The Bullish Momentum Continues

The price of Bitcoin (BTC) has been on a steady rise, reaching a year-to-date high and showing no signs of slowing down. As it approaches the $35,000 mark, here are three reasons why the bull move might not be over just yet.

Golden Cross and Liquidity Maps

Notable developments in the market include the formation of a golden cross between the 50-day moving average and the 200-day moving average on the daily timeframe. This bullish indicator suggests that further price upside could be on the horizon.

In addition, liquidity maps from DecenTrader and Kingfisher highlight the potential for a short squeeze between the $36,300 and $40,000 range if Bitcoin can break through the $36,300 level. This means there is still a good amount of liquidity for Bitcoin to climb higher.

Options Data and Investor Positioning

Bitcoin's options data aligns with the perspective that there could be more price upside in store. Last week's gamma event, which saw BTC price rally to $35,280, could be just the beginning. Data suggests the possibility of another gamma event in the $35,000 to $40,000 range, and investors are adjusting their positions accordingly.

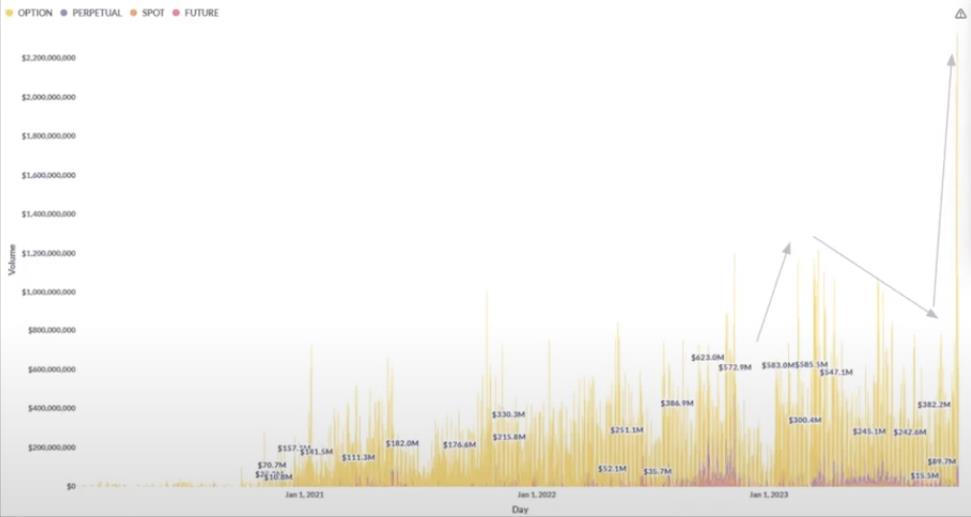

In fact, daily option volumes across the derivatives market have surged, indicating increased interest and activity in the Bitcoin options market.

Bull Pennant Pattern and Golden Cross

Technical analysis also supports the bullish sentiment. Traders are keeping an eye on the bull pennant pattern that has formed on the daily timeframe, along with the birth of a golden cross. These patterns suggest the potential for further price appreciation.

Short Liquidations and Spot Volumes

In the short-term, all eyes are on the $36,300 level. If Bitcoin can break through this resistance, it could trigger a cascade of short liquidations and a rapid increase in spot buying volumes. This would further fuel the bullish momentum.

The Potential for Explosive Moves

According to experts, if BTC/USD moves higher to $35,750 - $36,000, options dealers will need to buy $20 million in spot BTC for every 1% upside move. This could lead to explosive price action as the market moves towards these levels.

Please note that this article does not provide investment advice or recommendations. As with any investment, there are risks involved, and readers should conduct their own research before making any decisions.