Bitcoin to Reassert Itself with Impressive Annual Gains

According to Dan Morehead, CEO of hedge fund Pantera Capital, Bitcoin (BTC) is set to "reassert" itself and deliver over 100% annual price gains. In an interview with CNBC, Morehead expressed his optimism for continued crypto expansion, highlighting Bitcoin's recent performance. The cryptocurrency closed October with a 29% increase, marking its second best month of the year and reaching 18-month highs.

Concerns about Overvalued Stocks

While Morehead sees a bright future for Bitcoin, he also expressed concerns about another asset class: stocks. He described equities as "massively overvalued" and pointed to the high interest rates in the US as a potential risk. Morehead believes that equities should be 23% lower than their current level based on historical equity risk premium and interest rates.

Predicting Bitcoin's Growth and Potential Challenges

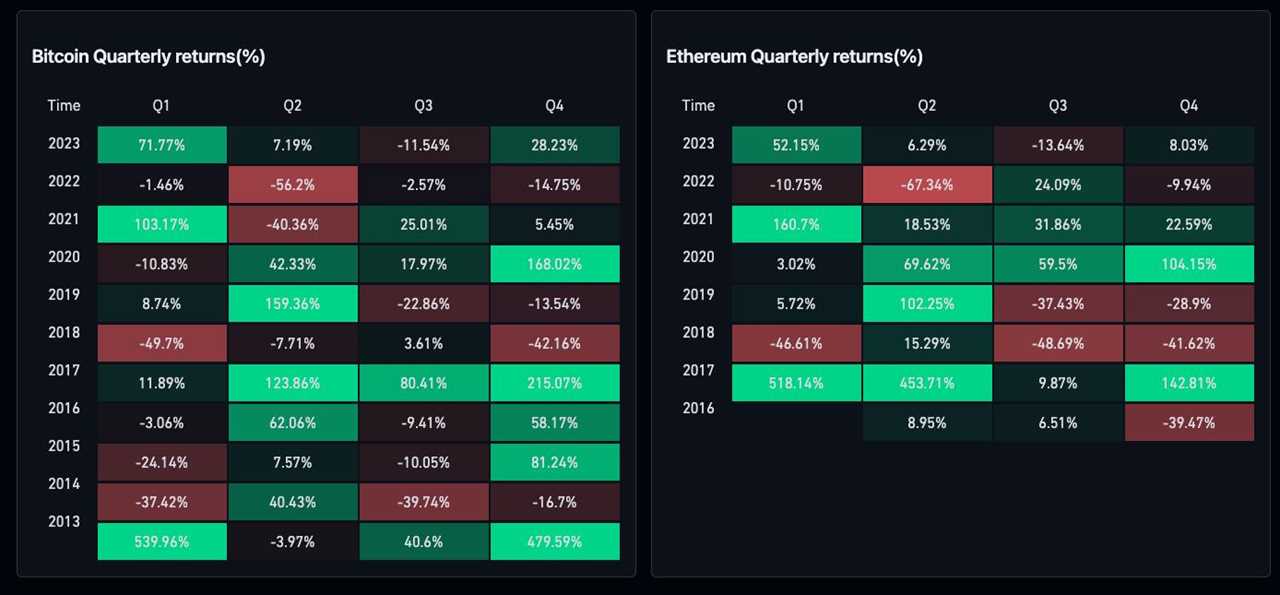

Despite his concerns about stocks, Morehead remains optimistic about Bitcoin's growth. He mentioned that Bitcoin has had a 14-year trend growth of 145% per year and expects it to continue doubling in value annually. However, some experts, like Filbfilb, co-founder of trading suite DecenTrader, predict a major retracement for Bitcoin before the 2024 block subsidy halving, possibly around March 2023.

Bitcoin's Positive Performance and Decoupling from Stocks

Although a potential equities comedown could impact Bitcoin's price, recent data suggests that Bitcoin has decoupled from stocks. This decoupling is seen as a positive sign for Bitcoin and has been labeled as a classic early bull market signal by research firm Santiment.

Note: This article does not provide investment advice or recommendations. Readers should conduct their own research and exercise caution when making investment decisions.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/ai-and-realworld-assets-gain-traction-in-investor-conversations