Introduction

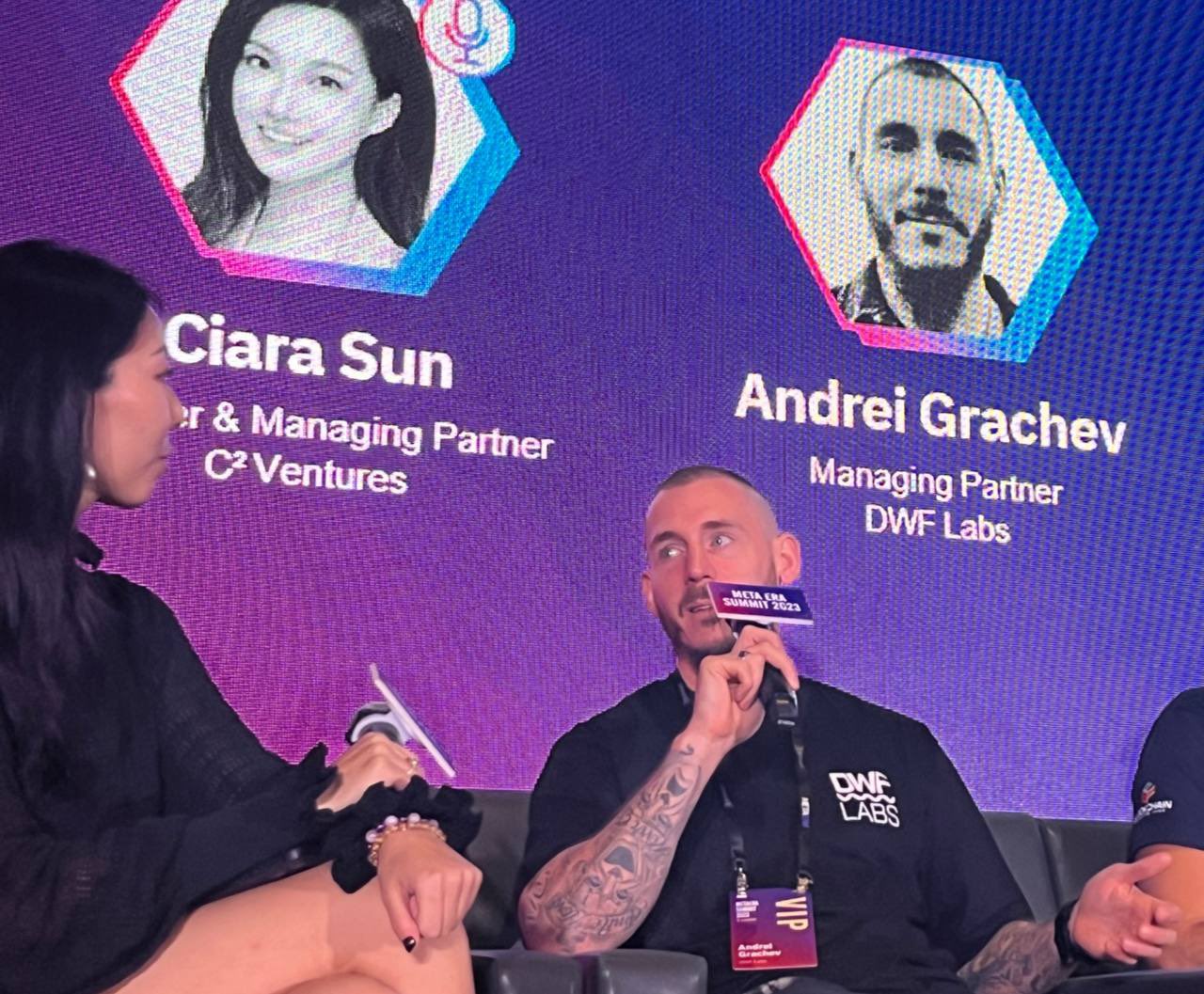

Venture capital has been crucial for start-ups in the blockchain space, providing vital funding during the critical early days of a project. Cointelegraph recently interviewed Andrei Grachev, co-founder of Digital Wave Finance (DWF) and managing partner of DWF Labs, an active investor in the crypto space. In the interview, Grachev discusses the background of DWF Labs, the rationale behind investing in tokens, risk evaluation, and the ideal portfolio company for DWF.

A closer look at DWF Labs

DWF Labs was founded in late 2021 by partners from DWF, a successful high-frequency trading entity that recognized the potential of blockchain technology. After refining their investment strategy, DWF Labs has been actively investing in promising projects and offering long-term financial support.

Investing in tokens: the market-making approach

Grachev explains that DWF Labs invests in tokens as part of their market-making approach. Market makers offer significant support to projects, including relationship-building with exchanges, liquidity support, and exchange listing introductions. The belief is that investing in tokens provides more value beyond executing trades.

Evaluating risks and assessing tokens

Grachev sheds light on DWF Labs' approach to evaluating risks and assessing tokens. They have developed various investment theses and categorize their investments into different verticals to diversify risk. They consider metrics such as market size, competition, team experience, tokenomics, and community engagement. Due diligence and consultation with industry experts are part of their process. Grachev believes that a diversified approach and thorough research can help mitigate risks and generate positive returns.

The ideal portfolio company for DWF

DWF Labs has diverse investments, but the categories that stand out are decentralized finance and trading, metaverse and GameFi, and infrastructure and enterprise. The primary consideration when prioritizing investments is potential market adoption. Grachev emphasizes the importance of the team's ability to execute, as well as evaluating underlying fundamentals rather than being swayed solely by hype or trends.

Investments in TON, EOS, and Crypto G

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/the-agenda-podcast-celebrates-20th-episode-with-cohost-interviews