Bitcoin Traders Await Direction as Price Range Remains Tight

Bitcoin (BTC) has been trading in a narrow range between $25,500 and $26,500, leaving traders uncertain about its next move. However, according to Charles Edwards, founder of Capriole Investments, the current price presents a low-risk opportunity for long-term buyers. Edwards' belief is based on Bitcoin's production cost and energy value.

Capriole Investments' Energy Value Theory Reveals Bullish Outlook

Charles Edwards proposed Bitcoin's energy value theory in December 2019, which estimates the fair value of Bitcoin based on the amount of energy required to produce it. According to Edwards, the fair value price of Bitcoin is approximately $47,200, with a floor price estimation of around $23,000. Edwards suggests a risk-reward ratio of 1:5, with the potential for higher price targets.

In a tweet, Charles Edwards shared a chart showing the relative distance between Bitcoin's price, its historical price floor (Bitcoin Electrical Cost), and fair value (Bitcoin Energy Value). He emphasized that the risk-reward ratio assumes no hype and that the price would stop at fair value, which has never happened.

Correlation between Bitcoin Energy Value and Spot Price

Bitcoin's energy value theory has shown a strong correlation with its spot price, suggesting that the theory is at least somewhat valid. However, there are limitations to the model. One limitation is that the accuracy of Bitcoin's energy value can vary over time due to changes in mining energy efficiency. Additionally, the theory does not take into account other factors that may affect Bitcoin's price, such as market demand and supply or miner actions before the upcoming halving in April 2024.

Potential Downside for Bitcoin's Price

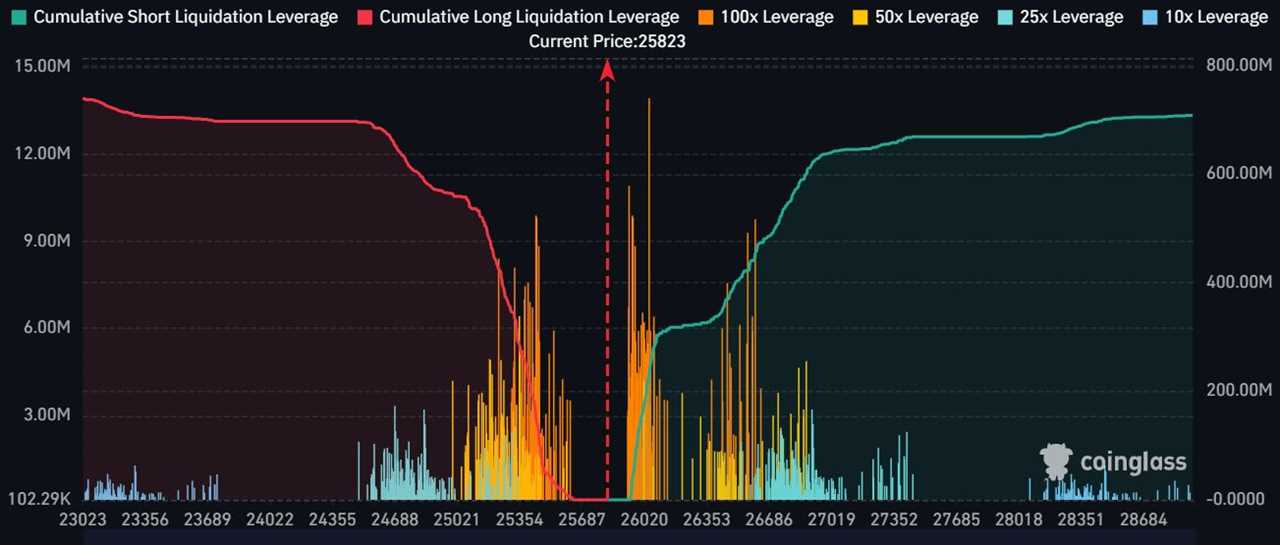

Bitcoin's spot liquidity data on Binance indicates that buyers are seeking support around the $24,600 level. However, bullish momentum appears to be fading as traders gather around yearly low levels and hope for them to hold. Futures orders liquidation levels from Coinglass suggest that buyers are anticipating a downside to $24,600, with smaller liquidations extending toward $23,000.

The price range between $25,000 and $25,500 has the most leveraged orders, attracting the attention of traders. If the price drops to the $23,000 level, it will test the conviction of buyers. A drop below $23,000 would target the levels from 2022, specifically $21,451 and $19,549.

Disclaimer: This article does not offer investment advice or recommendations. Investors and traders should conduct their own research before making decisions.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/ripple-expands-regulatory-licenses-in-the-us-with-acquisition-of-fortress-trust