Key Points:

- Block, a Bitcoin-focused fintech company led by Jack Dorsey, has published its third-quarter earnings report.

- The company reported $5.62 billion in revenue, exceeding analyst expectations.

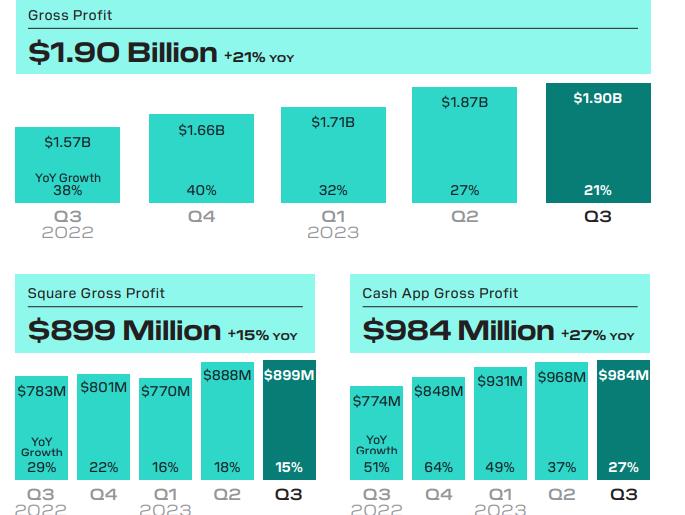

- Block generated a gross profit of $1.90 billion, with Cash App and Square contributing to the solid revenue growth.

- Bitcoin revenue accounted for 43% of the total revenue, with a gross profit of $45 million.

Surpassing expectations

Block, a fintech company that focuses on Bitcoin, has reported impressive third-quarter earnings, with $5.62 billion in revenue. This surpasses analyst expectations and highlights the company's strong performance in a competitive digital world.

Profitable quarter

The company's revenue growth was boosted by its popular Cash App and Square, contributing to a gross profit of $1.90 billion. Cash App, a mobile payment service, generated a gross profit of $984 million, while Square generated $899 million. These figures represent a significant increase compared to the previous year.

Bitcoin profits

Bitcoin played a crucial role in Block's success, accounting for 43% of the total revenue. The company reported a gross profit of $45 million from its Bitcoin holdings, thanks to a surge in the price of Bitcoin in recent months.

Strong demand and positive spending

Block's growth in the third quarter can be attributed to strong consumer demand and positive spending. The company's Bitcoin revenue and gross profit were fueled by an increase in the average market price of Bitcoin and the quantity of Bitcoin sold to customers. This highlights the growing popularity and adoption of Bitcoin in the financial world.

Future plans

In a shareholder letter, Jack Dorsey, the CEO of Block, discussed the company's focus and future plans. The company has authorized the repurchase of $1 billion in shares to offset dilution from share-based compensation. This demonstrates the company's commitment to maximizing shareholder value and driving future growth.

Steady Bitcoin holdings

Block has not experienced any impairment loss on its Bitcoin holdings since the previous quarter. As of September 30, 2023, the company's investment in Bitcoin had a carrying value of $102 million. However, its fair value, determined by observable market prices, was $216 million. This highlights the potential for further growth and profitability in the company's Bitcoin holdings.

Overall, Block's impressive third-quarter earnings report showcases the company's strong position in the Bitcoin market and its ability to generate substantial revenue. With a focus on future growth and shareholder value, Block is well-positioned to continue its success in the ever-evolving world of fintech.