Traders are using various strategies to determine whether Bitcoin price has bottomed, but on-chain activity and derivatives data hint that the situation remains precarious.

Has Bitcoin price bottomed yet? According to @noshitcoins, derivatives and on-chain data signal that further downside could be in store.

Traders have been trying to time the much-anticipated trend reversal ever since Bitcoin (BTC) initiated its 48% correction to $30,000 on May 12. The move culminated with $12 billion worth of futures long positions being liquidated, and to date, trader's confidence remains somewhat dampened.

The community started looking everywhere for trend reversal signs, including technical patterns, United States CPI inflation data and Bitcoin exchange deposits. For example, some analysts stated that a higher high, followed by a move above $40,000, would be enough.

We need to make a new Higher High to confirm a local bottom.

— Inmortal (@inmortalcrypto) May 24, 2021

Reclaim 40k and we can start talking about a sustained move back to 50k.#Bitcoin pic.twitter.com/myeWXIYWpp

However, two days later, Bitcoin managed to break the $40,000, although the move didn't last for more than six hours. Meanwhile, other traders inferred that a retest of the $30,000 bottom is needed before a bounce.

#Bitcoin $BTC #BTC is forming a Descending Broadening wedge here. It's bullish but there are two possible scenarios.

— Johnny Woo | Never DM you for Money (@j0hnnyw00) May 25, 2021

Green: breaking the resistance and maintain the uptrend.

Red: retest the bottom of the wedge (~30k) and bounce from there. pic.twitter.com/8L26kQvf7X

Although there could be empirical evidence or even logic backing those statements, market prices don't always react to external news or previous chart formations. Unlike stocks, Bitcoin investors can't rely on commonly used valuation multiples or even comparables.

Sure, a digital store of value is one use case, but at the same time, it is uncensorable and easily transferable. Furthermore, some users value Bitcoin's peer-to-peer fiat convertibility outside of KYC-regulated exchanges. Another factor to consider is the investors who are increasing their Bitcoin portfolio due to the lack of correlation with traditional financial assets.

This panacea of diverse and sometimes conflicting narratives creates barriers for modeling the market's potential, adoption status, and even measuring the effectiveness of recent developments.

Some will cheer for Tesla and large companies building up Bitcoin reserves, while others couldn't care less about who's holding BTC and instead focus on the challenges of scalability and fungibility.

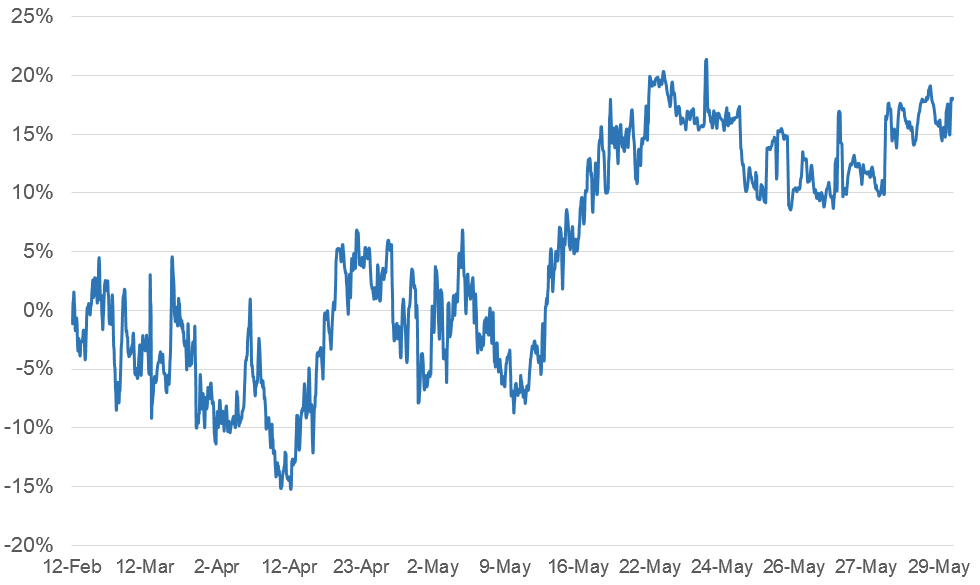

Skew: the professional "fear and greed" indicator

Call options allow the buyer to acquire Bitcoin at a fixed price when the contract expires. Put options, on the other hand, provide insurance for buyers and protect against price drops.

