The recent price slump of Bitcoin (BTC) and Ether (ETH) on August 18th has sent shockwaves through the crypto market, resulting in a bloodbath of liquidations for thousands of derivative traders. This downturn has caused billions of dollars worth of hedged positions to be liquidated, with several traders losing millions in a single trade.

Rapid Rise in Volatility

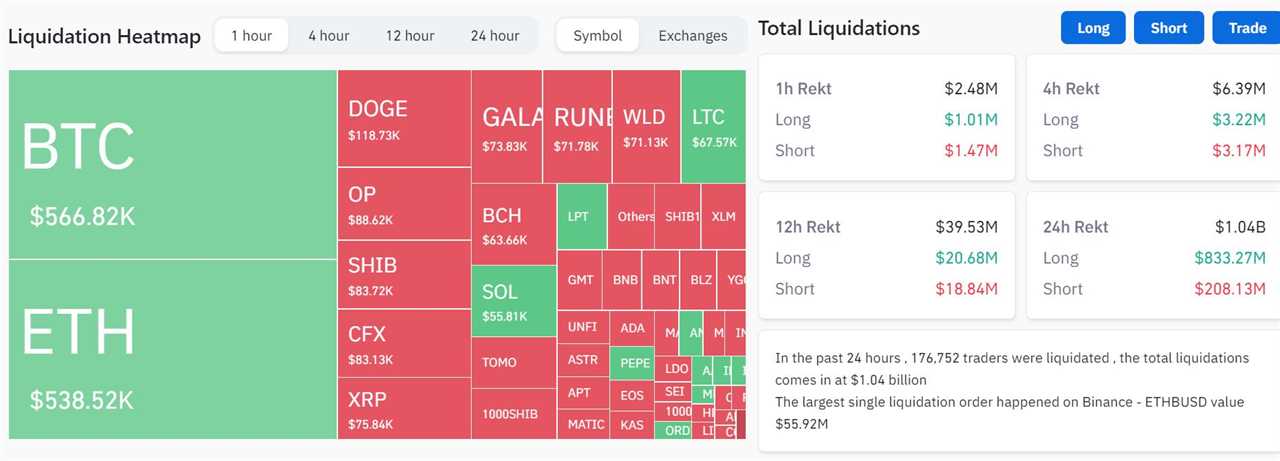

In the past 24 hours, a staggering total of 176,752 traders have been liquidated, according to data from Coinglass. What's even more alarming is that 90% of these liquidations occurred within the last 12 hours, indicating a sudden surge in price volatility. This comes just after BTC and ETH experienced their lowest daily volatility in several years.

Largest Liquidations

Among the sea of traders who suffered significant losses, two liquidations stood out for their sheer scale. One investor on Binance's ETHBUSD contract was liquidated at $1,434.37, resulting in a loss of $55.9211 million. Meanwhile, another Binance trader on the BTCUSDT contract lost nearly $10 million in liquidations.

The Biggest Liquidation Event Since FTX Collapse

This billion-dollar liquidation event marks the largest in the crypto market over the past 8 months, eclipsing the last major event during the FTX collapse.

Factors Influencing the Price Function

Several factors contributed to the recent price slump in the crypto market. These include the SpaceX Bitcoin write-down and macroeconomic factors, as BTC and ETH have been trading within a range for the past few months. BTC managed to hold onto the key $28,000 support for an extended period, while ETH finally gave in after holding the $1,500 support for a significant amount of time. Furthermore, the crypto market has witnessed lower liquidity, leading to a decline in trading volume for prominent exchanges like Coinbase.