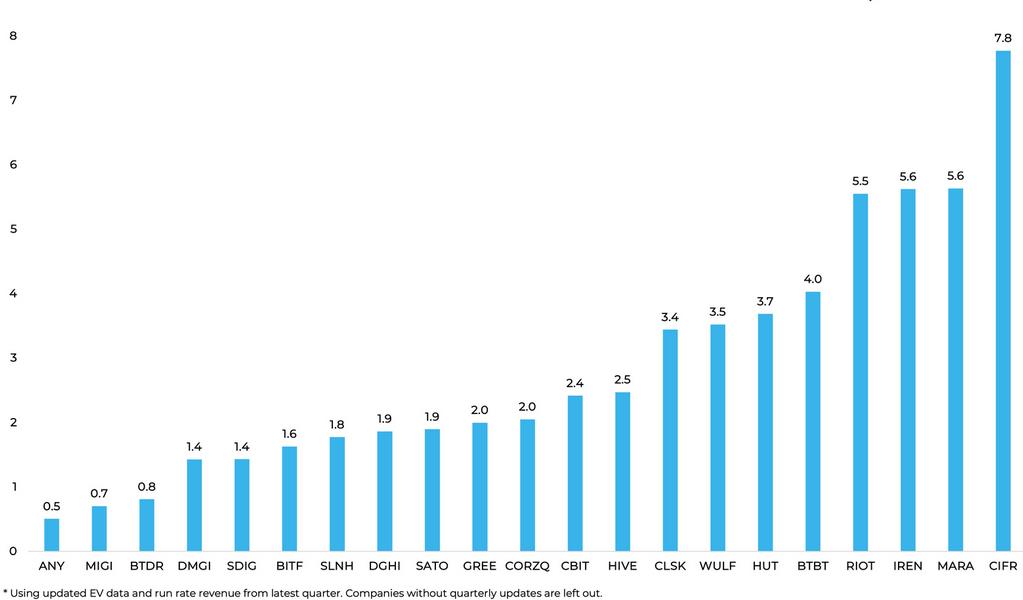

According to Jaran Mellerud, founder and analyst at MinerMetrics, Bitcoin mining companies Marathon Digital and Riot Platforms are among the most overvalued in the industry compared to their competitors. Mellerud's analysis is based on the enterprise value-to-sales ratio, which measures a company's value relative to its sales revenue. The higher the ratio, the more overvalued the company is.

Institutional Attention and Valuation Discrepancies

Mellerud attributes the high EV/S ratios of Marathon Digital and Riot Platforms to the attention they receive from institutional investors like BlackRock and Vanguard. He believes that these companies have been favored by institutional investors, giving them access to more capital and higher valuations compared to the rest of the industry. However, Mellerud expects investors to start allocating to other players in the coming months, which could even out the valuation discrepancies between these stocks and present better-priced opportunities for value investors.

Riot's Overvaluation Indicator

Mellerud points out that Riot Platforms has a high EV-to-Hashrate ratio of 156, which indicates its overvaluation. He explains that Riot has priced in "massive growth" as it constructs its gigawatt site and awaits the delivery of 33,000 MicroBT machines in early 2024. Mellerud also mentions that Riot has several business lines that are not reflected in its self-mining hashrate, so caution should be exercised in drawing valuation conclusions based solely on its EV-to-Hashrate ratio.

Bitcoin Mining Sector Rebound and Price Performance

The Bitcoin mining sector has experienced a strong rebound in 2023, with Marathon and Riot leading the way. According to Google Finance, Marathon's share price has increased by 170% and Riot's share price has increased by 228%. These mining stocks have outperformed Bitcoin itself, which has gained 113% year-to-date, according to Cointelegraph Markets Pro data.

Contrasting Views on Future Performance

While Marathon and Riot have seen significant price increases, not all mining analysts believe that this trend will continue. Caleb Franzen, founder of Cubic Analytics, notes that Bitcoin has already reached its year-to-date peak price, while the top mining stocks are still over 75% below their year-to-date highs. Franzen raises the question of whether Bitcoin mining firms will need to become twice as productive in order to sustain their business post-halving, when block rewards are cut in half.

Marathon currently has the largest Bitcoin holdings among mining companies, with 13,726 BTC worth $486.1 million. Hut 8, Riot, and CleanSpark follow with respective holdings of 9,366 BTC, 7,309 BTC, and 2,240 BTC.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/new-cryptolending-platform-tokenet-prepares-for-influx-of-institutional-clients