Whenever market makers and professional traders lean bullish, they will demand a higher premium on call (buy) options. This trend will cause a negative 25% delta skew indicator. On the other hand, if downside protection is more costly, the skew indicator will become positive.

A 25% delta skew oscillating between a negative 10%, and a positive 10% is usually deemed neutral. This balanced situation held until May 16, as Bitcoin lost the critical $47,000 support, which had held for 76 days.

As the markets deteriorated, so did the 25% delta skew indicator, and the cost of protective options spiked. Therefore, until the metric establishes a more neutral pattern nearer to the 5% level, it seems premature to call the market bottom.

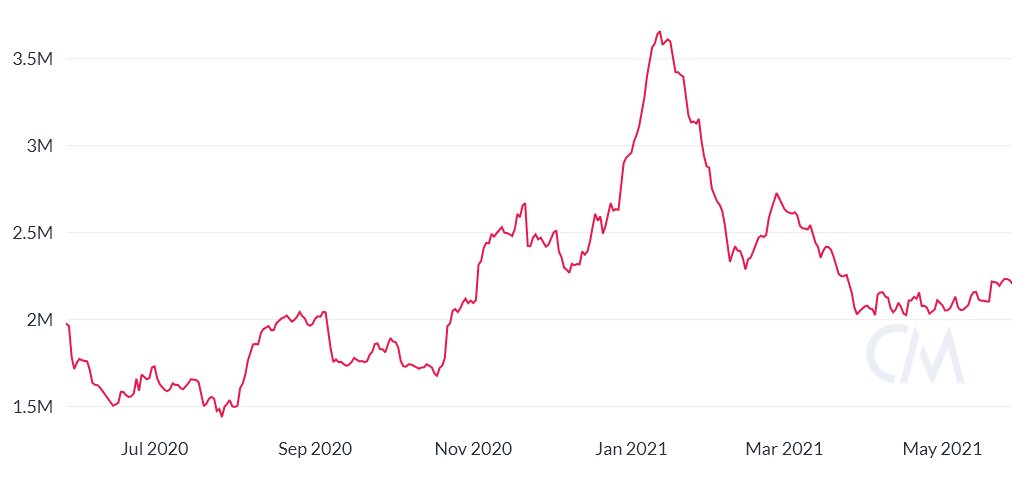

Active Bitcoin supply signals that weak hands need to cool off

Traders also monitor the number of BTC that have been active lately. This indicator can't be deemed bullish or bearish by itself as it does not provide information on how old the involved addresses are.

The 500% price rally from Oct. 1, 2020, and the $64,900 peak on April 14, 2021, caused a major increase in the supply moved in the months before the rally. When this metric presents a sharp decrease, it indicates that investors are no longer interested in participating at the current price level.

There are currently 2.2 million BTC active over the past 30 days, and this is significantly higher than levels seen before Oct. 2020.

As things currently stand, traders should not be so that Bitcoin has bottomed, at least until the market no longer has relevant activity surrounding the sub-$40,000 level.

author and do not necessarily reflect the views of Cointelegraph. Every investment and trading move involves risk. You should conduct your own research when making a decision.

Title: 2 Bitcoin price indicators suggest BTC has not bottomed yet

Sourced From: cointelegraph.com/news/2-bitcoin-price-indicators-suggest-btc-has-not-bottomed-yet

Published Date: Sun, 30 May 2021 21:00:00 +0100