The boom-and-bust cycle

The cryptocurrency industry is known for its boom-and-bust cycles, led by Bitcoin. These cycles are influenced by various factors, including Bitcoin's halving events, network adoption, and institutional support.

The concept of a supercycle

In 2020, Bitcoin educator Dan Held predicted the possibility of a "supercycle" for Bitcoin. This supercycle would see Bitcoin reaching new all-time highs and having enough adoption and institutional support to sustain its price.

The disappointing end of the last cycle

In the previous cycle, Bitcoin's price fell from its all-time high at the end of 2021, despite factors such as reduced supply and increased institutional support. The lack of support during the last leg of the cycle caused the market to decline.

Potential institutional support

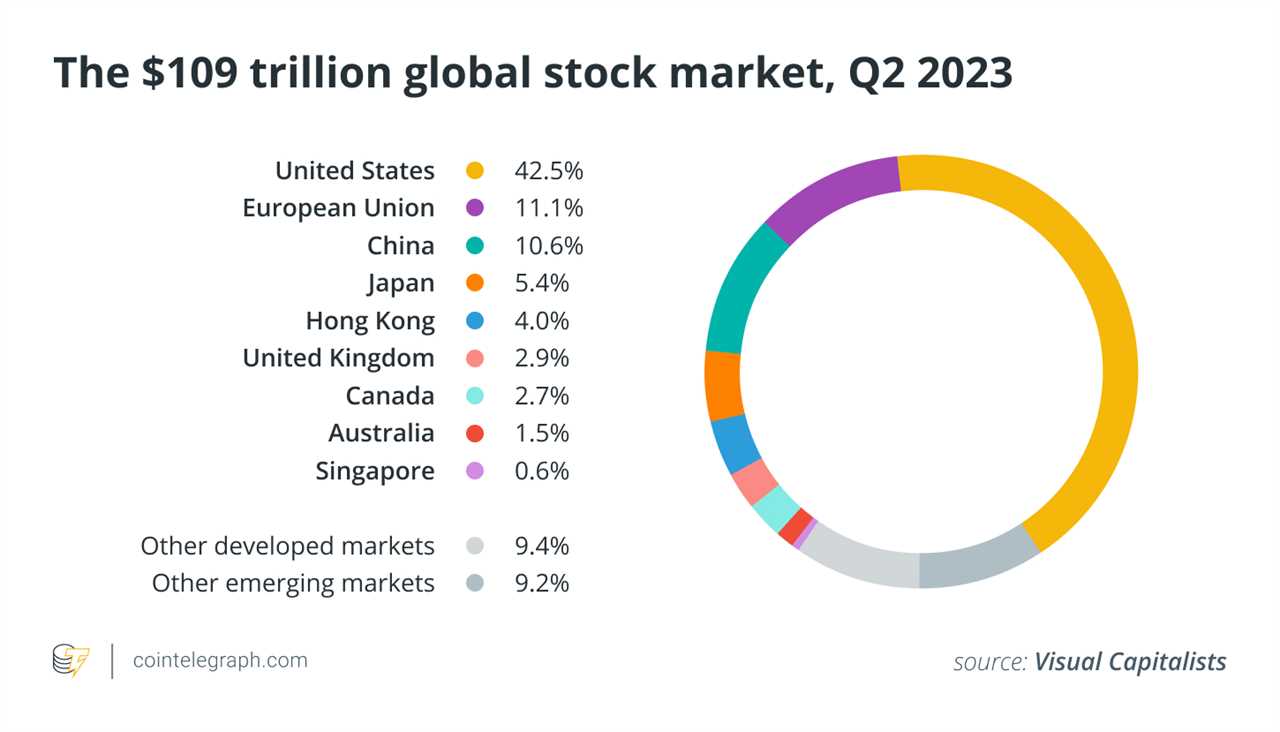

There is speculation that the United States, which comprises a significant portion of global equity markets, may allow spot Bitcoin ETFs to trade. This could provide the institutional support needed for a Bitcoin supercycle.

