Unlocking the floodgates

A recent decision by a United States appellate court could have far-reaching implications for the cryptocurrency market. The court directed the Securities and Exchange Commission (SEC) to reassess its denial of Grayscale's application for a Bitcoin exchange-traded fund (ETF). What's more, this decision could potentially open the floodgates for $600 billion in new cash to enter the crypto market.

Democratizing crypto investment

ETFs provide investors with a regulated way to gain exposure to different asset classes, including Bitcoin. The approval of a Bitcoin ETF could democratize investment in the cryptocurrency sector, similar to how ETFs have opened up investing in other markets.

Predictions and potential

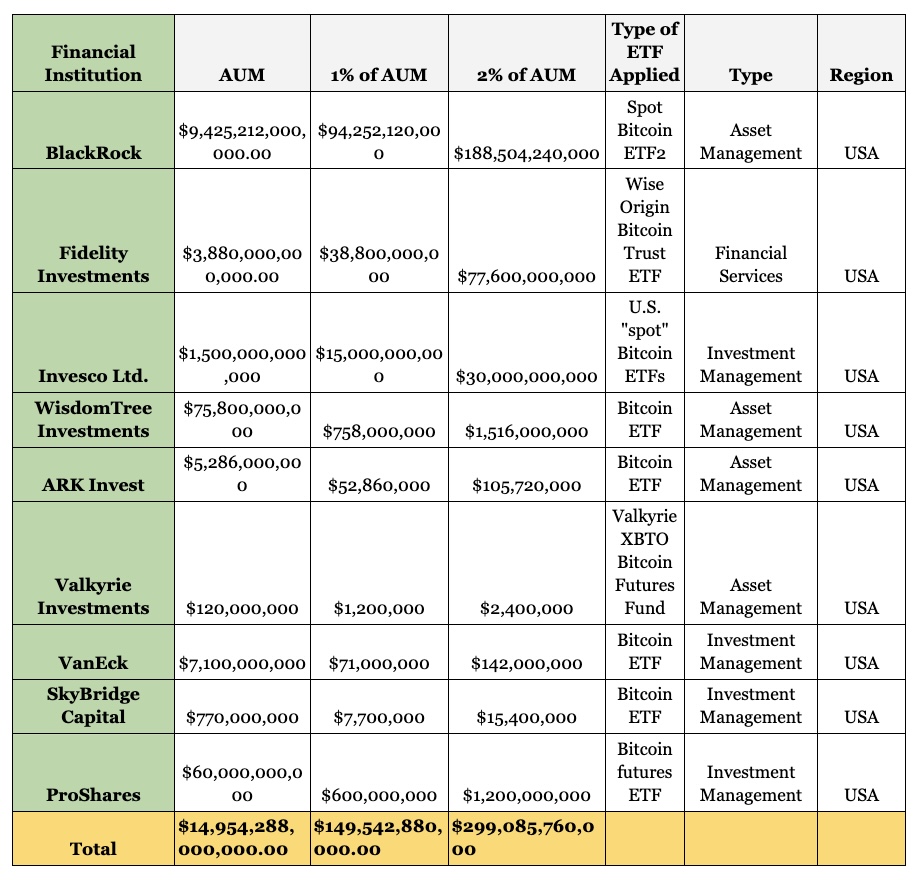

Market analysts anticipate potential Bitcoin ETF approval by early 2024. This could lead to an estimated $600 billion in new demand, according to a report by analysts at Bernstein. However, these predictions are speculative and depend on various factors like market dynamics and regulatory responses.

Delays and frustrations

The SEC's delays and rejections of Bitcoin ETF applications have drawn criticism and fueled investor frustration. A bipartisan group of lawmakers has urged the SEC to grant immediate approval, arguing that there's no reason to deny spot crypto ETFs and that they would enhance investor safeguards. This adds further uncertainty as the decision date for the ARK 21Shares Bitcoin ETF approaches.

Industry lobbying and regulatory developments

Alongside the SEC's deliberations, major players in the crypto industry are actively lobbying for new rules. Coinbase, for example, is spearheading one of the largest lobbying pushes in the crypto industry, aiming to garner support among lawmakers for the introduction of new regulations. The future of crypto regulations is being hotly contested.

Potential delays and updates

Recent actions by the SEC have raised concerns about potential delays in Bitcoin ETF approvals. Filings from major players such as BlackRock, Bitwise, and Wisdomtree are due for review in the third week of October. However, the SEC's recent actions on ARK 21Shares have sparked speculation that other filings due for review in mid-October could also experience delays. It remains to be seen whether there will be any significant updates on these applications soon.

Implications and rewards

Approval of Bitcoin ETFs would be a significant step towards mainstream crypto acceptance. It could also have geopolitical implications, setting a precedent for other countries and accelerating global adoption of cryptocurrencies. While hurdles remain, the recent court ruling signals progress and potential rewards for those willing to embrace change.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/google-cloud-joins-polygon-network-as-validator-for-fast-lowcost-ethereum