THE UK economy has swerved a double dip recession – but it shrunk at its fastest rate in 100 years in 2020.

Gross domestic product (GDP) dropped by 9.9% over the course of the 12 months due to the coronavirus pandemic.

Read our coronavirus live blog for the latest news & updates

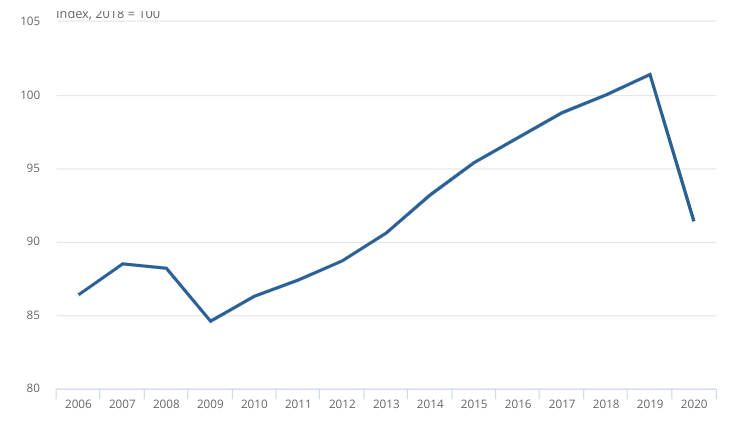

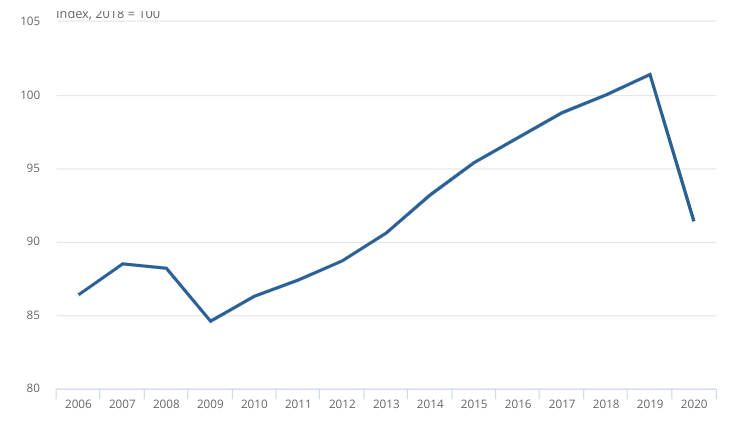

This graph shows how GDP figures have risen and fallen since 2006

The contraction in 2020 “was more than twice as much as the previous largest annual fall on record” according to the Office for National Statistics.

GDP was first measured in the aftermath of the Second World War and the measure has never previously dropped by more than 4.1% in a year.

But for the last three months of the year – October to December – GDP was up 1%, meaning the economy has avoided a double dip recession for now.

It comes after the Bank of England’s chief economist said the UK economy is set to bounce back “like a coiled spring” after Brits saved up to £250billion during the coronavirus lockdown.

A double-dip recession is when the economy shrinks, briefly recovers, and then contracts again.

The UK economy would need to shrink again for two consecutive quarters – or six months – to fall into double-dip recession territory.

On a monthly basis, GDP increased by 1.2% in December 2020, following a revised 2.3% decline in November.

Economists originally thought GDP has shrunk by 2.6% in November.

It comes after the country plunged into the “worst ever” recession earlier this year, when the economy shrank for two quarters in a row – the technical definition of recession.

The economy bounced back and grew by 15.5% in the three months to September, meaning the UK is no longer in recession.

Chancellor Rishi Sunak said: “Today’s figures show that the economy has experienced a serious shock as a result of the pandemic.

“While there are some positive signs of the economys resilience over the winter, we know that the current lockdown continues to have a significant impact on many people and businesses.

“That’s why my focus remains fixed on doing everything we can to protect jobs, businesses and livelihoods.”

Hinesh Patel, portfolio manager at Quilter Investors, added: “It is fair to say the UK economy experienced an annus horribilis in 2020.

“However, 2020 is in the past and the UK arguably has a promising second half of the year ahead given the success of the vaccine rollout.

“This could easily be derailed should one of the mutations prevent the vaccines properly taking effect, but for now a double dip recession has been avoided and soon lockdowns may potentially be the thing of the past.”

Speaking before the figures were released, Bank of England economist Andy Haldane said Brits had amassed “accidental savings” of up to £250billion during the lockdown.

He predicts people will be keen to spend big as restrictions are lifted, including on social occasions, holidays and meals out.

The economist said most people are now “desperate to get their lives, including their social lives, back” and will seize the opportunity to do so when it is allowed.

He wrote in an article for the Daily Mail: “The recovery should be one to remember, after a year to forget.

“A year from now, annual growth could be in double-digits.”

Before the latest lockdown restrictions were introduced, the economy was expected to grow in the first quarter of 2021.

But rising cases of coronavirus and a new mitant strain forced the government to act to save the NHS.

The pandemic has seen redundancies hit record highs as the unemployment rate rose to 5% with 1.72million people now out of work.