Emerging market adoption

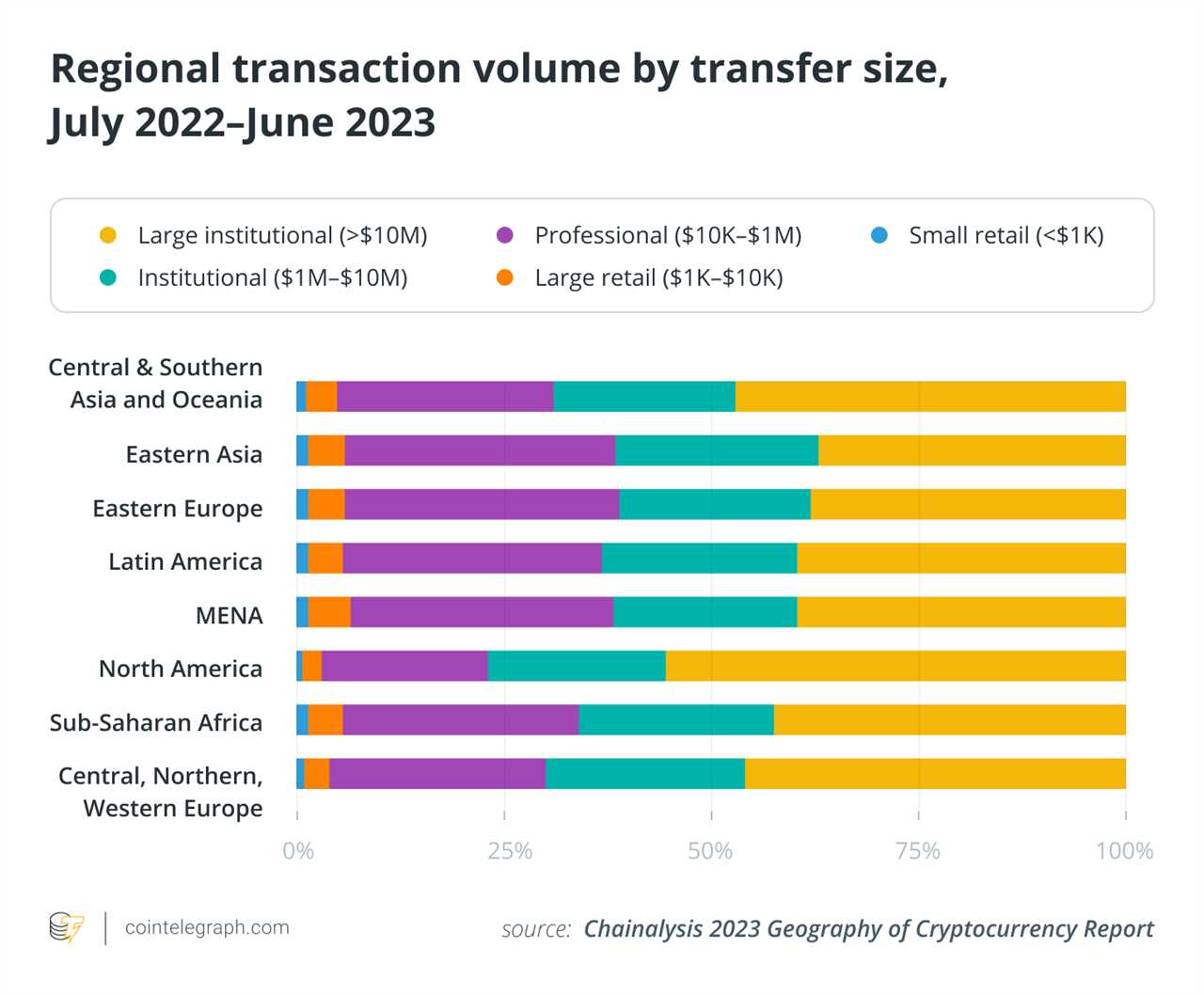

Chainalysis' report on cryptocurrency adoption in 2023 highlighted India, Nigeria, and Vietnam as the top countries for crypto adoption. These lower-middle-income countries are seeing increased adoption due to high inflationary monetary issues.

Value derived from market participants

While institutional adoption is important, Bitcoin's value ultimately comes from market participants. This value perception is crucial for the long-term sustainability of Bitcoin.

Past examples of overvaluation

Past examples, such as the whaling industry and the dot-com bubble, show that industries with institutional backing can be superseded by new technologies. The market's perception of value determines the success of these industries.

Potential future scenarios

Bitcoin's success in the future depends on factors such as institutional demand, supply, and adoption. Increased institutional adoption, the next halving event, and Bitcoin's use as a medium of exchange or store of wealth can contribute to a potential supercycle.

Expert opinions

Billionaire venture capitalist Tim Draper believes that a Bitcoin supercycle is possible in the future. Other experts mention factors such as a reduction in supply, increasing interest in Bitcoin, and a loss of confidence in fiat currencies as potential catalysts for a supercycle.

The likelihood of a 2024 Bitcoin supercycle

While the possibility of a supercycle in 2024 seems unlikely, continued adoption and market speculation suggest that a supercycle could occur in the future, possibly around 2028.

Note: This article does not provide investment advice. Readers should conduct their own research before making any investment decisions.