LOW-income families who have been told to self-isolate by NHS track and trace now have until the end of April to claim a £500 payment.

The Test and Trace Payment Support Scheme launched in September and was due to end at the end of January 2021.

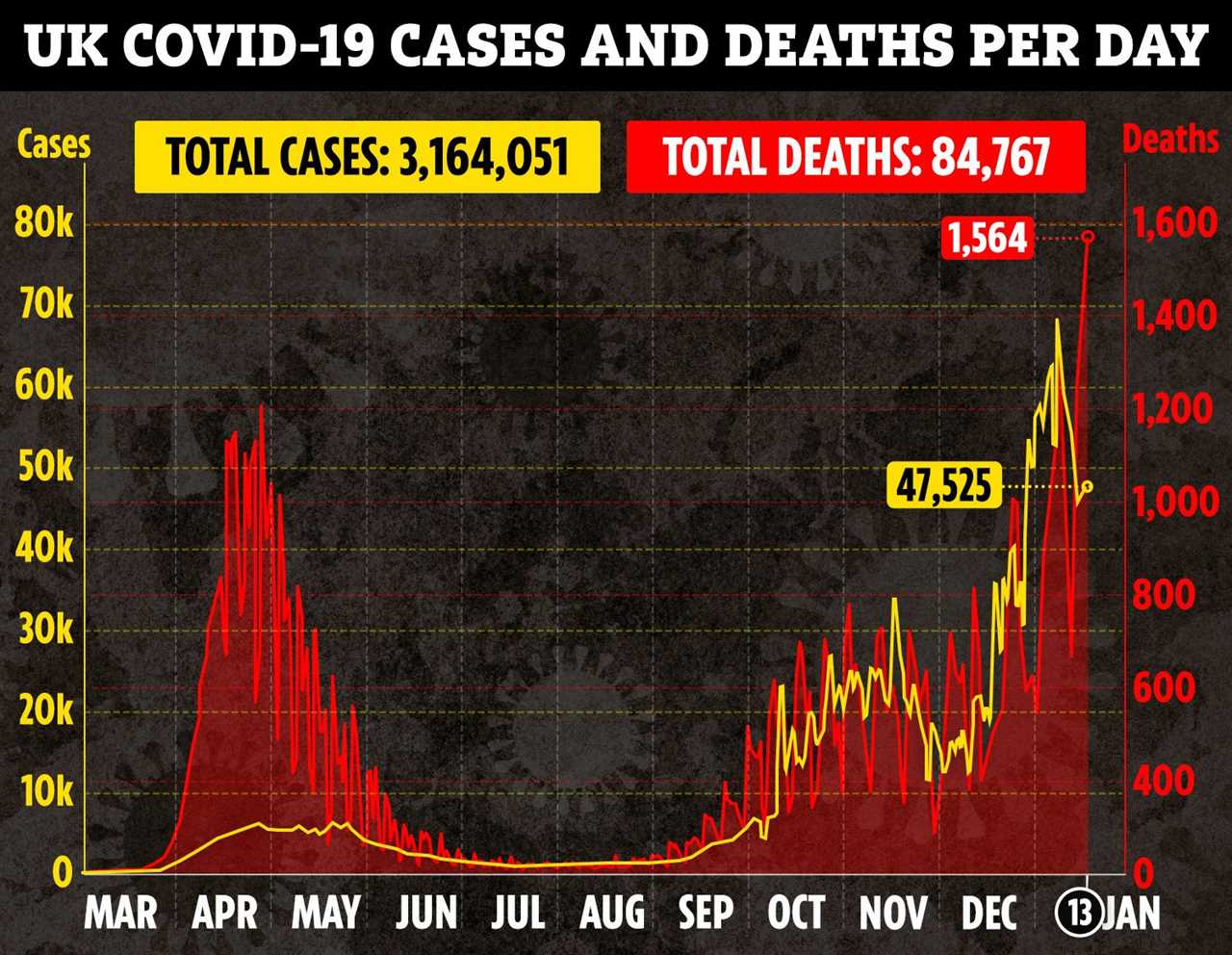

But it has now been extended until March 31 amid rising coronavirus cases and fears of a new mutant strain.

The one-off payments are available to people on certain benefits who will see their income drop as a result of having to stay at home.

Ministers paid out £15million by the end of last year under the scheme.

Anyone who is told to self-isolate by NHS Test and Trace or through an alert from the NHS Covid-19 app is legally required quarantine for 10 days or risk a £10,000 fine.

You will have to self-isolate if you have tested positive for coronavirus or if you have been told by the service that you have recently been in contact with someone who has the virus.

This may mean taking time off work and many people on low incomes may not be eligible for sick pay.

Low income households can apply for a £500 payment through their local council. Find your local authority to see where to apply.

There have been fears that local councils do not have enough money to cover these grants but the government has since announced an additional £20million to cover the cost of the scheme.

This is on top of the £50million previously provided.

Who can get a £500 payment for self-isolating?

Those who test positive for the virus or have come into close contact with someone who has it must self-isolate for 10 days.

Just fewer than 4million people on benefits in England will be eligible to the extra payment if they’re told to self-isolate, according to the government.

You will be eligible to claim the payment if you work full-time, part-time, self-employed or unemployed and you receive on of the following benefits:

- Universal Credit

- Working tax credits

- ESA

- JSA

- Income support

- Pension credit

- Housing benefit

The payments are only available to those who can’t work from home and will lose income as a result.

You will only get the payment if you have been asked by the official NHS Test and Trace team to self-isolate.

If you decide you have to quarantine because you are displaying symptoms, then you won’t be eligible for the funds, even though you’re following the guidance.

People who are employed, but on low incomes, will have to show evidence that they are working and also have a letter from their employer confirming they are having to self isolate at home.

Self-employed people will need to show evidence of their trading income and that their business cannot be carried out without social contact.

You’ll also have been given a number or code from the app, which you’ll need to include in your claim.

Find out what support you can get from Universal Credit if you are on a low income.

We’ve rounded up six ways to get financial support during lockdown from furlough to sick pay.

Also, see where you can get the vaccine when it’s your turn.