Record-Breaking Open Interest

The open interest for Bitcoin futures at the Chicago Mercantile Exchange (CME) has reached an all-time high of $3.65 billion. This metric takes into account the value of every contract in play for the remaining calendar months, reflecting the continuous matching of buyers (longs) and sellers (shorts).

Institutional Interest on the Rise

The number of active large holders of Bitcoin surged to a record 122 during the week of October 31, signaling a growing institutional interest in the cryptocurrency. Notably, the Bitcoin CME futures premium also reached its highest level in over two years.

Strong Demand for Long Positions

While neutral markets typically see an annualized premium ranging from 5% to 10%, the current 15% premium for CME Bitcoin futures stands out, indicating a strong demand for long positions. However, this also raises concerns as some may be relying on the approval of a spot Bitcoin exchange-traded futures (ETF).

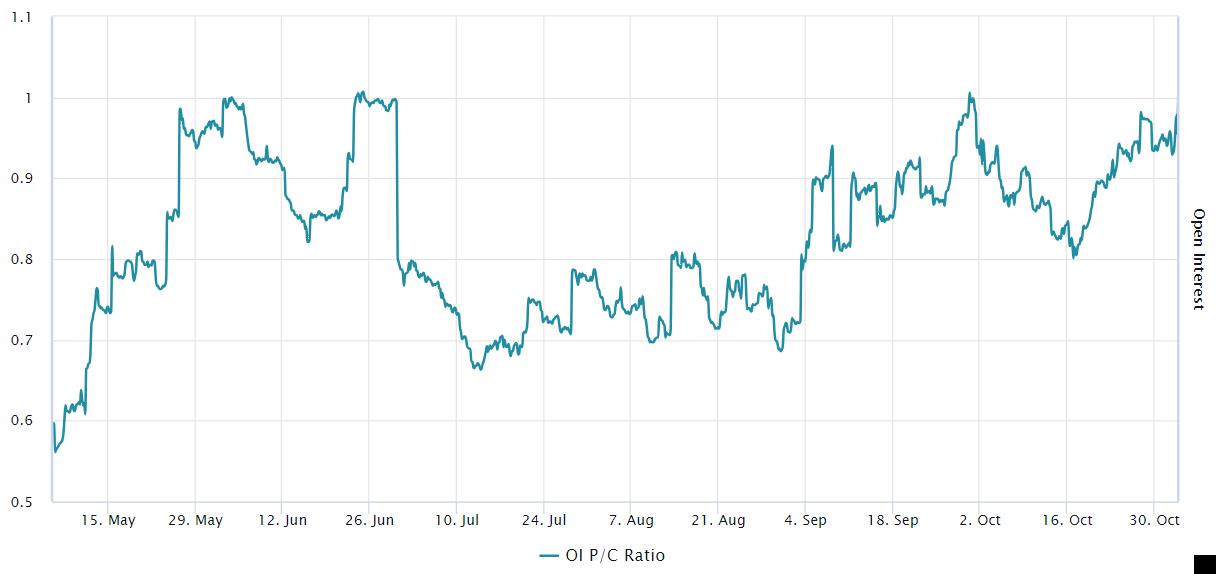

Protective Put Options on the Rise

In contrast to the bullish sentiment from CME futures, evidence from Bitcoin options markets reveals a growing demand for protective put options. The put-to-call open interest ratio at the Deribit exchange reached its highest level in over six months. Further analysis is required to fully understand this indicator, as investors could have sold the call option to gain positive exposure to Bitcoin above a specific price.

Spot Exchange Flows Determine Bitcoin's Price

Regardless of the demand in the derivatives market, Bitcoin's price ultimately relies on spot exchange flows. A recent rejection at $36,000 led to a 5% correction, bringing the price down to $34,130. Interestingly, the Bitfinex exchange experienced daily net BTC inflows of $300 million during this movement, suggesting real buyers at the $34,000 support level.

Downturn Unrelated to U.S. Federal Reserve Decision

The recent correction in Bitcoin's price occurred independently of the U.S. Federal Reserve's decision to maintain interest rates at 5.25%. While the Russell 2000 Index futures, measuring mid-cap companies in the U.S., gained 2.5% and reached a two-week high, Bitcoin's movement remained unaffected.

Gold Remains Stable

During the same period, the price of gold remained stable at around $1,985, indicating that the world's largest store of value was not impacted by the monetary policy announcement. The question remains: how much selling pressure do Bitcoin sellers at $36,000 still hold?

Assessing Bitcoin Availability on Exchanges

The availability of Bitcoin for sale on exchanges can be deceiving. Merely assessing current deposits does not provide a clear picture of short-term availability. A lower number of deposited coins may reflect lower investor confidence in exchanges, which have faced legal challenges and concerns over their involvement in facilitating funds for terrorist organizations.

Impact of Traditional Fiat Fixed Income Operations

The cryptocurrency market has been influenced by increased returns from traditional fiat fixed income operations. The collapse of lucrative cryptocurrency yields following the Luna-TerraUSD collapse in May 2022 has had lasting effects on the lending sector, leading to the collapse of several intermediaries.

Growing Institutional Demand for Bitcoin Derivatives

Despite the challenges and uncertainties, there is undeniable growing institutional demand for Bitcoin derivatives, as indicated by CME futures data. However, it remains difficult to predict the supply between $36,000 and $40,000, a level untested since April 2022.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/opinion-bitcoins-halving-and-the-christmas-season-a-risky-combination