Warren Buffett's Value Investing Strategy

Warren Buffett, the highly respected investor and chairman of Berkshire Hathaway, celebrated his 93rd birthday last month. Throughout his long career, Buffett has stuck to a value investing strategy that is similar to the "buy and hold" approach often associated with cryptocurrencies.

However, Buffett's focus is on assets with strong earnings potential and investing in companies and sectors where he and his team have a deep understanding of the risks, competition, and advantages.

Can Buffett's Strategy Outperform Bitcoin?

The question investors should ask is whether Buffett's strategy can outperform Bitcoin in the long run. It's worth noting that one of the greatest stock pickers of all time currently holds cash and short-term bonds as the second-largest position in his portfolio.

An interesting example of Buffett's approach is Berkshire Hathaway's largest holding, Apple shares. Despite acquiring them when the company was already valued at over $500 billion, Buffett continued to add to his investment even as the stock rallied over 500%. This shows his commitment to long-term strategies, regardless of recent price movements.

Buffett's Views on Non-Productive Commodities

Buffett has downplayed non-productive commodities, such as gold, as a store of value. In a shareholder letter from 2012, Berkshire Hathaway expressed concerns about the devaluation of paper currency and the limitations of gold as a store of value.

They argued that gold lacks practical utility and that investments in productive companies generate substantial dividends and returns. Despite Buffett's skepticism, the price of Bitcoin surged by 683% in the 12 months following his critical comments on non-productive commodities.

Bitcoin's Performance vs Berkshire Hathaway

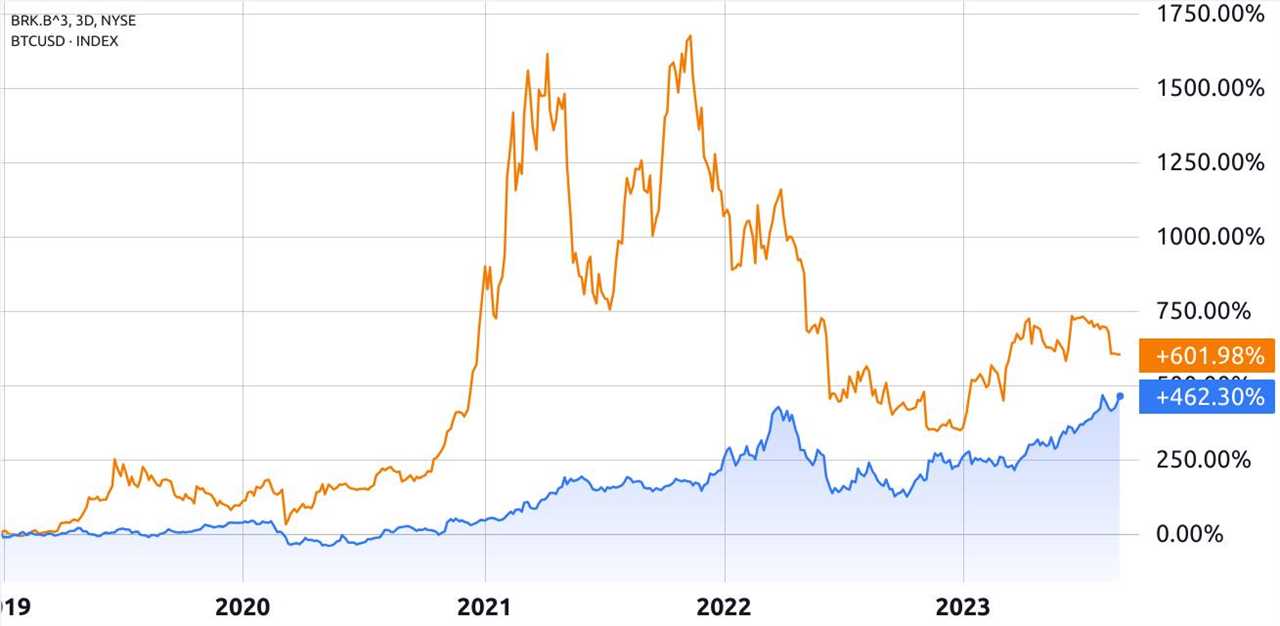

To compare the performance of Berkshire Hathaway's stock holdings to Bitcoin, we calculated Berkshire Hathaway's stock performance using a factor of 3 to simulate a leveraged position.

If an individual had invested $1,000 in Bitcoin (spot) and initiated a leveraged long position in Berkshire Hathaway shares in early 2019, they would have observed a return of $7,020 in BTC compared to $5,623 in Buffett's holding company.

Similarly, for an investment starting in 2017, it would have resulted in $3,798 in BTC, as opposed to $1,998 using the leveraged long strategy in Berkshire Hathaway's shares.

Buffett's Cash Position Raises Questions

It is worth noting that Berkshire Hathaway is currently holding a record-high $147 billion in cash equivalents and short-term investments, representing 18.5% of the company's total market capitalization. This raises questions about whether they are waiting for better entry points into selected stocks or if they deem the returns on fixed-income investments to be satisfactory.

This scenario highlights that even the most accomplished stock market investor may have reservations about deploying their cash. It also raises questions about whether some of the funds currently on the sidelines might seek alternative forms of protection if inflation makes a resurgence.

Bitcoin as a Store of Value

Bitcoin may not be a perfect store of value, and its volatility has been a subject of concern. However, it's important to acknowledge that Bitcoin has yet to face a global economic recession, making it premature to pass definitive judgment.

Despite its flaws, Bitcoin's consistent outperformance compared to Berkshire Hathaway shares suggests that investors increasingly view it as a viable alternative store of value.

With Bitcoin's total market capitalization currently standing at $500 billion, there is significant untapped potential for it to play a greater role in the financial landscape.