The price of Bitcoin (BTC) experienced a sharp drop of 11.5% between August 16 and August 18, leading to the liquidation of $900 million worth of long positions and pushing the price to a two-month low. This unexpected downturn led many traders to question whether professional traders were able to profit from the crash.

Largest daily liquidation in Bitcoin's history

Bitcoin witnessed one of its largest daily liquidations by volume on record. Within a span of just 20 minutes on August 18, the cryptocurrency fell by 7.5%, erasing $42 billion in market capitalization. This mass-liquidation event saw more outflows in one day compared to the FTX collapse in November.

Whales and market makers caught off guard

There is a belief among cryptocurrency traders that whales and market makers have an advantage in predicting significant price shifts, giving them an upper hand over retail traders. While this may hold some truth, advanced trading software and strategically positioned servers do not guarantee immunity from financial losses during market volatility.

For larger-sized and professional traders, a majority of their positions may be fully hedged. By comparing these positions with previous trading days, it is possible to estimate whether recent movements anticipated a widespread correction in the cryptocurrency market.

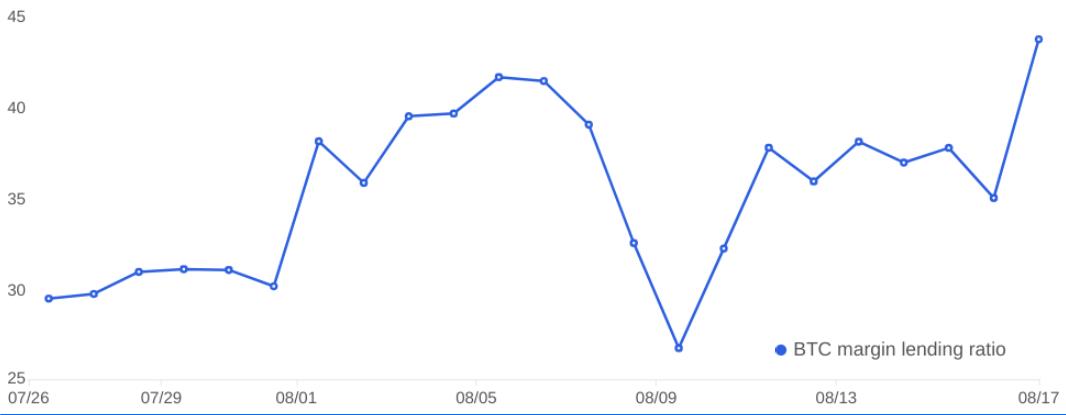

Margin longs at Bitfinex and OKX reflect unpreparedness

Margin trading allows investors to amplify their positions by borrowing stablecoins and using the funds to acquire more cryptocurrency. Traders who borrow Bitcoin, on the other hand, use the coins as collateral for short positions, indicating a bet on price decline.

Bitfinex margin traders are known for establishing position contracts of 10,000 BTC or greater, indicating the involvement of whales and substantial arbitrage desks. Data shows that on August 15, the Bitfinex margin long position stood at 94,240 BTC, nearing its highest point in four months. This suggests that professional traders were completely caught off guard by the sudden Bitcoin price crash.

Similarly, the OKX BTC margin lending ratio approached 35 times in favor of long positions on August 16, aligned with the seven-day average. This indicates that whales and market makers maintained their positions on margin markets before the Bitcoin price collapse on August 16 and 17, further supporting the argument that professional traders were unprepared for negative price movement.

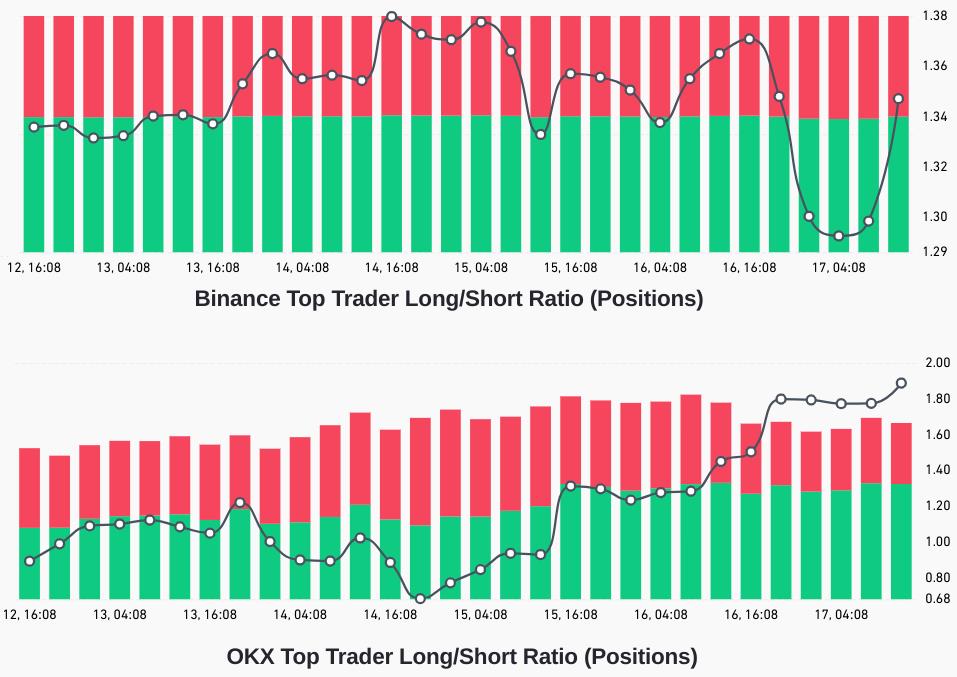

Futures long-to-short data confirms lack of readiness

Examining the net long-to-short ratio of top traders across perpetual and quarterly futures contracts offers a clearer insight into their bullish or bearish stance. Prior to the release of the Federal Reserve FOMC minutes on August 16, prominent BTC traders on Binance exhibited a long-to-short ratio of 1.37, matching the peak levels observed in the previous four days. A similar pattern emerged on OKX, with the long-to-short indicator for Bitcoin's leading traders reaching 1.45 just before the BTC price correction started.

Data from BTC futures suggests that professional traders did not reduce their exposure prior to August 16, both in futures and margin markets. This indicates that they were taken by surprise and did not profit from the price crash.

In summary, the recent Bitcoin price crash has left professional traders unprepared and resulted in significant losses. While whales and market makers may have an advantage in predicting price shifts, this does not guarantee immunity from market volatility. Stay informed and cautious when navigating the cryptocurrency market.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/shiba-inus-shibarium-network-back-in-action-after-temporary-pause