AI and Blockchain Technologies Change the Game

A new report from Moody's Investors Service has predicted that artificial intelligence (AI) and blockchain technologies have reached a "tipping point" and will have profound effects on industries. The report suggests that these technologies have the power to reshape entire sectors, leading established industries to shrink or disappear while simultaneously creating new markets from scratch.

New Sectors and Opportunities

Transformative technologies, such as AI, have a history of shrinking established sectors or even wiping them out entirely. The report suggests that AI will drive the emergence of completely new sectors, including content generation, mobility, education, and healthcare. On the other hand, blockchain technology has already led to the emergence of cryptocurrencies and decentralized finance. However, the report notes that the track record of these segments has been inconsistent over the past 18 months.

Economic Growth and Financial Inclusion

AI is expected to boost economic growth by increasing productivity through task automation, which will partially offset the effects of aging and shrinking populations in many countries. Furthermore, blockchain technology has the potential to foster financial inclusion and modernize payment systems. However, the report suggests that it may take until the next decade for these benefits to fully materialize.

Implications for Financial Markets

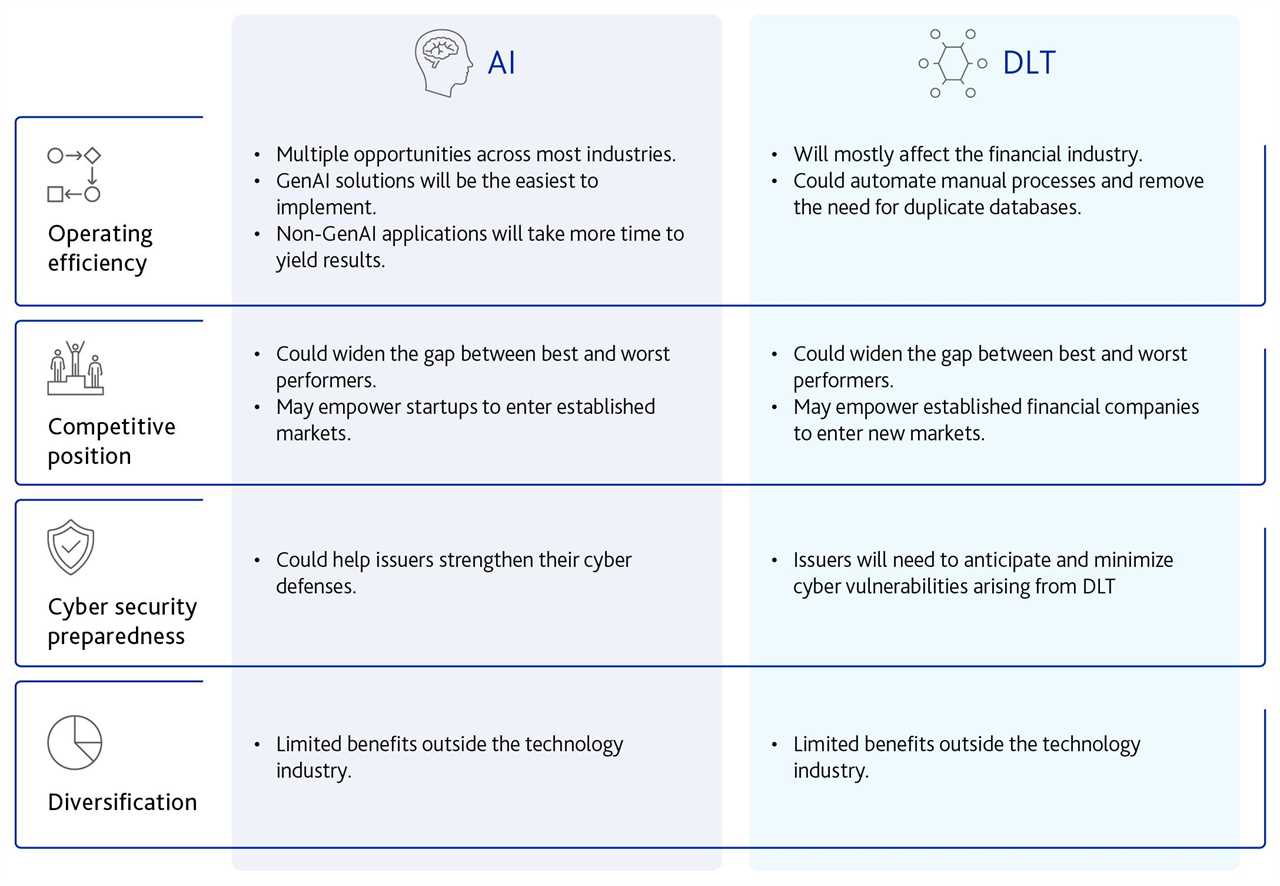

When it comes to the impact on global financial markets, the report emphasizes that AI and blockchain technologies will improve process efficiency and create new financial products. This, in turn, will enhance credit profiles for financial firms, as long as they effectively address financial, regulatory, and cybersecurity risks.

The report further states, "The coming transformation will bring process efficiency and new products, but also amplify existing risks and give rise to new ones." The interaction of risk and opportunity will be transmitted to debt issuer credit profiles through various channels, with the impact varying by sector and issuer strategy.

Measuring Credit Risk

The technologies are expected to influence various measures of credit risk, including business strategy and implementation, financial performance, governance and risk management, and industry and economy-level changes. Overall, the report suggests that the economic and financial effects of technological changes will be positive. However, it cautions that there will be significant differences in how the costs and benefits of progress are distributed among individuals, companies, and countries.

As AI and blockchain technologies continue to evolve and permeate different sectors, the report highlights the need for careful consideration of associated risks and regulatory measures to ensure the smooth transition into this transformative era.

Did you miss our previous article...

https://trendinginthenews.com/crypto-currency/binances-controversial-decision-to-freeze-bnb-wallets-in-11m-rug-pull