The Chicago Mercantile Exchange (CME) has been a major player in the Bitcoin futures market since 2020, accumulating billions of dollars in open interest. However, a closer look at the pricing and trading dynamics of CME Bitcoin futures reveals some interesting insights and differences compared to crypto exchanges. In this article, we delve into the factors influencing CME's pricing and trading and explore why it may fall short in providing price guidance to BTC investors.

The rise of CME Bitcoin futures

Introduced in December 2017, CME's Bitcoin futures contract came at a time when Bitcoin was experiencing record highs. Investors saw the potential to make bullish bets and bet against the price using leverage through CME derivative contracts. This was a significant development, considering the concerns about manipulation on unregulated exchanges that had previously led to the rejection of Bitcoin exchange-traded fund (ETF) proposals by the Securities and Exchange Commission.

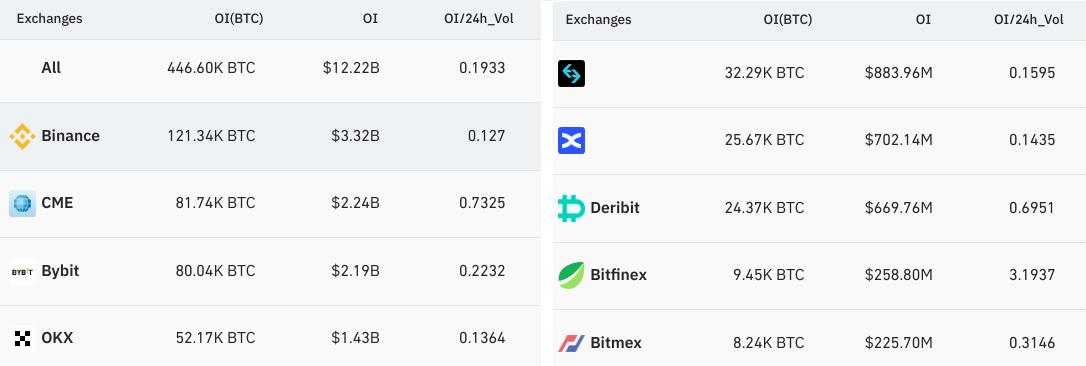

Divergence in open interest

While CME initially gained traction in the Bitcoin futures market, its open interest started to lag behind exchanges like Binance, OKX, Bybit, and Bitget. By January 2023, CME's Bitcoin futures market reached $1.2 billion in open interest, trailing behind its competitors. However, CME remained unaffected by the recent downturn in the Bitcoin price, maintaining its open interest while others saw a reduction.

Differences in contract settlement and trading volume

CME's Bitcoin futures stand out from crypto exchanges in various ways. Firstly, CME exclusively offers monthly contracts, unlike the perpetual or inverse swap contracts that dominate crypto exchanges. Additionally, CME contracts are always cash-settled, while crypto exchanges offer contracts based on both stablecoins and BTC. These distinctions contribute to the difference in open interest between CME and crypto exchanges.

Furthermore, the trading volume on CME falls short of its open interest, unlike crypto exchanges where the daily trading volume often surpasses the open interest. Binance, for example, sees a daily volume nearing $10 billion, three times greater than its open interest. This discrepancy can be attributed to CME's higher margin requirement and the fee-free trading environment for market makers on crypto exchanges. Moreover, CME has limited trading hours and a full closure on Saturdays, further impacting its trading volume.

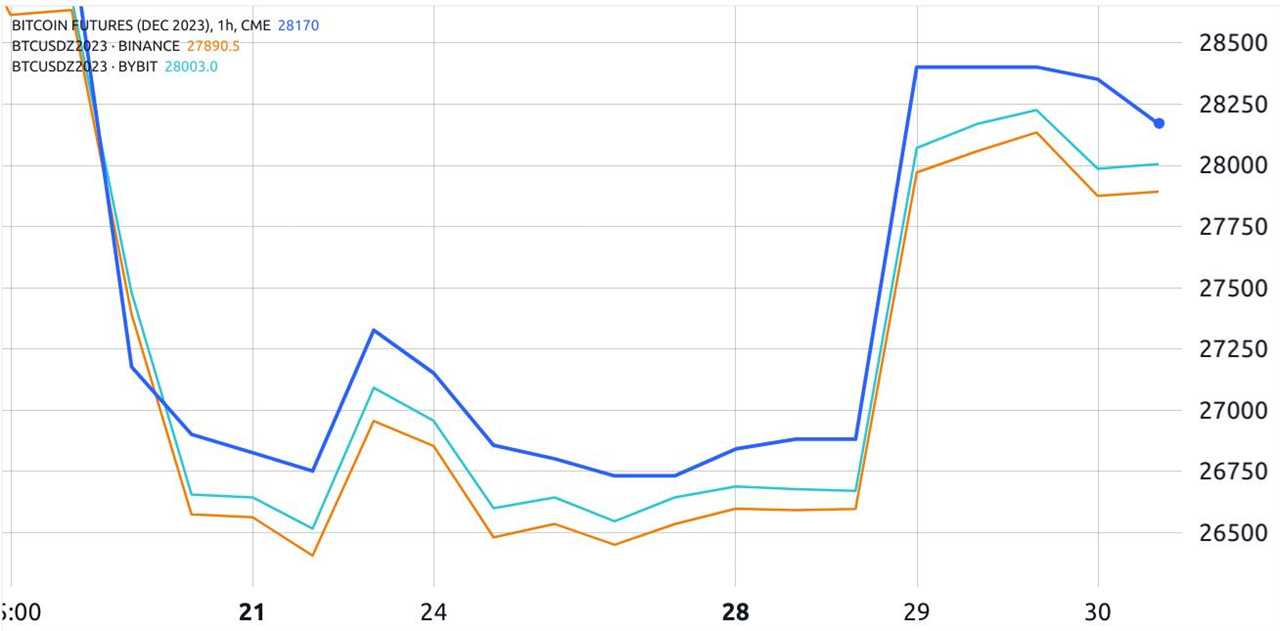

Pricing disparities and solvency risks

Price divergences between CME and crypto exchanges are influenced by factors such as shifts in demand for leverage among long and short positions and disparities in the Bitcoin index price calculation across providers. Another crucial consideration is the solvency risks associated with margin deposits until the BTC futures contract settlement. Notably, CME Bitcoin futures have traded at a higher price than those on Binance for the same expiration date, highlighting the pricing variations.

No enhanced price guidance for BTC investors

While CME's trading volumes are on the rise, its pricing mechanism does not perfectly mirror Bitcoin's price movements on crypto exchanges. Given the complex interplay of variables affecting pricing and trading dynamics, CME Bitcoin futures may not provide enhanced price guidance to BTC investors seeking to understand the overall market sentiment and direction.

Disclaimer: This article is for general information purposes only and should not be taken as legal or investment advice. The views and opinions expressed here are the author's alone and do not necessarily reflect or represent the views and opinions of The Guardian.