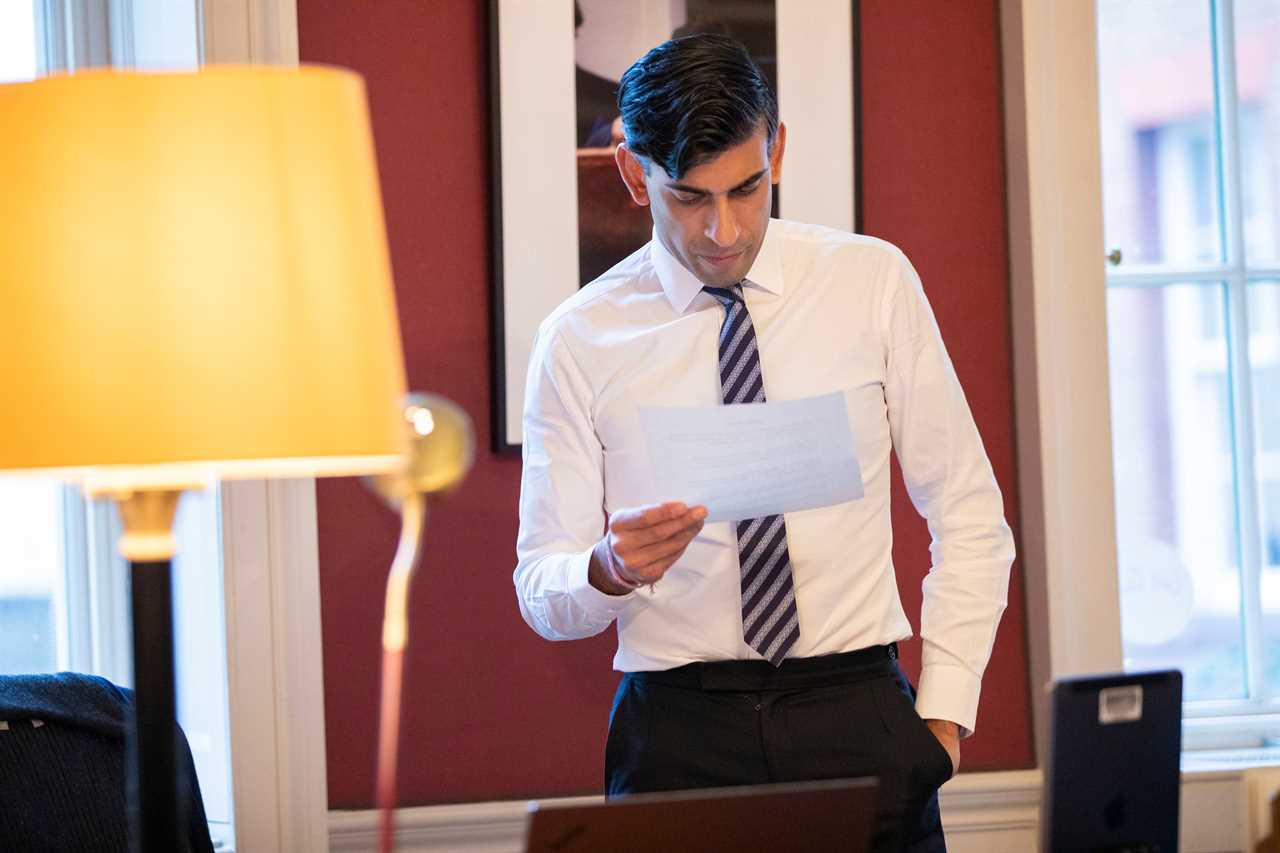

RISHI Sunak is poised to delay plans for tax rises in his March budget due to the spiralling cost of the coronavirus crisis, it’s been reported.

The Chancellor is said to believe it would be the “wrong time” to announce them and they are now likely to be pushed back until at least the autumn.

However, he has rejected calls to extend the temporary cut on stamp duty which is due to expire at the end of March, the Times reported.

Analysts say the property tax cut helped to fuel a boom in the housing market as buyers sought houses with gardens during lockdown.

“We’ll be in the midst of a recession and living under severe lockdown restrictions,” one government source said of the tax rises.

“The mutant strain of the virus has changed our entire perspective on this. It’s too soon.”

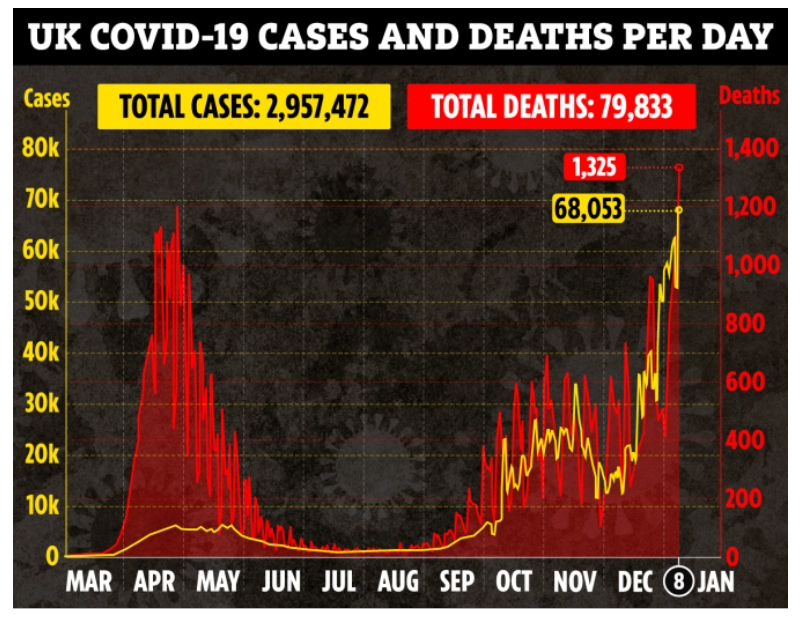

This year, the UK country is expected to have to borrow more than DOUBLE the £158billion it did during the financial crash in 2008.

Britain’s economy now looks likely to tip back into recession after shrinking in both the final quarter of 2020 and the first quarter of 2021.

The slump followed a record 25 per cent fall in output in the first two months of lockdown last year.

To try and help bring in extra cash there were plans to cut pensions tax relief for high income households, ramp up capital gains tax and introduce a digital sales tax.

The source said that it was not yet known if those tax rises will be included in the budget, say reports.

The news comes as the Chancellor works on plans to bail out up to a million small businesses who missed out on financial support during the pandemic.

He launched a £4.6 billion support package for businesses on Tuesday to soften the expected recession caused by a surge in Covid cases.

Mr Sunak has previously announced emergency help for the economy worth £280 billion – including a massive job protection scheme which will run until the end of April.

And on Thursday, we reported how the Treasury is also considering a scheme to bailout up to a million small business owners excluded from previous Covid support.

A team of Treasury officials are scrutinising a proposal that would see the Government pay up to 80 per cent of lost trading profits of sole directors of limited companies.

The Directors Income Support Scheme would pay grants of up to £7,500 to cover three months of lost trading profits and would be limited to those who earn less than £50,000 a year.

Initial estimates have put the cost of the scheme between £2-3 billion depending on take-up.

A government source insisted there was still no guarantee that the scheme will be introduced as there are still several loopholes to close down to avoid fraud, waste and legal challenges.

Many self-employed workers have been shut out of Government Covid grants because they pay themselves in dividends.