Record-breaking activity in Bitcoin options market

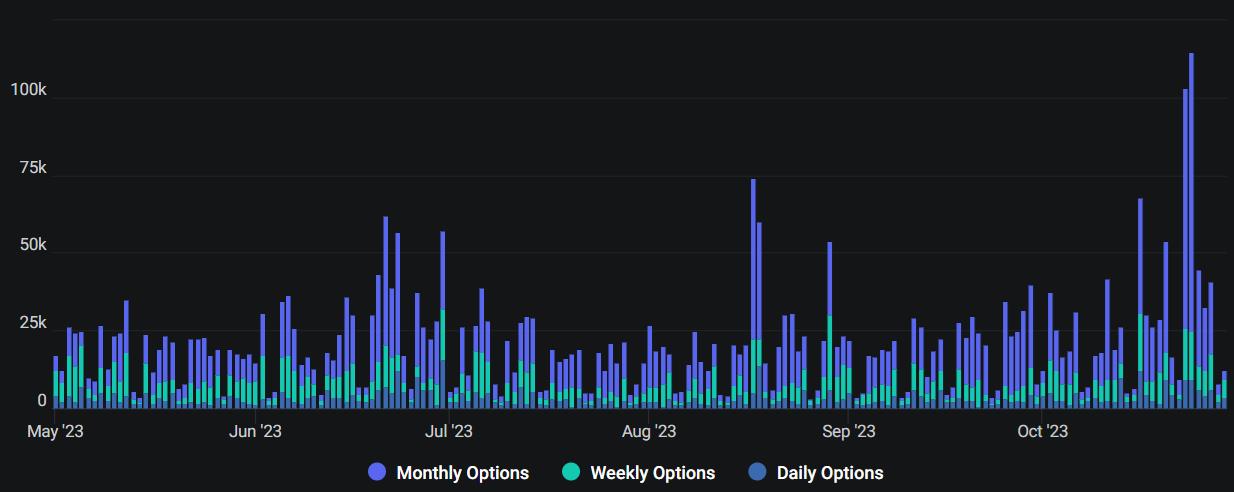

The Bitcoin options market experienced a surge in activity on October 23 and 24, reaching its highest level in over six months. This coincided with a significant 17% price rally for BTC over the same two-day period. Traders are now questioning whether this increased activity is solely due to anticipation of a Bitcoin spot exchange-traded fund (ETF), or if optimism has waned following the recent price surge above $34,000.

Analyzing the options data

Bitcoin's recent gains have been a rare sight in 2021, despite its impressive year-to-date performance of 108%. The last time such price action occurred was on March 14, when BTC surged by 25.2% in just two days. Notably, a staggering 208,000 contracts were exchanged during this period, compared to the prior peak of 132,000 contracts exchanged on August 18.

Analysts are paying attention to the potential "gamma squeeze" risk, which refers to the need for option market makers to cover their risk based on their exposure. Estimates suggest that BTC options market makers may need to cover $40 million for every 2% positive move in Bitcoin's spot price.

The demand for call and put options

When assessing Bitcoin options volume and total open interest, it's important to consider whether these instruments are primarily being used for hedging or neutral-to-bullish strategies. From October 16 to October 26, there was a predominance of neutral-to-bullish call options, with the demand consistently lower than put options. However, the landscape changed on October 28, when investors started seeking protective put options.

Bitcoin options delta skew and investor confidence

To gauge investor confidence, analysts are analyzing the Bitcoin options delta skew. When traders anticipate a drop in Bitcoin's price, the delta 25% skew tends to rise above 7%. A neutral position indicates periods of excitement. The skew shifted to a neutral position on October 24, but improved confidence on October 27 caused it to re-enter the bullish zone.

Extraordinary options premiums and continued optimism

Prior to the 17% rally on October 23, Bitcoin bulls using options contracts were paying the highest premium relative to put options in over 12 months. This signifies extreme confidence and optimism, potentially driven by expectations of a Bitcoin ETF. Even after the price surge above $34,000, optimism has endured as reflected by the present negative 13% skew.

It remains to be seen whether the increased activity in the Bitcoin options market is solely driven by ETF expectations or if traders are still optimistic about further price gains. As with any investment, it's important for readers to conduct their own research and make informed decisions.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/crypto-funds-experience-largest-weekly-inflows-in-over-a-year