A warning has been issued that the approval of the first spot exchange-traded fund (ETF) for Bitcoin (BTC) in the United States could lead to a decline in its value. According to Joshua Lim, head of derivatives at capital market firm Genesis Trading, BTC price action could become highly volatile at the start of 2024.

Bitcoin ETF approval: Retail may be left holding the buck

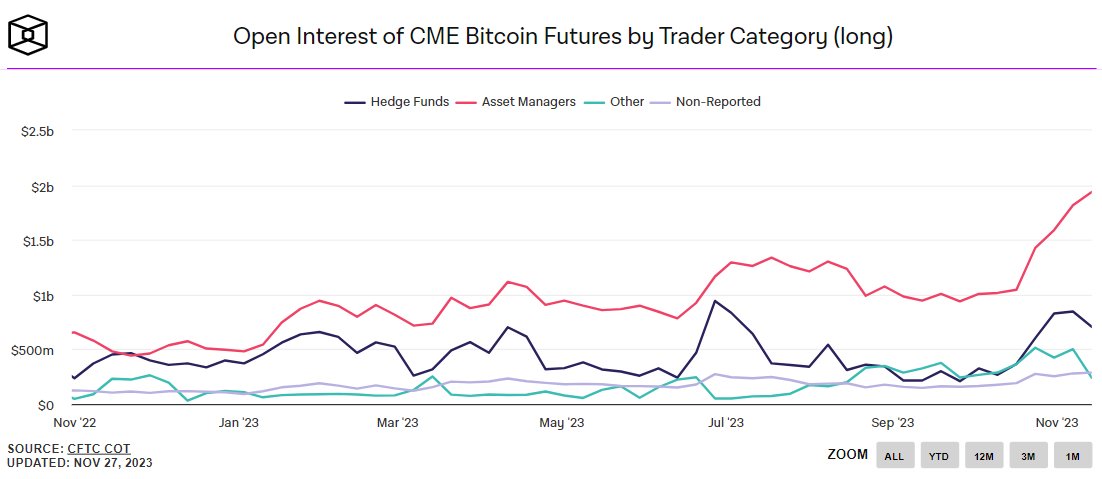

The approval of a spot ETF for Bitcoin is attracting attention from traditional finance (TradFi) as they bet on making significant gains. Lim stated that many in the traditional finance industry have already invested in cryptocurrencies and are now paying a high price to maintain their positions. Data on open interest in CME Group's Bitcoin futures supports this claim.

"Commitment of traders data showing asset managers increased length by about $1bn since end of Sep."

The performance of the first Bitcoin futures ETF (BITO) and the stocks of crypto firms such as Coinbase (COIN) also indicate growing interest from institutional investors. However, experts like Lim suggest that once the spot ETF is approved, there could be a "buy the rumor, sell the news" event, causing the market to quickly lose momentum.

A gold ETF rerun?

Lim is not the only one concerned about the potential impact of ETF approval on retail investors. James Straten, a research and data analyst at crypto insights firm CryptoSlate, pointed to the history of the Gold ETF (GLD) to support these concerns. When the GLD was introduced in 2004, it initially dropped in value before seeing a significant increase over the following years.

Despite recent news stories, including the $4.3 billion settlement between the U.S. government and Binance, institutional interest in Bitcoin remains strong. CME futures continue to trade at a premium over the Bitcoin spot price, indicating ongoing accumulation by institutions.

Interesting to note that throughout all of the courtroom drama, institutions are accumulating #Bitcoin. The CME currently has a >$350 premium to the Bitfinex spot price -- and it has consistently traded at a premium for well over a month.

Please note that this article does not provide investment advice or recommendations. Readers should conduct their own research before making any investment or trading decisions.