Miners Face "Severe" Income Stress

A new research report warns that Bitcoin miners will face a significant increase in costs after the next block subsidy halving. Analytics firm Glassnode, in its newsletter "The Week On-Chain," predicts that miners will encounter "income stress" as competition in the sector continues to rise.

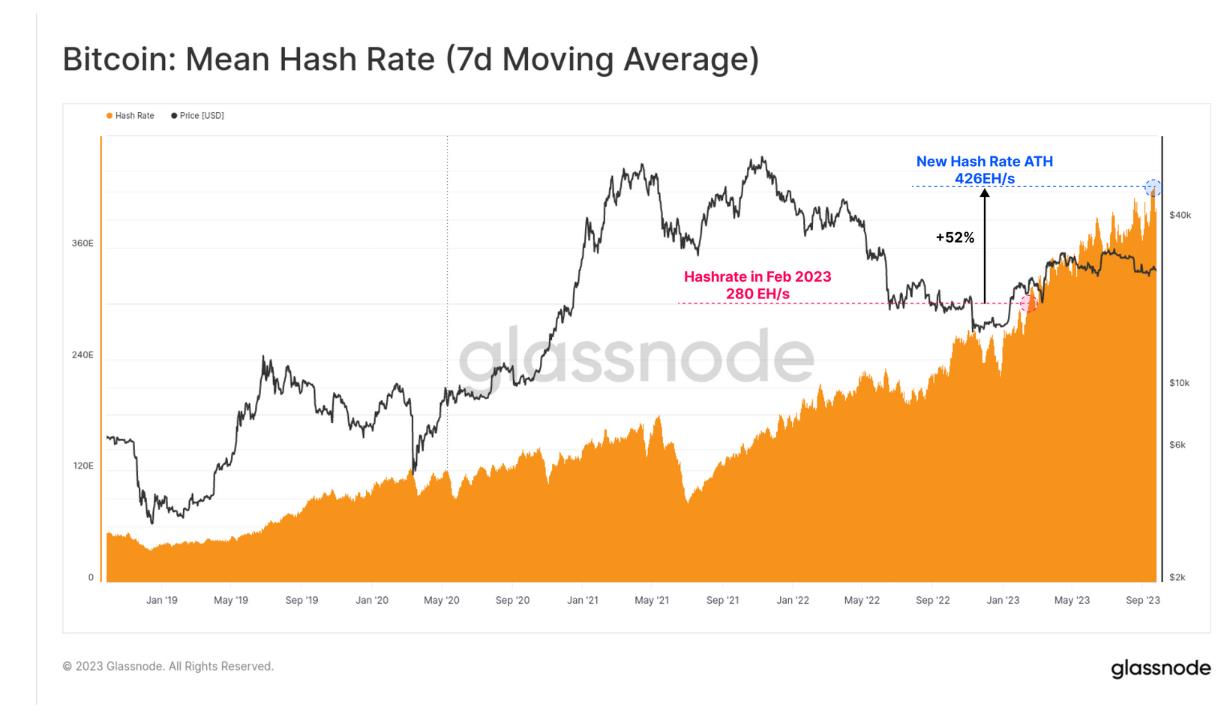

The hash rate, which represents the combined processing power used in the blockchain, has reached record highs. This surge in hash rate indicates that miners are facing unprecedented conditions in their struggle to earn a profit at the current price levels of Bitcoin (BTC).

Glassnode points out that ordinal inscriptions have been helping miners generate revenue, as they convert empty blockspace into a source of income. However, the amount of hashrate competing for these rewards has increased by 50% since February, leading to a looming showdown.

Block Reward Halving and Rising Mining Costs

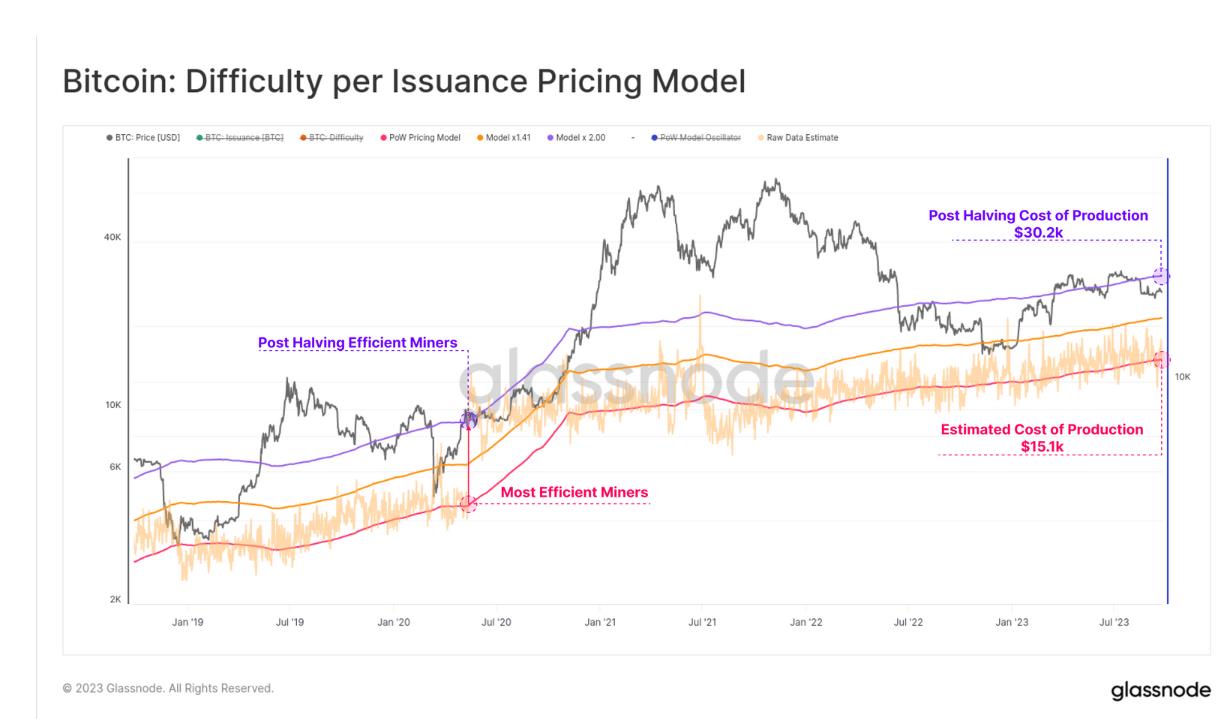

In April 2024, the block rewards for miners will be halved, causing the so-called "production cost" of each BTC to double. Glassnode estimates that the production cost per Bitcoin, currently around $15,000, will surpass $30,000. This will create significant income stress for the majority of miners.

Glassnode presented two models to estimate the price at which miners will fall into the red. The first model compares issuance to mining difficulty and suggests that the most efficient miners have an acquisition price of around $15,100. The second model, known as the "purple curve," doubles this level to $30,200, indicating severe income stress for the mining market.

Optimism and BTC Price Incentives

Despite these challenges, some analysts are optimistic about how miners will handle the situation. Analyst Filbfilb believes that miners will increase their accumulation of BTC leading up to the halving. He argues that miners are incentivized to ensure that prices are well above marginal cost before the event.

The build-up to the halving is also expected to be influenced by smart money "buying the rumor" and speculating on the impact of the event on the supply dynamics of BTC.

It is important to note that this article does not contain investment advice or recommendations. Readers should conduct their own research and exercise caution when making investment decisions.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/europe-remains-fertile-ground-for-cryptocurrency-ecosystem-insights-from-blockchain-expo