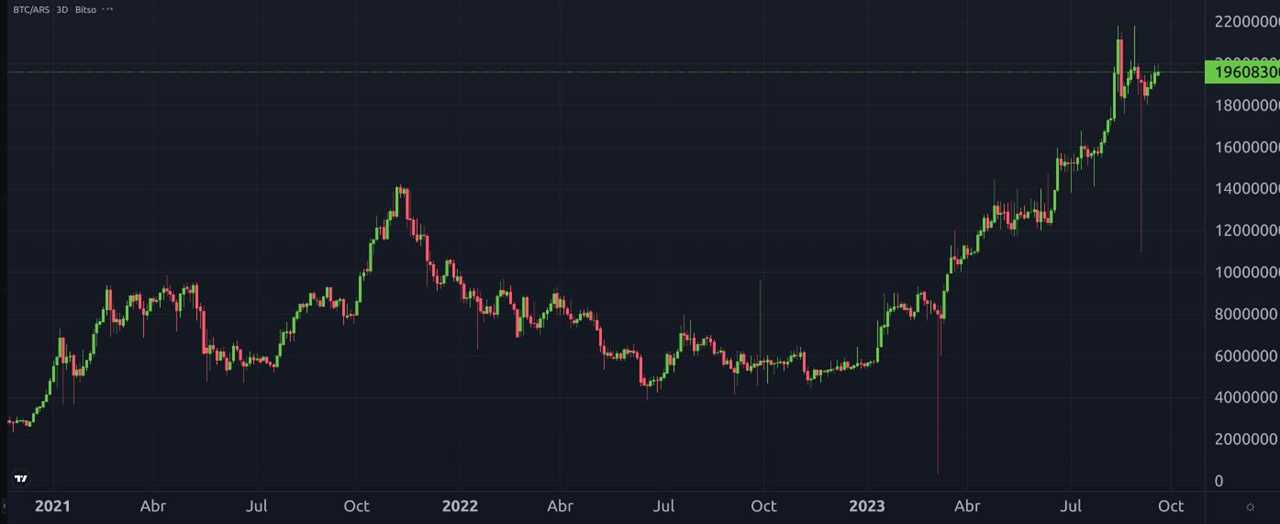

Bitcoin's Surging Price in Argentine Pesos

Bitcoin's price in Argentina has reached a new all-time high, surpassing its previous peak earlier this year. Despite the country's ongoing struggle with hyperinflation, Bitcoin has managed to generate significant gains when priced in the local Argentine Peso (ARS) currency.

Argentina's History of Hyperinflation

Argentina has a long history of grappling with hyperinflation, caused by populist policies and budget deficits. Over the years, the government has resorted to inflating the money supply through bank deposits and government bonds. The result has been a staggering increase of 277% in the country's aggregate money supply M1, from 2.81 trillion ARS in July 2019 to 10.66 trillion ARS.

The Discrepancy in Bitcoin's Price in ARS

While Bitcoin's price on domestic exchanges in Argentina has surged to 19.6 million ARS, investors may find a different price when consulting Google or CoinmarketCap. This is because of the official currency rate for the Argentine Peso, which is more complex than what most investors are used to. The official rate, known as the "dollar BNA," is set by the Central Bank of Argentina and affects government transactions, as well as imports and exports.

The Impact of Manipulating the Official Exchange Rate

By artificially strengthening the official rate in favor of the Argentine Peso, the government aims to stabilize the economy and reduce capital flight. However, this manipulation ultimately contributes to inflation and hinders economic growth. It creates incentives for the existence of an unofficial market, known as the "dollar blue," which fosters illegal activities and discourages foreign investment.

Bitcoin's Reliability as a Store of Value

While Bitcoin has seen a gain of 150% in Argentine Pesos over a two-year period, the official inflation rate during the same period has exceeded 300%. This makes it incorrect to claim that Bitcoin has been a dependable store of value. In comparison, those who held dollars or stablecoins saw their holdings increase by 297%, effectively matching the inflation rate.

Future Adoption of Stablecoins

The disappointing outcome for Bitcoin proponents in Argentina is likely to favor the adoption of stablecoins in the region. However, the experience has taught investors about the advantages of self-custody and scarcity, given the ongoing inflation of the local currency.

Ultimately, as long as the U.S. dollar maintains its purchasing power and keeps pace with local inflation, Bitcoin may struggle to become the preferred store of value for Argentinians.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/investors-should-tame-their-expectations-for-the-next-crypto-bull-run-says-blockchain-founder