Bitcoin's impressive October surge

Bitcoin (BTC) experienced a significant price surge of 26.5% in October, reaching several key milestones. This includes a one-year high in BTC futures premium and the Grayscale GBTC discount. These indicators point to a positive outlook for Bitcoin, but there is more to consider.

Bitcoin's uphill battle

Despite these positive indicators, Bitcoin's price is still hovering around 50% below its all-time high of $69,900. In comparison, gold is trading just 4.3% below its peak level. This stark difference suggests that Bitcoin's adoption as an alternative hedge is still in its early stages.

Analyzing the macroeconomic environment

Before jumping to conclusions about the future of Bitcoin, investors must consider the larger macroeconomic environment. One key factor to watch is the U.S. Treasury's plan to auction off $1.6 trillion of debt over the next six months. This move has led some to view Bitcoin as a potential store of value.

Institutional demand driving Bitcoin futures

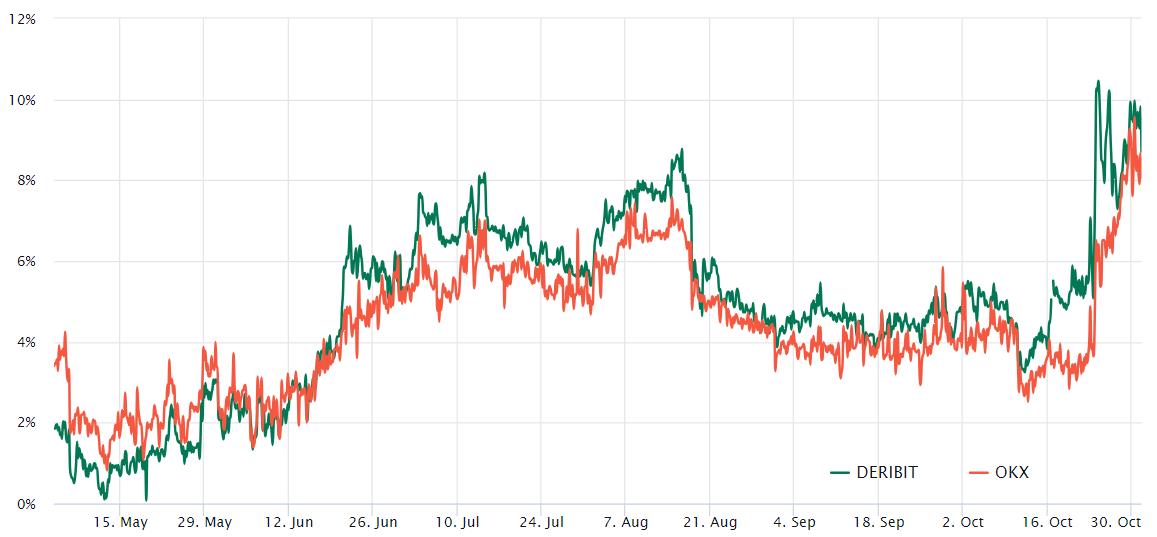

The surge in Bitcoin futures open interest, reaching its highest level since May 2022 at $15.6 billion, can be attributed to institutional demand driven by inflationary risks in the economy. Additionally, the Bitcoin futures premium, which measures the difference between futures contracts and the spot price, has reached its highest level in over a year.

Exchange risks and caution

While the data seems positive, investors should approach exchange-provided numbers with caution, especially when dealing with unregulated derivatives contracts. Exchange risks have escalated post-FTX, and the 8.6% Bitcoin futures premium may not be as bullish as it seems.

Bitcoin's return to the mean

Overall, the positive data and performance of Bitcoin suggest a return to the mean rather than excessive optimism. The approval of a spot Bitcoin exchange-traded fund (ETF) could trigger sell pressure from GBTC holders, potentially impacting Bitcoin's price.

Note: This article is for general information purposes and is not intended to be and should not be taken as legal or investment advice.