Cryptocurrency exchange Coinbase has introduced a new crypto lending service exclusively for institutional investors in the United States. The move is seen as an opportunity for Coinbase to take advantage of the recent failures in the crypto lending market.

Introducing Coinbase Prime

Coinbase has quietly unveiled its institutional-grade crypto lending platform, called Coinbase Prime, to investors in the US. This platform allows institutions to execute trades and store assets, offering a full-service prime brokerage experience.

In a statement, Coinbase reportedly said, "With this service, institutions can choose to lend digital assets to Coinbase under standardized terms in a product that qualifies for a Regulation D exemption."

Investment Figures and Response

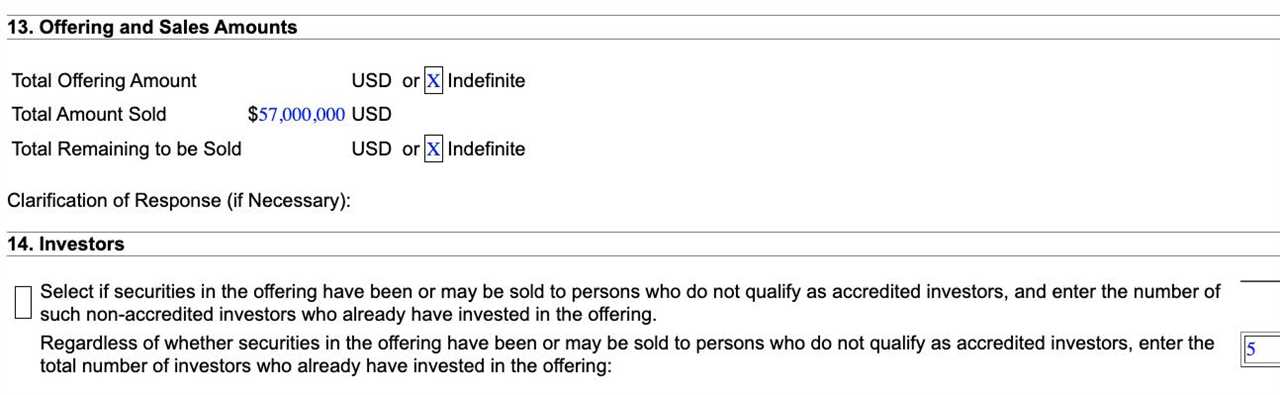

According to a filing with the US Securities and Exchange Commission, Coinbase has already attracted $57 million in investments for its lending program. The offering has attracted the interest of five investors since the first sale on August 28.

Coinbase did not respond to a request for comment when asked by a media outlet.

Background on Coinbase's Lending Programs

Earlier this year, Coinbase halted new loans issuance on Coinbase Borrow, a program designed to offer users up to $1 million in loans collateralized by Bitcoin (BTC). The new institutional lending platform, operated through Coinbase Credit, is a part of the same entity that manages Coinbase Borrow.

This announcement comes following the US Securities and Exchange Commission charging Coinbase with offering and selling unregistered securities in relation to its crypto staking services, which allow users to earn yields by lending their crypto to the platform. Coinbase has refuted the SEC's allegations and paused its staking program in California, New Jersey, South Carolina, and Wisconsin during proceedings.

Learning from Industry Failures

Last year, the crypto lending industry faced a significant crisis, resulting in major companies like BlockFi, Celsius, and Genesis Global going bankrupt due to lack of liquidity caused by the bear market in 2022. As a result, industry experts suggest that the crypto lending sector must address issues related to short-term assets and liabilities to avoid similar collapses in the future.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/new-funding-round-brings-54-million-to-blockchainbased-ip-ownership-network