

The chart reveals that Bitcoin's price is on the cusp of decoupling from the traditional market as the M2 supply continues to rise. This trend has been observed in previous years, such as 2021, 2017, and 2014, which saw significant spikes in Bitcoin's performance.

Pal expressed his enthusiasm for the global M2 supply, stating that it is the catalyst for Bitcoin outperforming the NDX (Nasdaq 100 Index) and turning the crypto market into a "Super Massive Black Hole."

The M2 represents the total amount of money estimated to be in circulation by the United States Federal Reserve. It includes cash held by individuals as well as money in savings accounts, checking accounts, and other short-term savings instruments.

While a Bitcoin bull run is often associated with the block reward halving that occurs every four years, Pal suggests that other macroeconomic factors, such as the growth of M2, also play a crucial role. The next halving is scheduled for April 2024 and is expected to reduce the market supply of BTC, increasing demand.

Bitcoin has historically performed well during periods of fast M2 growth, which is often accompanied by reduced interest rates, quantitative easing, and fiscal stimulus. Conversely, during times of monetary tightening by central banks, the cryptocurrency market has struggled to gain bullish momentum. The 2021 bull market coincided with 6% or higher aggregate M2 growth at major central banks including the Federal Reserve, European Central Bank, Bank of Japan, and People's Bank of China.